7 Dec – Breif respite towards futures gap and then more selling

7 December 2018

11 Dec – Bullish as expected but gave some back later in the session

11 December 2018Pre-open Scenarios

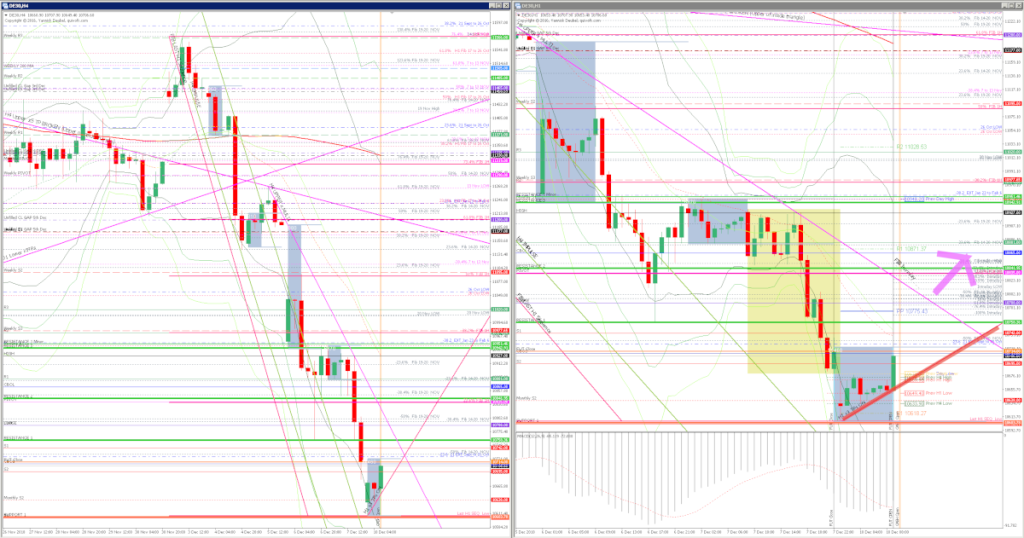

The same question again today: will we see new lows or will we see a relief rally? Is there anything that could trigger such a rally? Apparently not. Rallies are quickly and powerfully sold. The US session on Friday was weak, so that the Dax was trading ON below Friday’s low.

On the H4 and H1 charts from MT4 you can see the force of the move down from 11566, where the market was just after the open and just a week ago.

What the market looked like at the end of the day

Key points about today’s PA and setups that worked

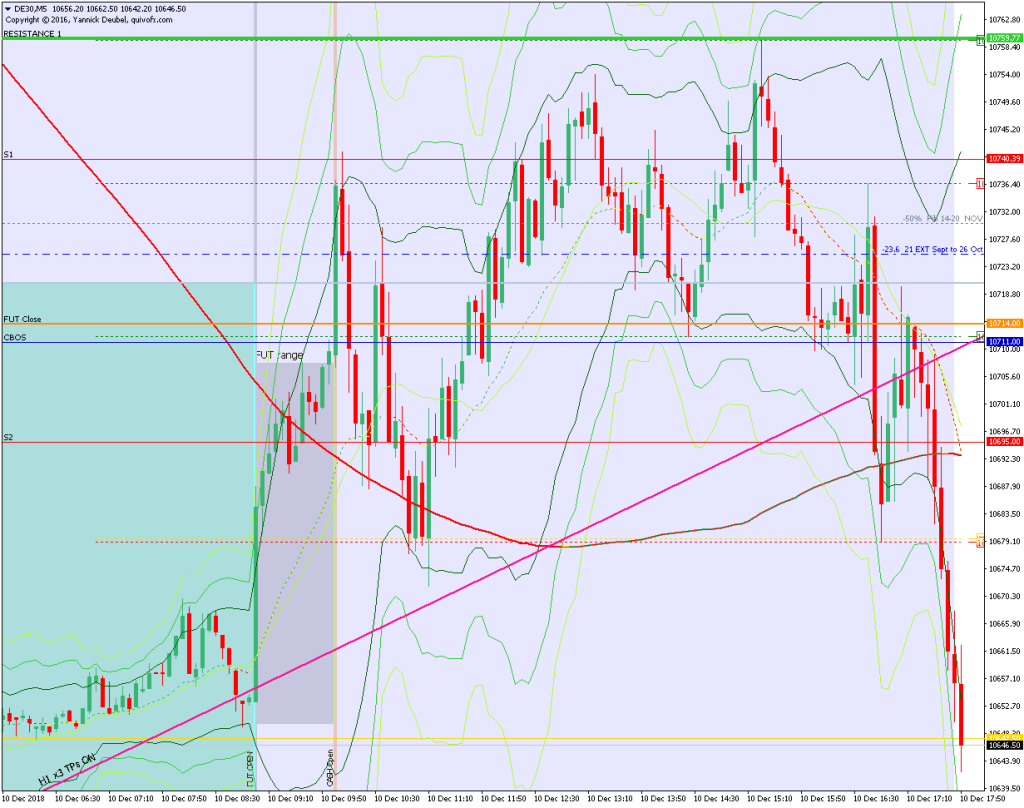

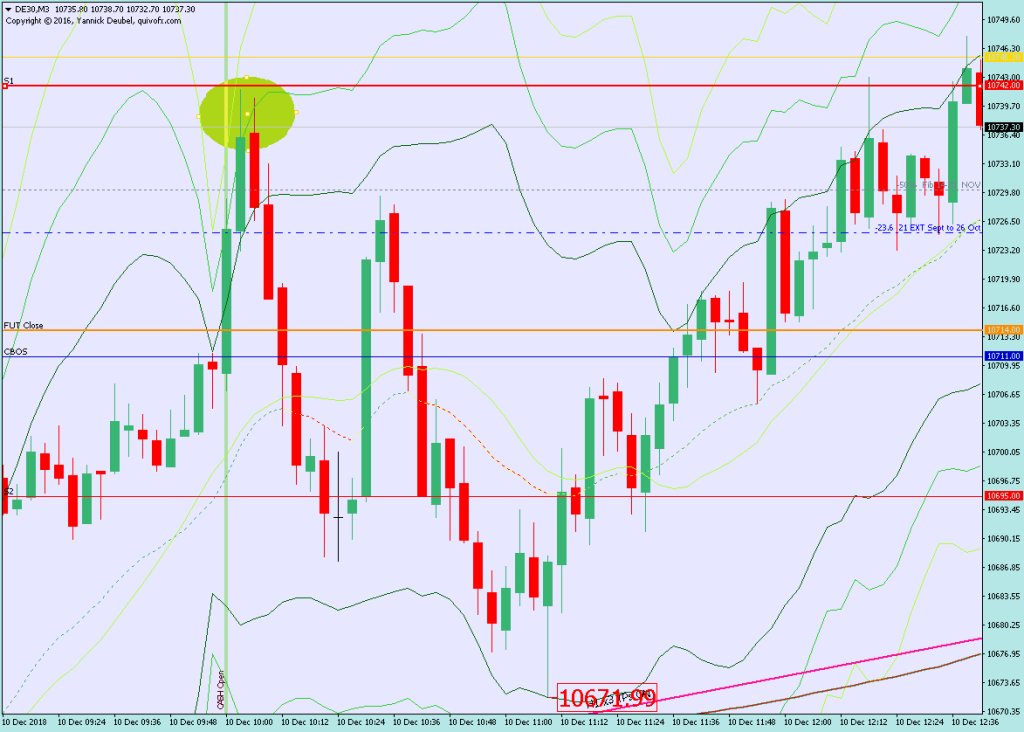

- With CBOS regained and S1 rejected in the first minutes, this is ranging price action and needs to be traded as such.

- Unless price moved significantly away from the 169 and started to punch through levels, I trade the ranging PA setups which are: 3Min Bolli, fading 169 touches and trading M1 compressions.

- While inside the lilac Neutral Zone, longs worked as well as shorts, but shorts had the advantage that they could be held through a TL break (pink TL containing the ON correcticve move up) if it occurred, and with a nice entry, they would not be vulnerable to a small reaction to the TL.

How effective was my Neutral Zone? There were valid long and short setups within the Neutral Zone but the lower edge was in the wrong place – it should have been the TL that supported the ON and European session corrective action. Breach of this level saw powerful selling, whereas when it broke out of the Neutral Zone, it was already exhausted and began to reverse.

How precise were my levels? RES 1 was spot-on, RES 2 and Res 3 were not in play. SUP 1 was hit during the US session and exceeded by nearly 20 points but prices did reverse there.

What I did

09:00 Sell x 91 @ 10718 | Cash open spike | P&L = -1R

09:02 Buy x 24 @ 10726 | NONE | P&L = -1R

09:06 Sell x 82 @ 10735 | 3Min Bolli | P&L = +1.7R

09:23 Sell x 90 @ 10689 | M1 TL Break by hand | P&L = -1R

09:25 Sell x 89 @ 10691 | M1 TL Break by hand | P&L = -1R

09:30 Buy x 65 @ 10700 | 3P HLR| P&L = -0.1R

09:52 Buy x 65 @ 10700 | 3P HLR | P&L = -1R

09:56 Sell x 48 @ 10689| Igloo | P&L = -1R

10:04 Sell x 96 @ 10687 | 169 Fade | P&L = +0.7R

10:14 Buy x 48 @ 10701 | 3P HLR | P&L = 1.1R

10:42 Sell x 81 @ 10712 | 3Min Bolli | P&L = -1R

15:23 Sell x 81 @ 10754 | 3Min Bolli | P&L = +1.7R

TOTAL = -1.9R

10 trades: win x 4; loss x 5; 1 x BE

Today’s most gorgeous setup

Using the 3Min Bolli system to sell S1 just after the open. This trade hit the level while outside the 2 Std.dev Bolli band and immediately reversed for 70 pts.

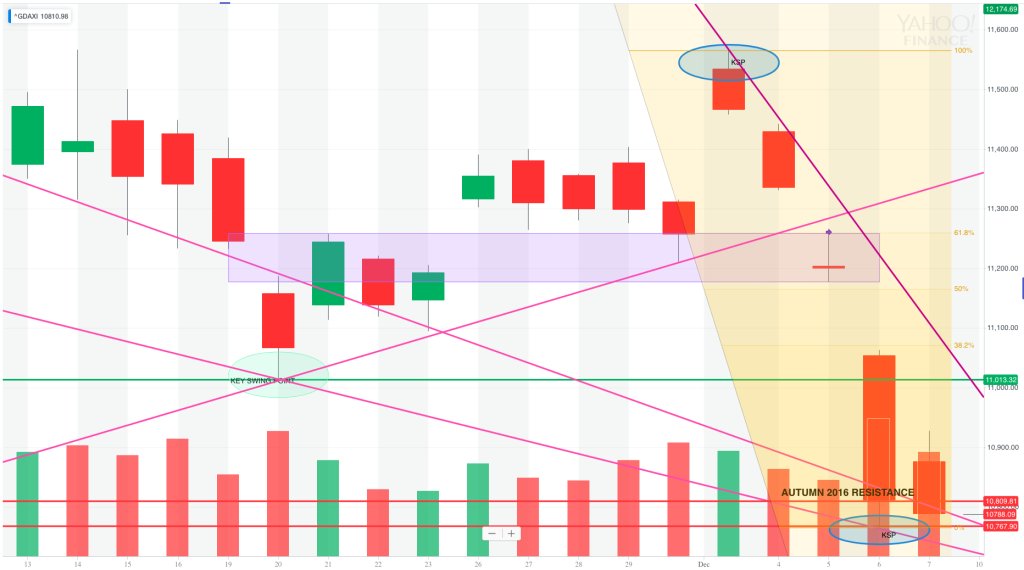

For reference: 3 month cash chart at COB yesterday