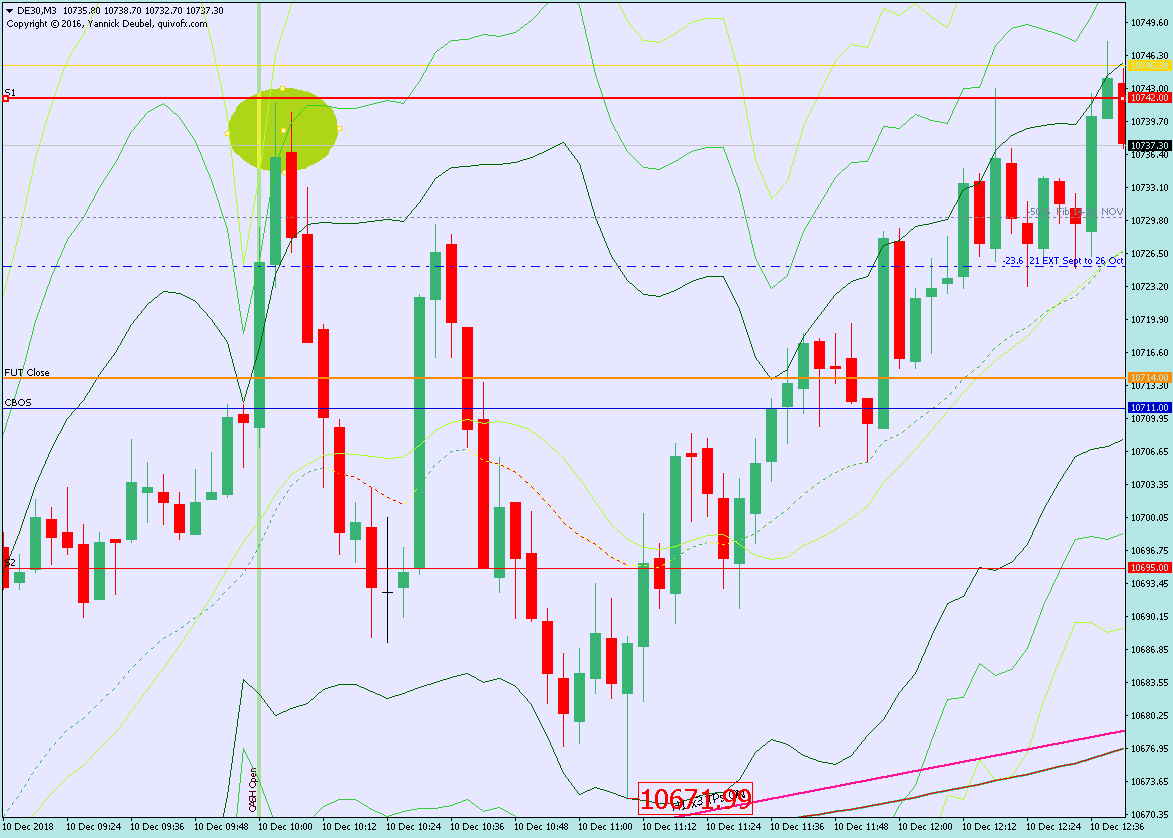

10 Dec – Ranging action up to RES 1 then reversal (again)

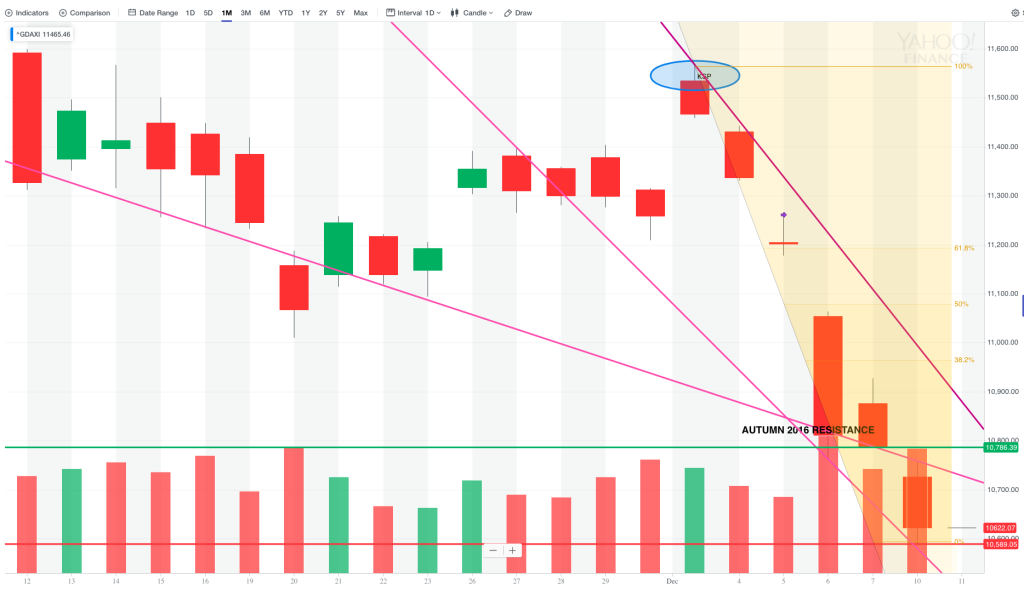

10 December 201812 Dec – Rising wedge and fibs in control for more gains

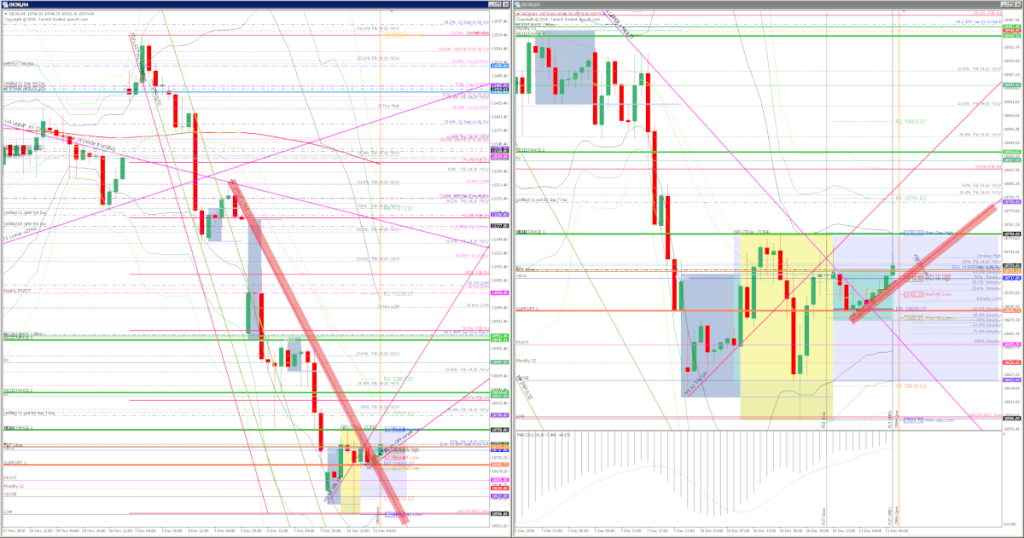

12 December 2018Pre-open Scenarios

Now, this looks like a day to get long; ON we’ve broken the upper TL that contained the impulse move down. The lows yesterday afternoon were bought up with great enthusiasm and the bull pin bar this formed inspired further gains.

The futures opened with a 98pt up gap and they held on to gains. So far, there hasn’t been any further acceleration but the market has remained above CBOL but below y’day High.

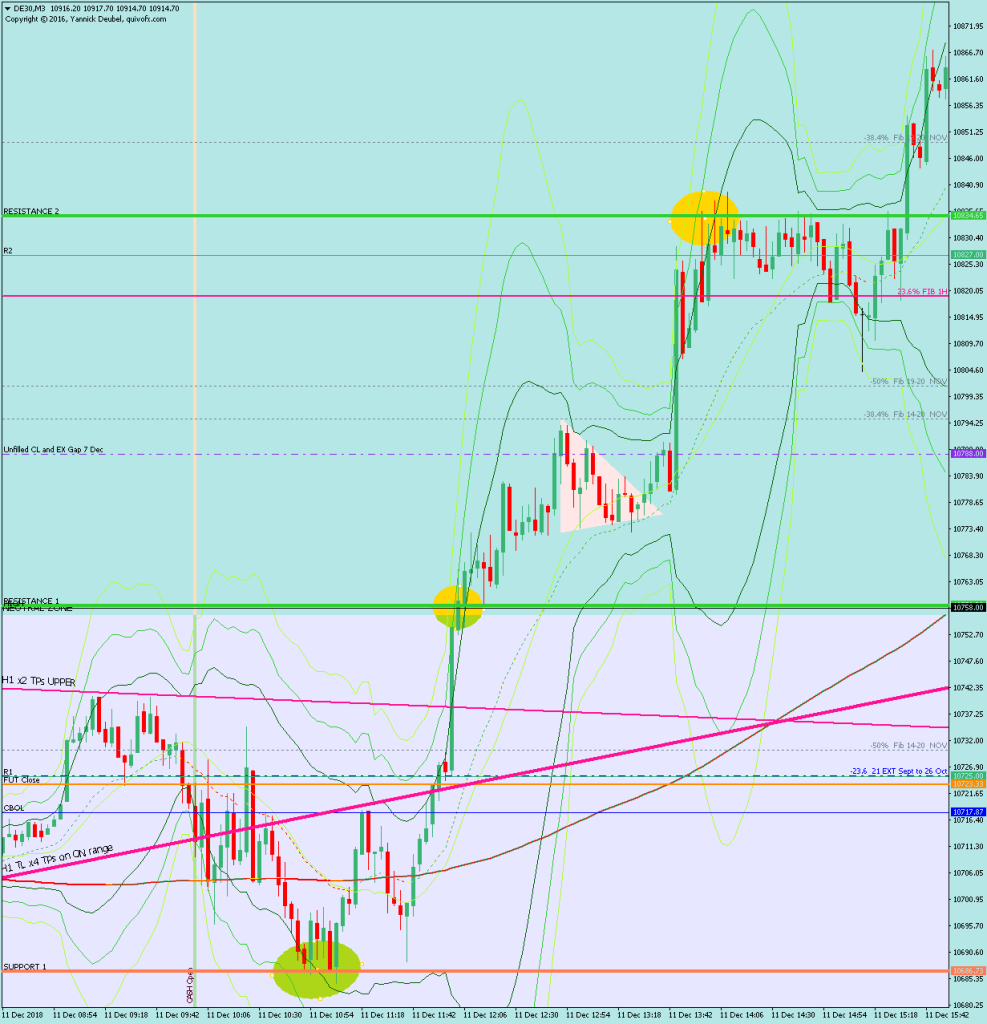

What the market looked like at the end of the day

Key points about today’s PA and setups that worked

This was a very bullish day as expected and the key points about the PA and how to trade are:

- The market had got very extended ON and saw a burst of buying at the open which took it straight into the TL formed in the most recent two trading days.

- It then made a small retrace to the bottom of the futures session range – this was also a level that had seen a lot of activity and was the futures close on 7th Dec. The 3Min Bolli system worked perfectly to buy the low of the day (see below)

- Once it broke out the Neutral Zone it juts kept going and very hit R3. At the break (circled in gold) three trades setup: An M1 Tl break, a J-Lo and a compression above a KL.

- As the trend continued the best way to add or enter it was to use a compression – in this case around 169 MA on M1 chat (not shown here as it’s M5)

- The break out also setup as a short on 3Min Bolli system although not a very convincing one.

How effective was my Neutral Zone? Both longs and short were successful inside the zone and when it broke it ripped.

How precise were my levels? SUP 1 was spot on and allowed me to buy the low of the day. RES 1 and RES 2 were also spot on

What I did

09:00 Buy x 89 @ 10712 | Cash open spike | P&L = +0.5R

09:00 Sell x 19 @ 10710| H1 TL break | P&L = -1R

09:02 Sell x 89 @ 10711 | M1 TL Break by hand (break) | P&L = -1R

09:08 Sell x 89 @ 10713 | M1 TL Break by hand | P&L = +0.5R

09:09 Buy x 99 @ 10700 | 169 Fade (3Min) | P&L = +0.5R

09:18 Sell x 99 @ 10716 | 169 Fade (1Min) | P&L = -1R

09:28 Buy x 98 @ 10722 | 169 Fade (1Min) | P&L = -1R

09:29 Sell x 88 @ 10710 | M1 TL Break by hand (Comp) | P&L = +0.7R

09:33 Buy x 97 @ 10713 | 169 Fade (3Min) | P&L = +0.1R

09:41 Buy x 97 @ 10706 | 169 Fade (3Min) | P&L = -1R

09:52 Buy x 81 @ 10688| 3Min Bolli | P&L = +1.7R

10:12 Sell x 98 @ 10698 | 169 Fade (3Min) | P&L = -1R

10:20 Sell x 96 @ 10713 | 169 Fade (1Min) | P&L = +0.5R

10:58 Buy x 88 @ 10729 | M1 TL Break by hand (break) | P&L = +2R

11:03 Sell x 82 @ 10764 | 3Min Bolli | P&L = -1R

11:10 Buy x 89 @ 10767 | J-LO | P&L = +1.6R

11:18 Buy x 89 @ 10769 | M1 TL Break by hand (break) | P&L = +1.1R

12:08 Sell x 100 @ 10784 | 3Min Bolli | P&L = +0.4R

TOTAL = +2.8R — # Trades =17 — Winners = 10 — BE = 1

Today’s most gorgeous setup

Buying the 3Min Bolli Band just after the open. We knew that it was likely to be an up day (broken TL, new supportive TL, exhausted down move and seasonal factors) and this move to SUP 1 was a gift.

For reference: 3 month cash chart at COB yesterday