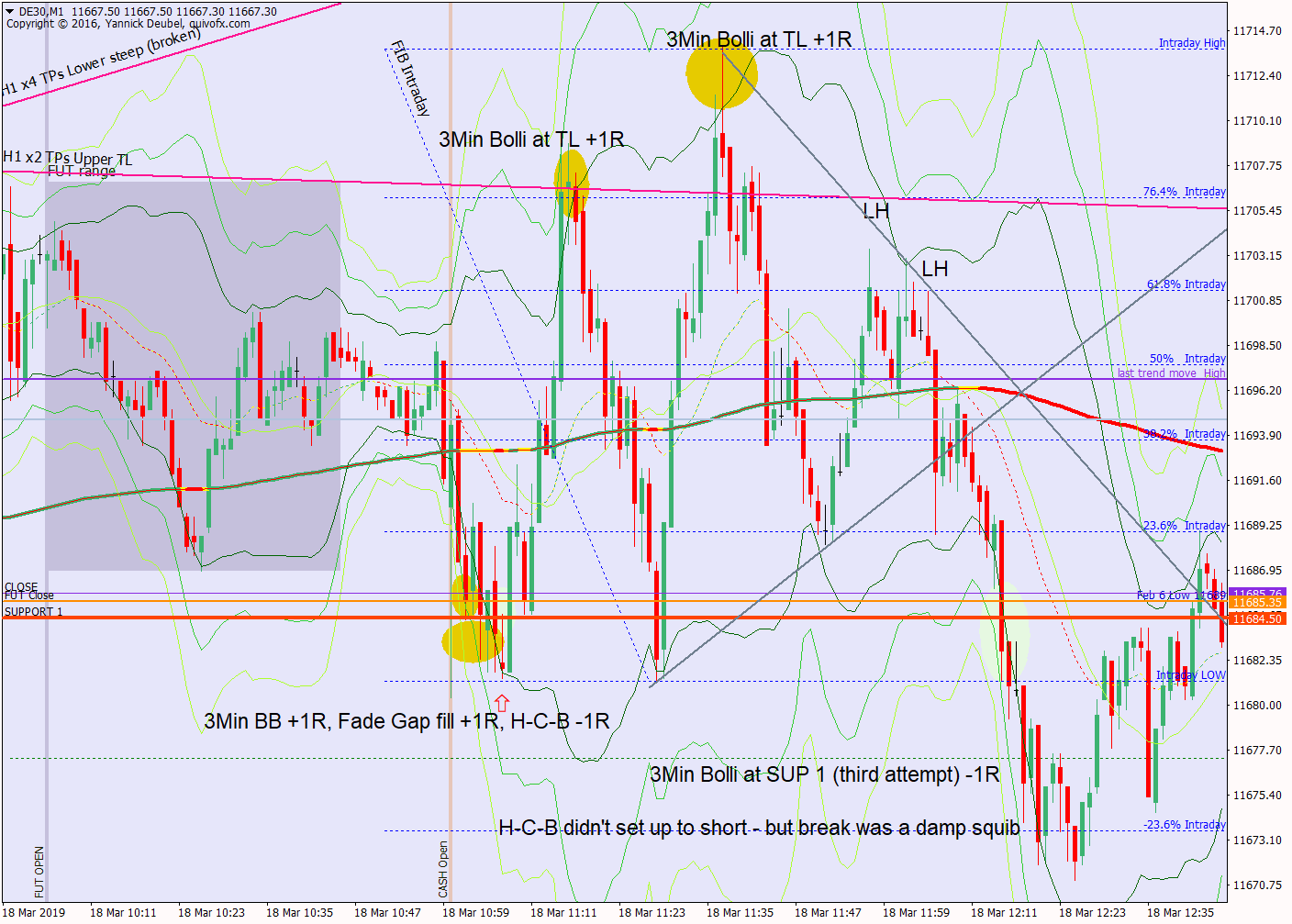

18 Mar – Slow, slow but drift was lower

18 March 2019

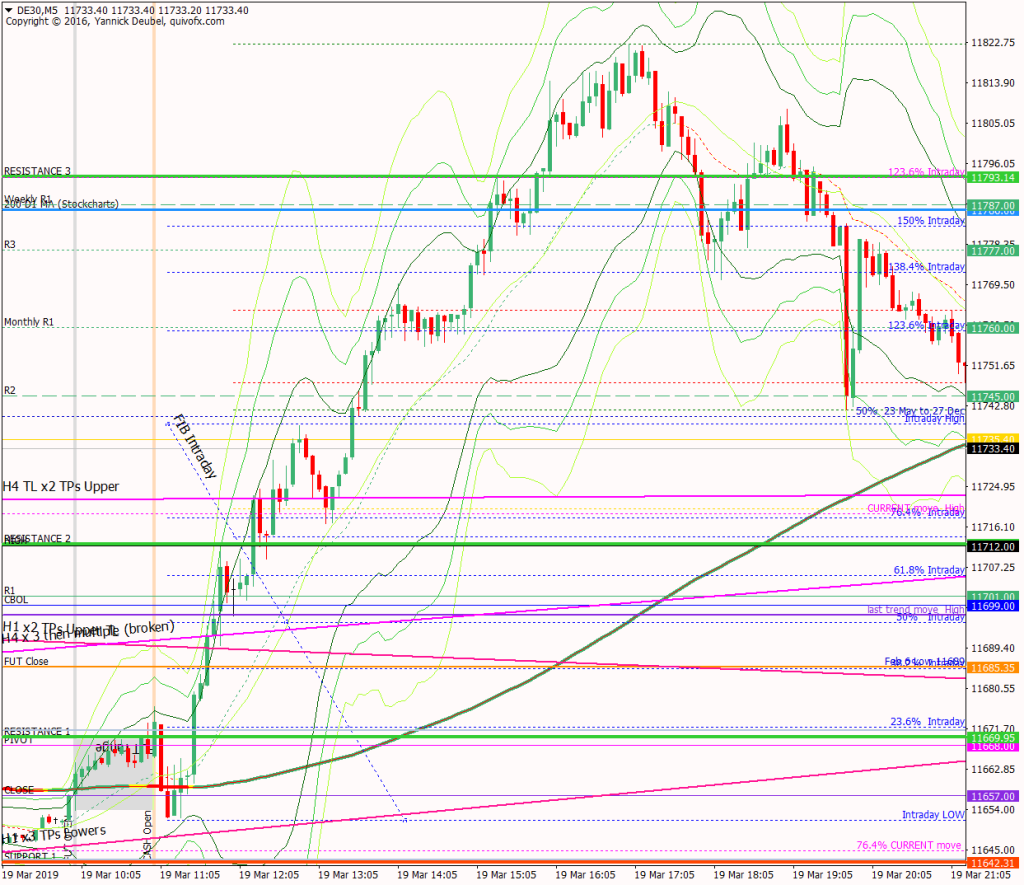

20 Mar – TL cracks and the market loses 100pts

20 March 2019Pre-open scenarios

The tight range continues, but the lower TL that is supporting the uptrend is now in sight, so today I will be trading a break of that and buying that level too. It coincides with the 76.4% retrace of the current move so will be an interesting area today. The levels above are beautifully clear today with CBOL at 11699. If this is hit, I will trade it in both directions. Overall, the peeling away from the upper channel implies lower and although we have a HH from last week, I am really looking a for is a head-and-shoulders to form as although the PA is positive, it lacks conviction. Once this range/channel breaks the ATR should increase to make trading more fun.

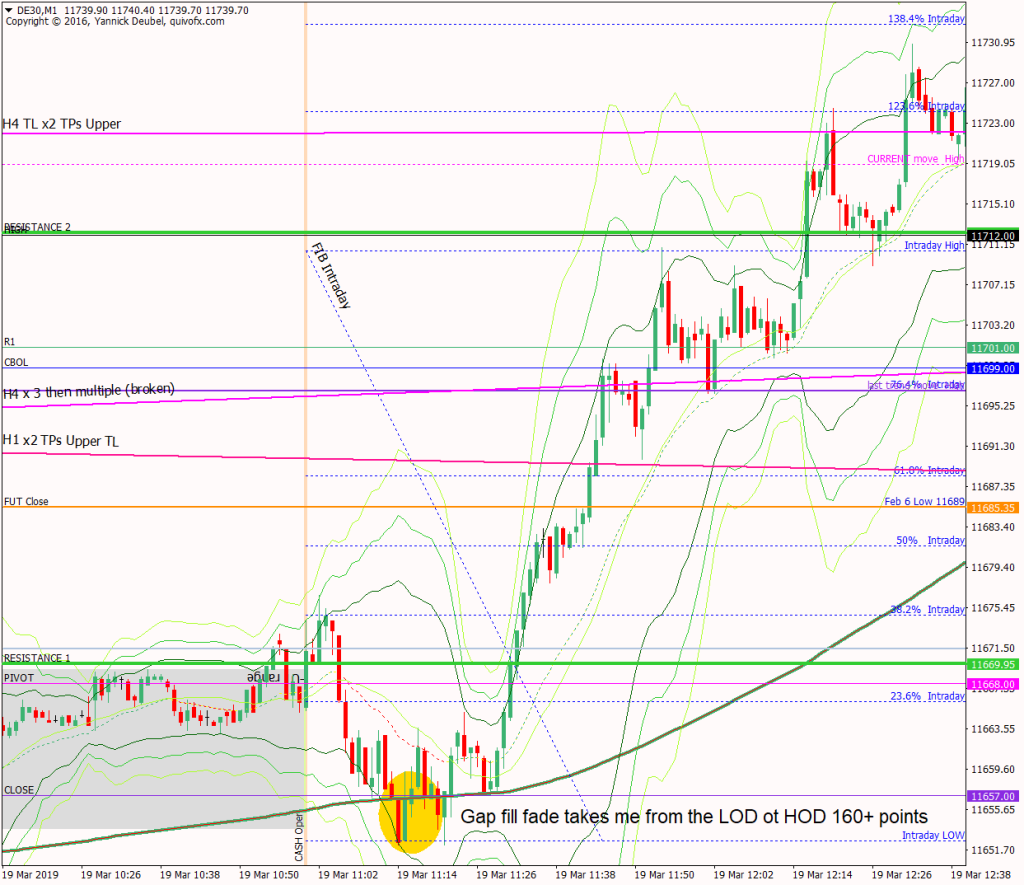

Futures opened at 11657, leaving a gap of 0pts against the cash close and -6 against the futures close. The futures open was within Friday’s range so there are no ex-gaps.

Physical/body

Sleep – what time did I go to bed? 23:40, which is only 7hrs and I woke up a couple of times in the night

How much coffee have I had? Half aluminium pot

How do I feel? Am I going to win today? Feel good about yesterday and a bit anxious that I can’t repeat it

H4 and H1 charts from the morning futures session

There is a triangle forming on the H4, reflected by the low ATR at 114 today. As was the case yesterday, the market has a lot of resistance to get through to move higher. But there is also a magnet up above, with the daily cash 200MA in spitting distance at 11,784. So the question today is, is the recent low volatility and peeling away from the upper channel a sign that the market is rolling over or is it having a pause to collect more fire power?

What the market looked like at the end of the session

PA during my trading hours

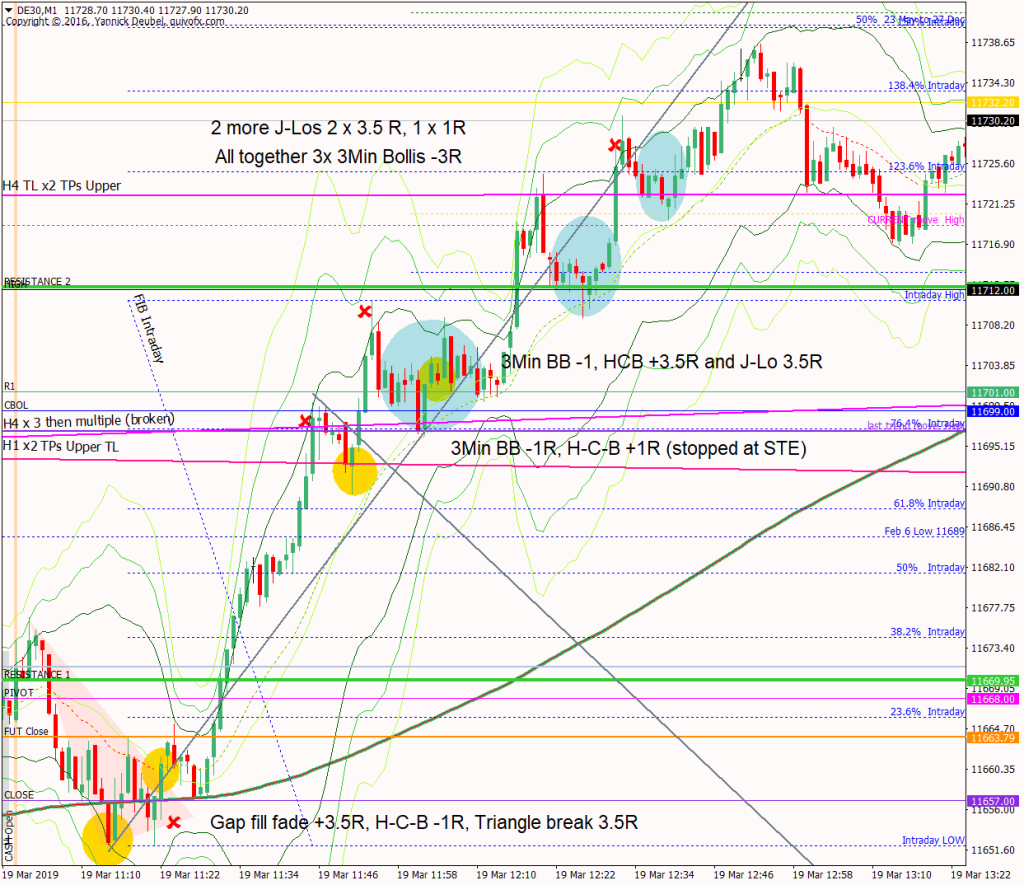

Key points about today’s PA and setups that worked

ATR is down to107 and the range during the first 30mins was just 27pts

- the first trade was a 3Min Bolli short at the open which only ran down to the gap fill, but it would have been a good position if the TL below had broken

- a low volatility environment is ideal for the gap fill trade and especially at it filled while outside the3Min Bolli – the trade actually achieved 16R as it was the low of the day

- price vibrated around the gap and formed a triangle above it, supported by the M1 169 and the M3 169 and this turned out to be another 16R trade

- having reversed in response to the gap fill the market took off and powered straight through RES 1

- even TLs didn’t hold it back and could only be successfully traded as J-Los and H-C-Bs

- the market hugged the upper 3min Bolli Band the whole way up, making shallow retraces at each KL

- the trend was so strong that it went straight through R3, weekly R1 and cash daily 200MA, overshooting the latter by around 30pts and then closing 3pts above it

How effective was my Neutral Zone? I forgot to add this in this morning and this did me a big disservice as I didn’t have this higher TF reference map for the PA. I like to think I would have put the upper limit at the TL shown on the H4 and H1 charts but I can’t be sure – anyway, it’s omission today made me realise what it´s for, which I had lost track of.

How precise were my levels? RES 1 provided a good selling opportunity at the open for +1R and then the market ripped through it. RES 2 was just missed on the first attempt and exceeded on the second – it didn’t work as a 3Min Bolli but it did give excellent H-C-B and J-Lo setups. RES 3 was a not a good level but saw a minor reaction (why was it there and just above weekly R1 and daily cash chart 200 MA??)

What I did

TOTAL = 2.5R | # Trades 15 | Winners 3 | BE 5

Average R per winner = 3.2 | Losses > 1R = x | Scratched (loss<1R) = 0

R-multiples: trades 2:1 or more = 3 | trades 5:1or more = 3

Outcome using standard TP strategy and same trades:

(STE at 1:1 50% off at +20 and 50% off at +50)

2:1 trades (3xR) + 5:1 trades (3 x 2.5R) + BE (0R) + Losses (-7R) = 3.5R

Variance vs. SYS = -1R

Today's most gorgeous setup

Ther gap close fade was a very easy 16R trade. This trade was also outside the 3Min Bolli and at the 169, and it was with trend, so that is as perfect as a setup could be.

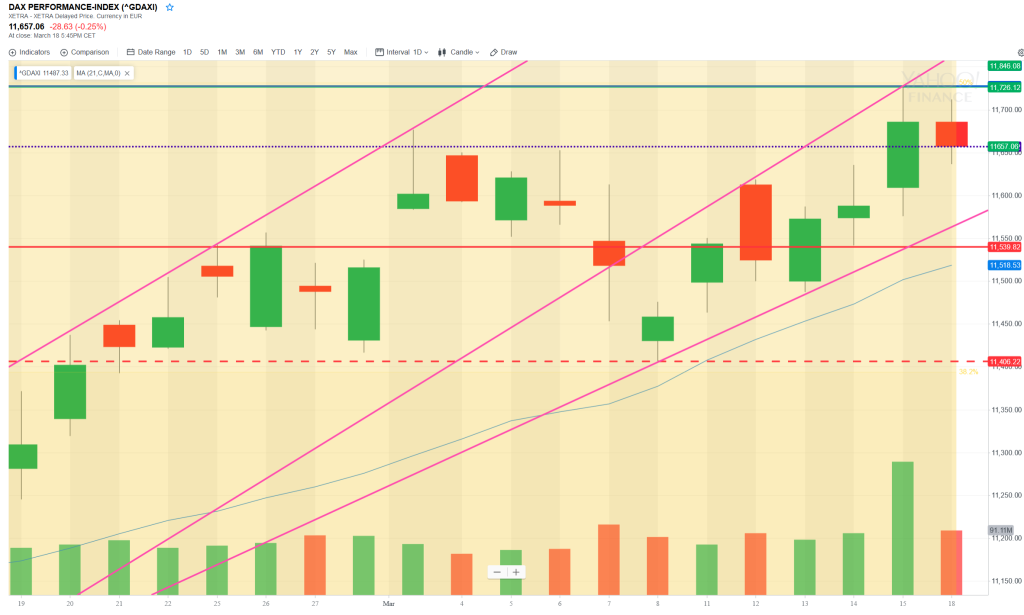

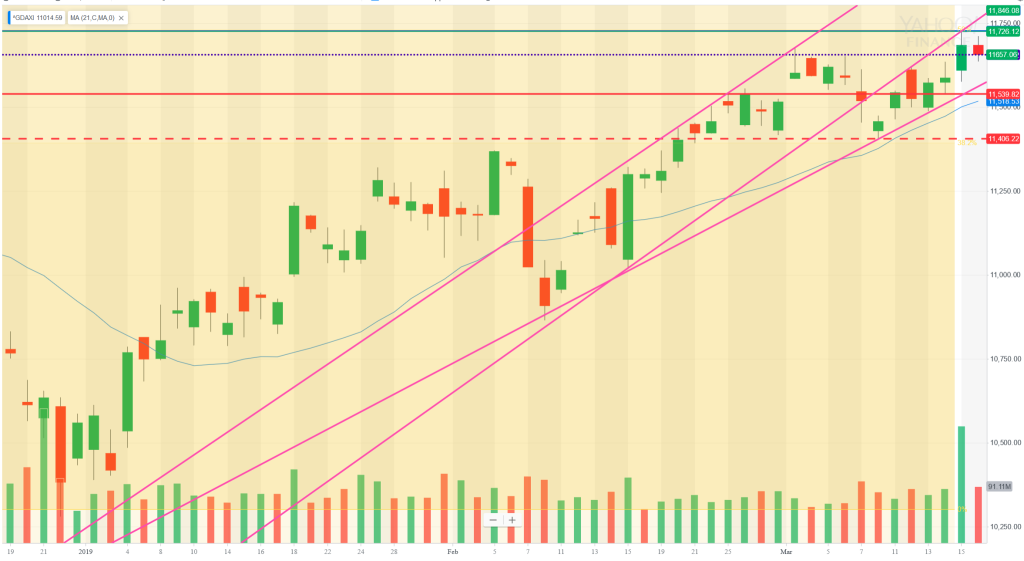

For reference: 6 month cash chart at COB yesterday