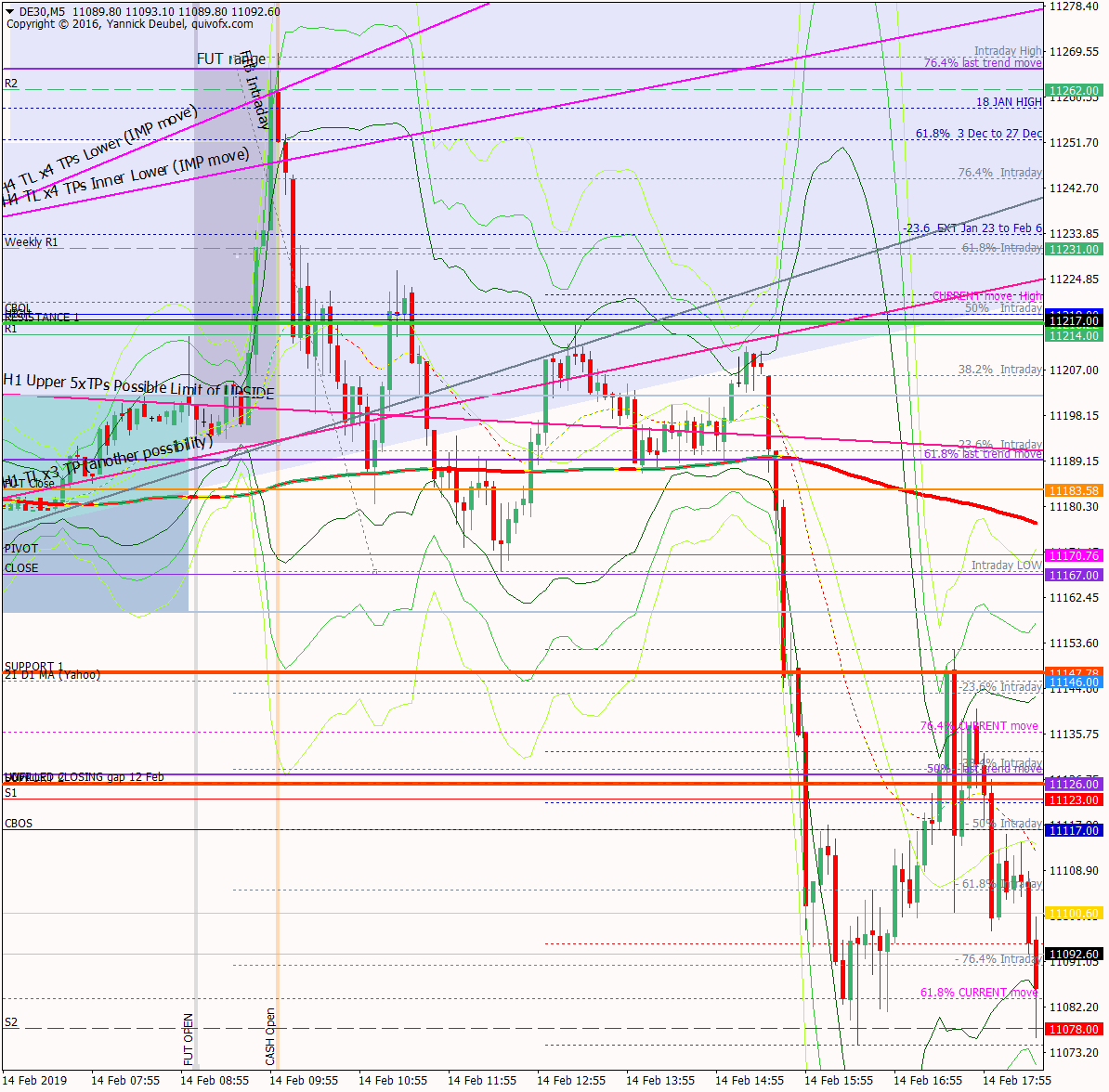

14 Feb – Rapid run up to R2 only to reverse all the way down to S2

14 February 2019

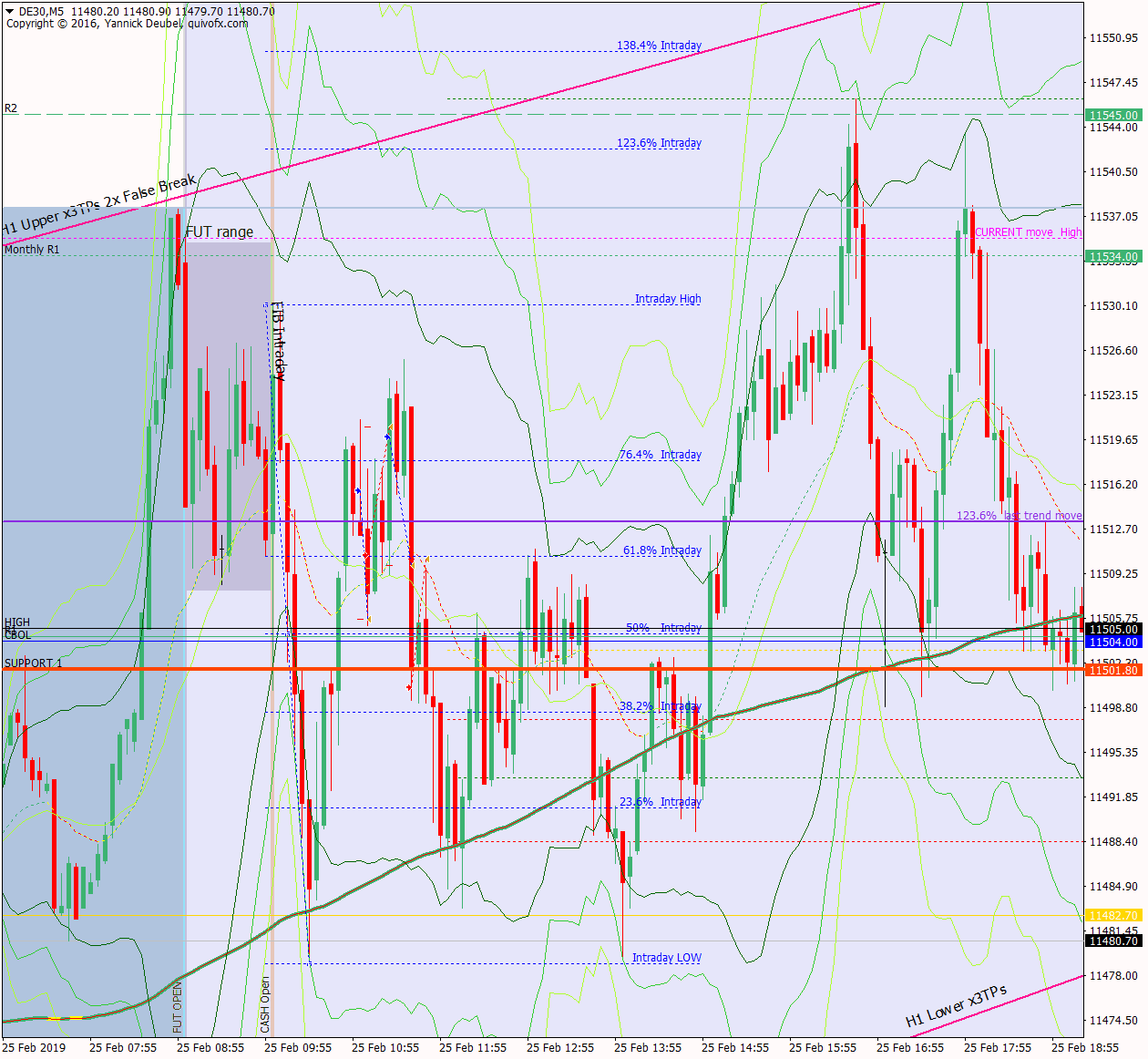

25 Feb – Tight range and ON levels in control

26 February 2019Pre-open Scenarios

The levels are very clear today and the question is whether Friday’s huge move will move will have legs. The move was also an outside day. Does the market now have enough MOM to exceed the 5th Feb highs? It is interesting that this level is also the bottom of the previous upward channel. If it does get here today, I will definitely expect a pullback before it regains the channel. The 3-month chart shows the two parallel channels quite clearly. On the downside, it has a way to go but a break of the lower upward sloping TL would mean curtains for this rally – the 5-day ATR is now 184 so the market has some energy.

Overall, with unfilled gaps above at 11465 and the TL structure that is shown on the 6-month chart at the bottom of the page, I think it will have to get up to 11500 area before staging a significant reversal – there are just too many magnets pulling the market up. So let’s see. If it doesn’t reach these levels, it will be a vry negative indication.

Futures opened at 11,340 leaving a gap of +40 against the cash close and +19 against the futures close. The futures open was above Friday’s range, creating and ex-gap of +17.

Body

- Sleep – what time did I go to bed? 10:40 and to sleep around 11:00

- Did I sleep well? Yes

- How much coffee have I had? Half the large pot in my bullet proof

- How do I feel? Am I going to win today? Overall negative but the PA is beautiful so want to trade.

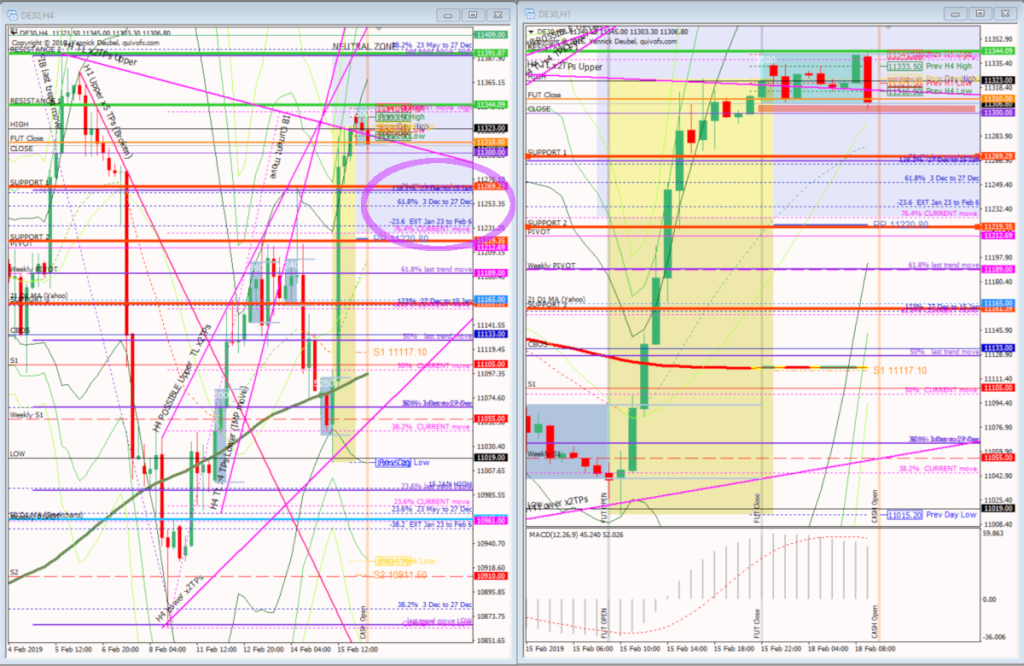

H4 and H1 charts from morning futures session

What the market looked like at the end of the day

As is often the case after a big move, today was not exciting at all:

- the market broke down through the ON support at the open

- there was some buying below the gap close and a bit of to-ing and fro-ing around the confluence of the close and BNR

- the market wanted lower but with very little conviction and stayed above the 74.6% retrace of the big move.

- the low of the day was the 61.8% of the 3 to 26 Dec move.

Key points about today’s PA and setups that worked

How effective was my Neutral Zone? This was not in play today; I set the lower bound of the zone as the 74.6% Fib of the Friday’s move and the top was the recent swing high at 11,391

How precise were my levels? SUP 1 was the only one of my levels that was active today and it was not accurate; the Fibs from recent moves were the KLs today.

What I did

TOTAL = -2.8R | # Trades 13 | Winners 2 | BE 6 | Losses 5

Average R per winner = 1 | Losses > 1R = 0 | Scratched (loss<1R) = 4

R-multiples: trades 2:1 or more = 2 | trades 5:1or more 1 = 0

Outcome using standard TP strategy and same trades:

(STE at 1:1 50% off at +20 and 50% off at +50)

2:1 trades (2R) + 5:1 trades (0R) + BE (6x0R) + Losses (-5R) = -3R

variance vs. my performance = +0.2R

Today’s most gorgeous setup

There were some opportunities but nothing that stood out as an easily 5R trade.

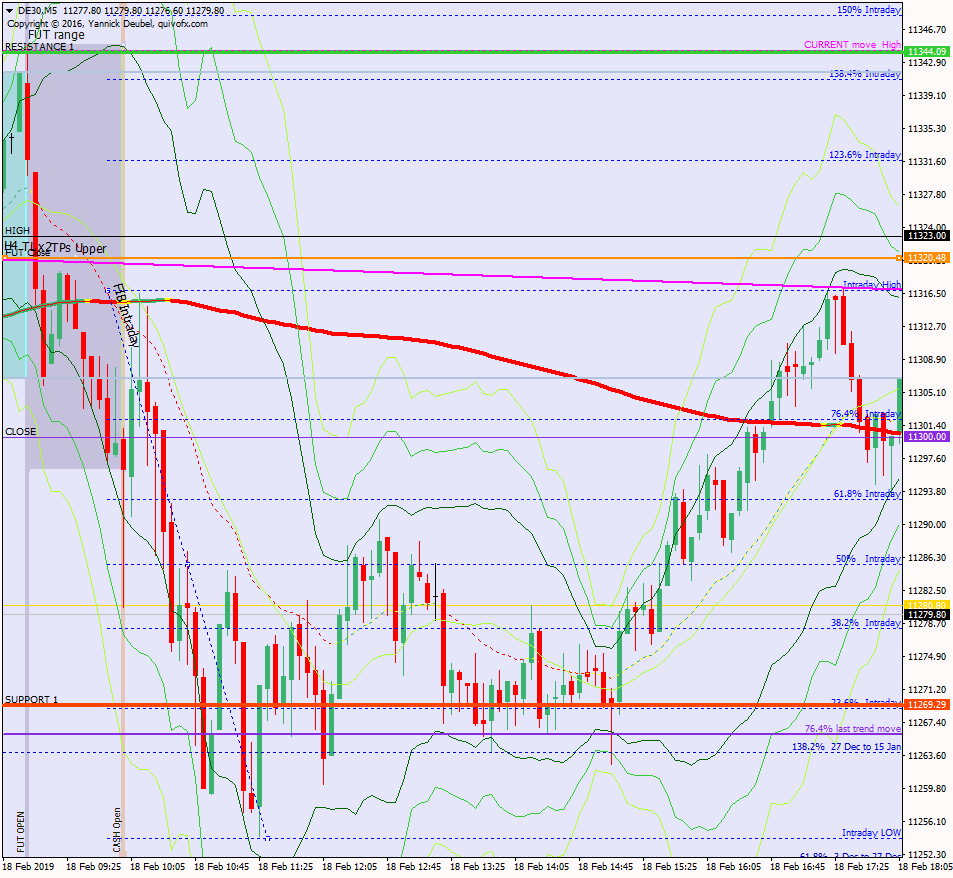

For reference: 6 month cash chart at COB yesterday