12 Dec – Rising wedge and fibs in control for more gains

12 December 20182 Jan – Early selling reverses to break new highs

3 January 2019Pre-open Scenarios

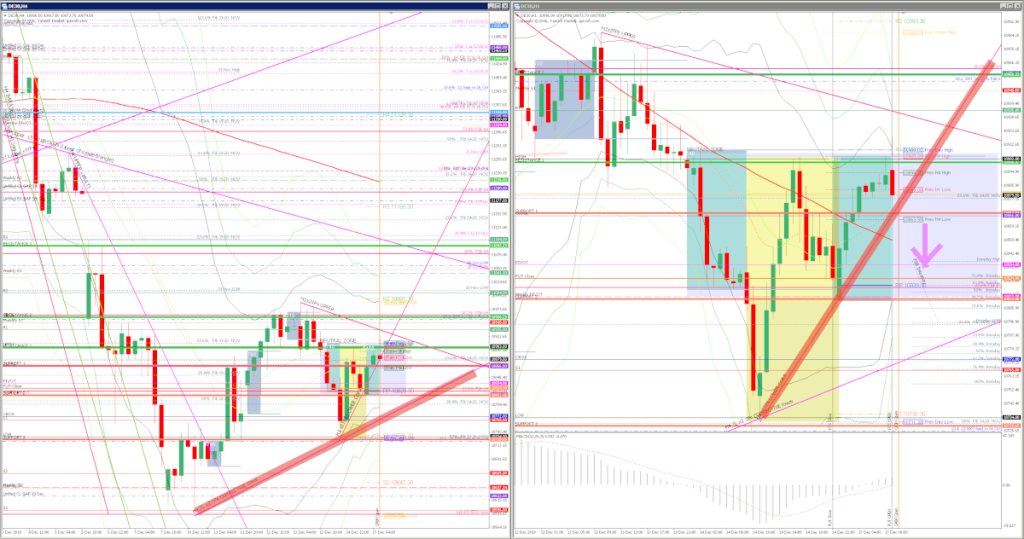

Seasonal factors say that this should be positive but it just seems to be so weak, up moves simply don’t have much welly and get sold down again. There are still many open gaps above which could fill during thin trade around the holiday season. But equally, because the TL supporting the corrective retrace (higher of the two upward TLs on the chart below) has broken we could see at best a retest of that line and then a reversal which eventually breaks the lower TL too.

My plan to today is to buy gap fill and then to buy and sell moves into TLs and KLs if they set up as 3Min Bolli trades. There will also be opportunities to trade the 169 on the 3Min.

What the market looked like at the end of the day

The critical level today was the TL supporting the ON corrective move up. This broke before the open and the market never regained it – we saw HHs but below the TL.

Key points about today’s PA and setups that worked

- The TL defined the market action today and gave some perfect trade setups.

- The break of the TL happened just before the cash open.

- The market went straight for the FUT gap close and this setup perfectly as a 3Min Bolli, the cash gap close didn’t present a trade.

- The best trades where retests of the TL, which setup as 3Min Bolli trades – although the last attempt at the line didn’t hit it – perhaps giving more weight to the sell idea.

- The prospect of a Santa Rally seems to be dead in the water, but distorted thinking today as this would normally be a week to get long.

How effective was my Neutral Zone? The Neutral Zone was ineffective today – the TL mentioned above should have been the lower edge of the zone but i wanted to include gap close and futures close.

How precise were my levels? RES 1 was exceeded by 8pts during the FUT session from where it sold off all day. SUP 1 was the gap close which the market didn’t take much notice of and SUP 2 was spot on, with a small igloo forming after the market first hits it to give a great entry opportunity. SUP 3 saw no reaction.

What I did

09:00 Buy x 89 @ 10864 | Opening Spike | P&L = -1R

09:00 Sell x 24 @ 10859 | H1 TL Break by Hand| P&L = +1.8R

09:05 Sell x 48 @ 10850 | Igloo | P&L = +0.3R

09:15 Buy x 98 @ 10830 | FUT Gap fade | P&L = +2R

09:25 Sell x 90 @ 10849 | M1 TL Break by Hand | P&L = -1R

09:30 Buy x 89 @ 10868 | M1 TL Break by Hand | P&L = -1R

09:35 Sell x 88 @ 10862 | M1 TL Break by Hand| P&L = +0.8R

09:39 Buy x 87 @ 10870 | M1 TL Break by Hand | P&L = -1R

09:45 Sell x 86 @ 10859 | M1 TL Break by Hand | P&L = +0.7R

09:57 Buy x 97 @ 10880 | 169 Reversal| P&L = -0.7R

09:58 Sell x 97 @ 10875 | 169 Reversal | P&L = +0.9R

09:58 Sell x 81 @ 10871 | 3Min Bolli | P&L = 0R

11:11 Sell x 82 @ 10862 | NONE | P&L = -1R

11:19 Sell x 80 @ 10864 |NONE | P&L = -1R

11:20 Buy x 87 @ 10874 | M1 TL Break by Hand| P&L = -1R

11:21 Sell x 95 @ 10875 |169 Reversal| P&L = -1R

11:24 Buy x 95 @ 10880 |169 Reversal| P&L = -1R

TOTAL = -2.8R — #Trades 17 —- Winners 6— BE 1

Today’s most gorgeous setup

This was the sell at a retest of the underside of the H1 TL, where the 169 on the M1 and M3 converged. A similar trade set up later in the day just before the 200pt reversal.

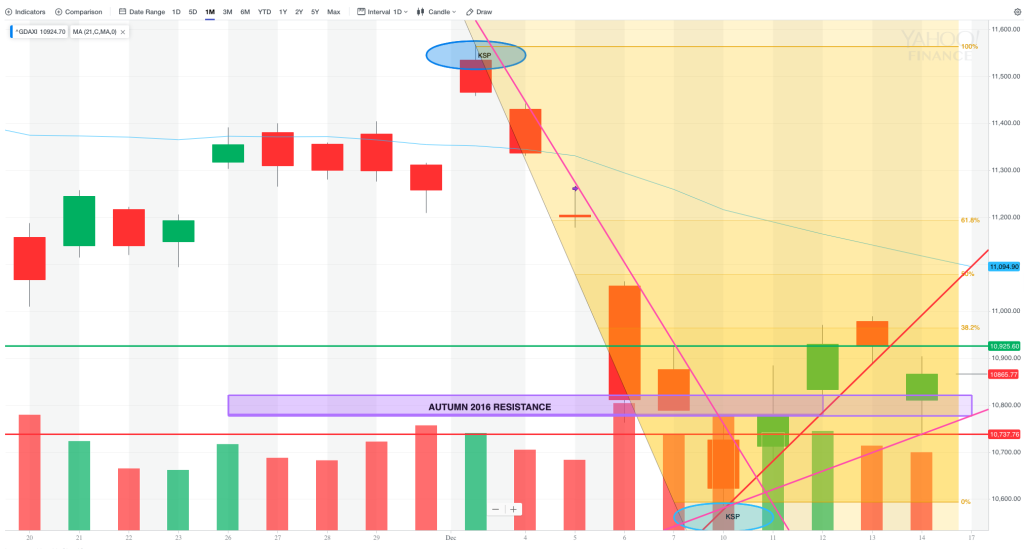

For reference: 3 month cash chart at COB yesterday