11 Dec – Bullish as expected but gave some back later in the session

11 December 2018

17 Dec – TL supporting H1 Friday’s corrective action breaks for 200pts

17 December 2018Pre-open Scenarios

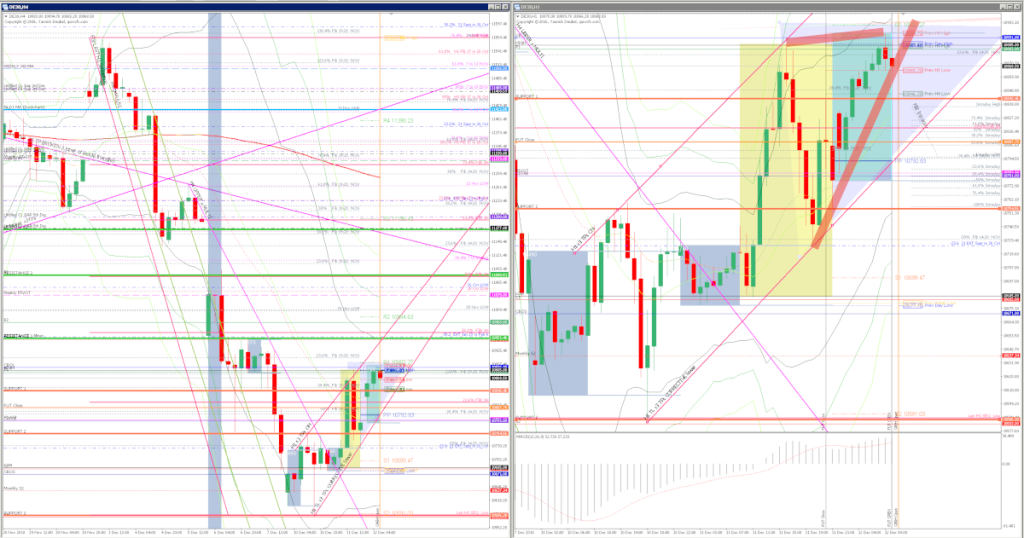

We got the rally yesterday. The market opened with a 97pt gap up, messed around a bit in the first hour or two but then made some nice gains. The overall result was up 158pts to close 11780 with a high at 11885. But the cash open price was 11719 so the majority of those gains came from the ON action.

The market gave back a lot of the gains in the afternoon session but has rallied ON to above yesterday’s high. It looks like we need to get long and the question for the rest of the week is: will the upward sloping TL that has formed from the lows of yesterday and Monday hold? If so – as I said yesterday – that will create a supporting TL for a Christmas rally.

What the market looked like at the end of the day

Key points about today’s PA and setups that worked

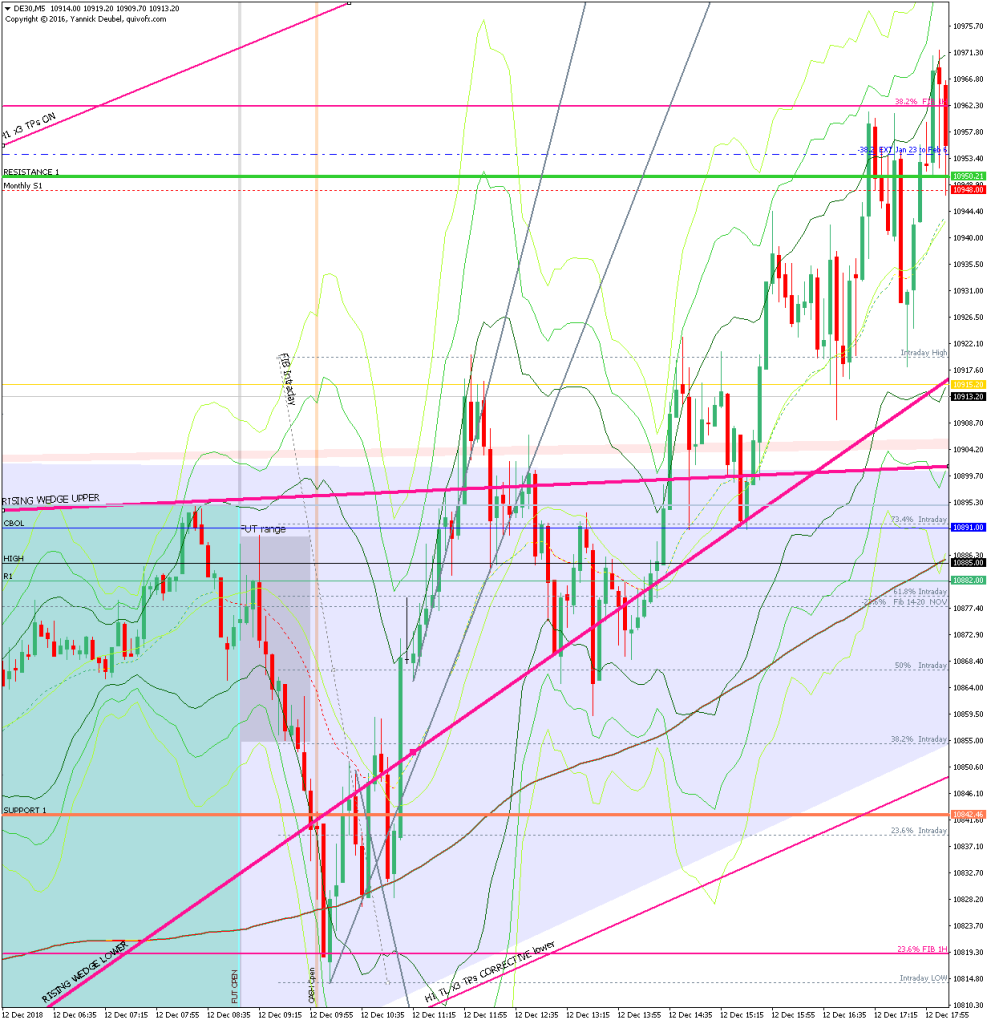

- The market sold CBOL during the futures session so the next levels to look for were the lower TL of the rising wedge, then the 23.4% retrace of the impulsive move and then the TL that had been supporting the corrective move.

- Knowing that it’s bullish above the Neutral Zone bottom TL, buying the 23.6% retrace gave the perfect entry.

- Once CBOL broke, trading retests of the level using M1 TLs was a winning strategy.

How effective was my Neutral Zone? The lower TL contained but didn’ attract price (the 23.6% found the buyers) and the upper boundary was in the wrong place – CBOS was the level.

How precise were my levels? SUP 1 didn’t see much of a reaction as – again – the 23.6% just below was the active level. RES 1 was close to the active level but the 38.4% fib was where the sell orders were located.

Perhaps when there is such a clear Swing High to Low and an impulsive more that the fibs really take priority when deciding levels.

What I did

09:00 Buy x 89 @ 10712 | Cash open spike | P&L = +0.5

09:00 Sell x 19 @ 10710 | H1 TL Break| P&L = -1R

09:02 Sell x 89 @ 10711| M1 TL Break by hand | P&L = -1R

09:06 Sell x 82 @ 10735 | 3Min Bolli | P&L = +1.7R

09:23 Sell x 90 @ 10689 | M1 TL Break by hand | P&L = -1R

09:25 Sell x 89 @ 10691 | M1 TL Break by hand | P&L = -1R

09:30 Buy x 65 @ 10700 | 3P HLR | P&L = -0.1R **

09:52 Buy x 65 @ 10700 | 3P HLR | P&L = -1R **

09:56 Sell x 48 @ 10689 | Igloo | P&L = -1R *

10:04 Sell x 96 @ 10687 | 169 Fade | P&L = +0.7R

10:14 Buy x 48 @ 10701 | 169 Fade| P&L = +1R

10:42 Sell x 81 @ 10712 | 3Min Bolli | P&L = -1R

14:23 Sell x 81 @ 10754 | 3Min Bolli | P&L = +1.7R

* This was traded as an Igloo but it couldn’t have been because the market was not in a downtrend

** This was traded as 3P HLR but it couldn’t have been because there was no trend and this is an exhaustion reversal trade

TOTAL = -2R — # Trades = 13 — Winners = 5 — BE = 0

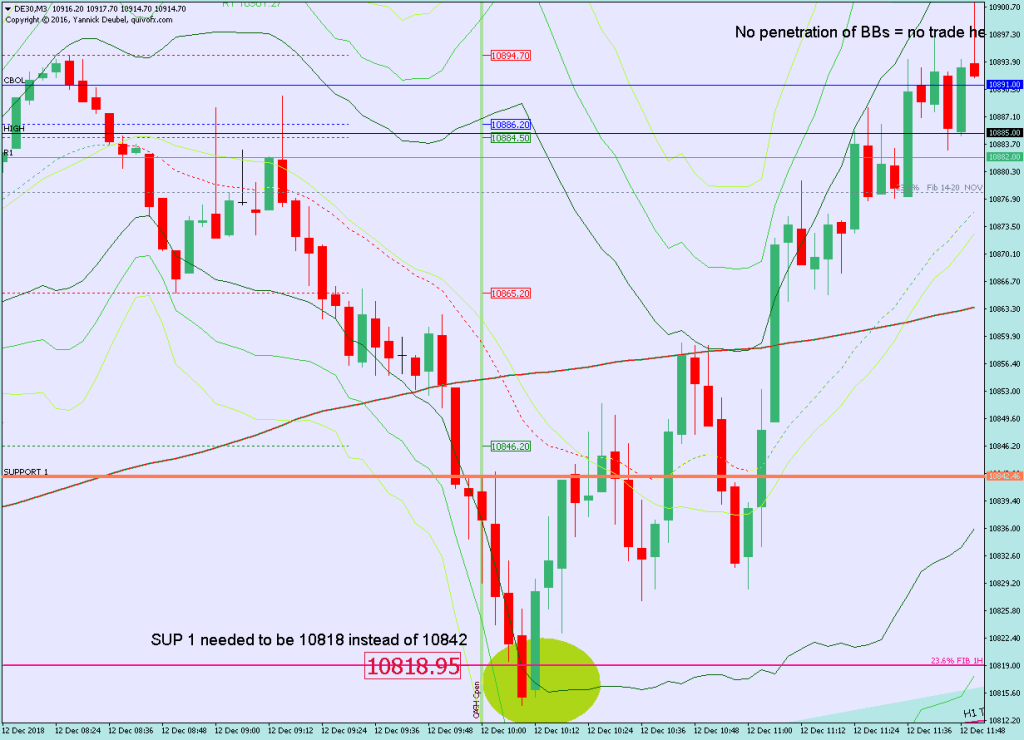

Today’s most gorgeous setup

Today, I didn’t read the market and the levels and to take today’s best setup, I needed to have SUP 1 at the 23.4% fib of the whole impulse move.

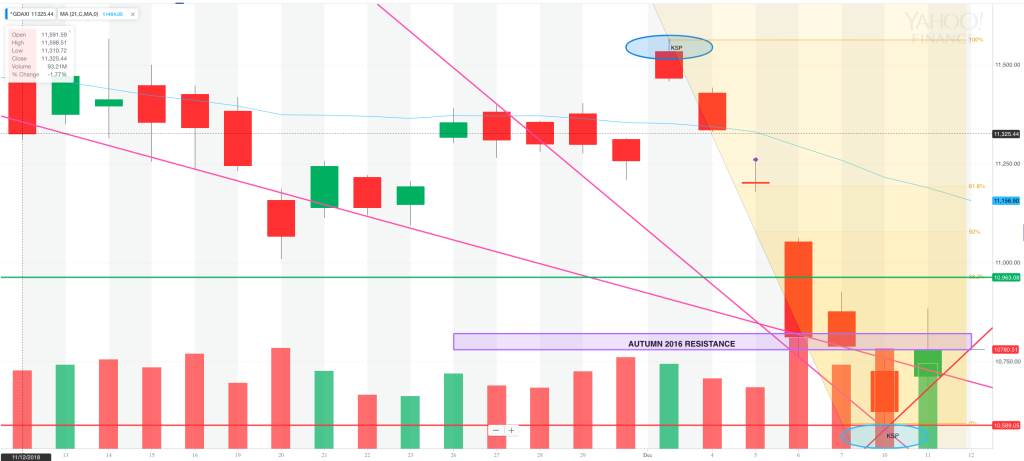

For reference: 3 month cash chart at COB yesterday