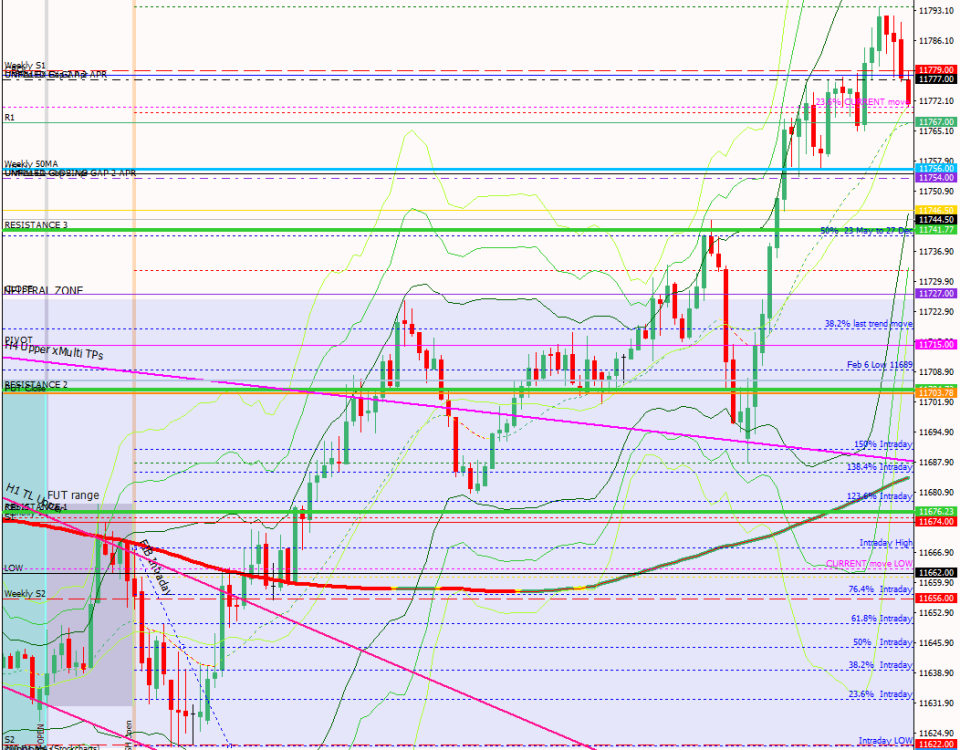

17 Dec – TL supporting H1 Friday’s corrective action breaks for 200pts

17 December 20183 Jan – Second failed break out long of TL

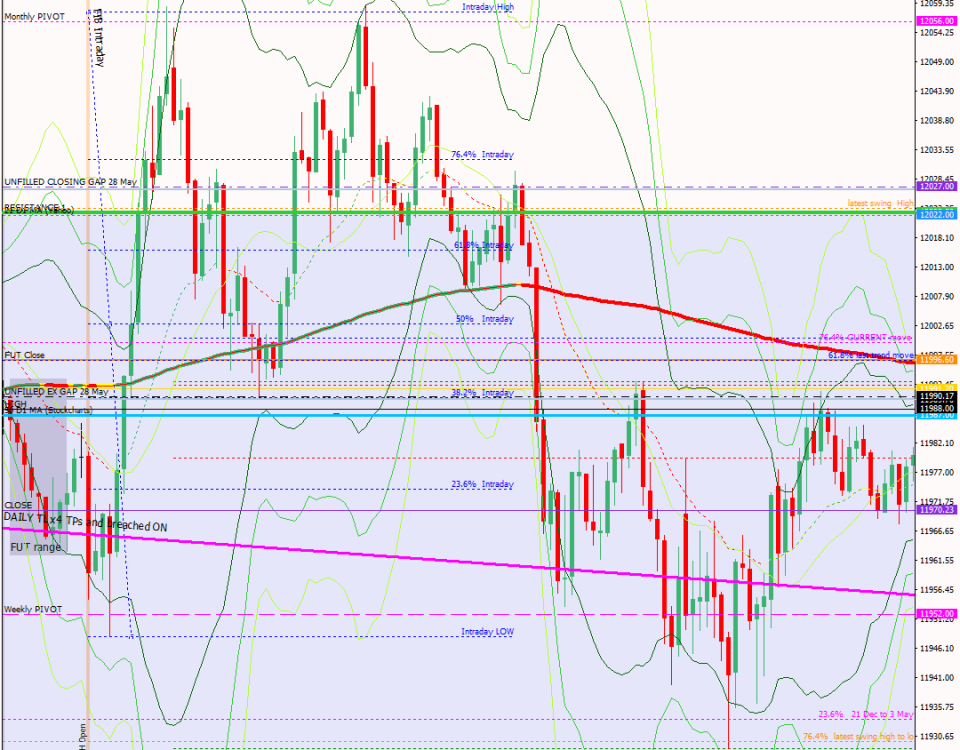

3 January 2019Pre-open Scenarios

The first day of trading in the new year is often seen as bullish and the ON market opened with a big gap up but then gave it all back and more. This morning the 10253 level is a critical on the downside and the 10583 on the upside. Between the two the market is in short term no-man’s land in a strong down trend.

Futures opened at 10498 with a down gap of 61pts. The ON high was around 10700, so it broke the upper TL but this was quickly rejected.

What the market looked like at the end of the day

Key points about today’s PA and setups that worked

- The market broke out of my Neutral Zone for 80pts in early and since this was also below CBOS, this was an easy break to take.

- The best entry into the sell was to take the cash open spike but this would have been a tricky trade to take given that it was the first trading day of the year.

- The market hardly paused at SUP or the Low but reacted to these levels on the way back up.

- The reversal was indicated by nice clear PA, but up until then we had all the marks of a trending day: 169 was far away from prices and levels were smashed through.

- Once it regained my Neutral Zone and confirmed the lower side of it with a restest (see gold circke ion above cahrt), the stage was set for at least a retest of the Highs.

- PA tells me that the lower TL was active as it retested it during the afternoon and then went on to break the upper TL, but this was all outside my trading hours.

How effective was my Neutral Zone? A break of the zone saw 80pts come off the market and once the market regained it, it stayed bullish which all tells me it was the right place.

How precise were my levels? SUP 1 was spot on as it provided the level for the lower side of my Neutral Zone; SUP 2 was smashed through on the way down but reacted on the retrace. RES 1 was rejected for 25 pts on the first hit and broken through on the second

What I did

08:44 Buy x 45 @ 10506 | Long for 1st of Month | P&L = -1R*

09:02 Buy x 82 @ 10481 | Cash open spike| P&L = -1R*

09:04 Buy x 44 @ 10481 | NONE – reaction to loss | P&L = -1R*

09:05 Sell x 81 @ 10468 | M1 TL Break by hand | P&L = +3.2R

09:10 Sell x 22 @ 10447 | H1 TL Break by hand| P&L = +0.7R

09:13 Buy x 76 @ 10435 | 3Min Boilli | P&L = -1R

09:31 Buy x 61 @ 10404 | 3-Leged Stool | P&L = +3.1R

09:31 Buy x 76 @ 10402 | M1 TL Imp-Corr by hand| P&L = -1R

09:40 Sell x 83 @ 10418 | M1 TL Imp-Corr by hand | P&L = -1R

09:57 Sell x 82 @ 10420 | Mistake | P&L = -1R

11:00 Sell x 82 @ 10428 | M1 TL Fade by hand| P&L = -1R

11:04 Buy x 81 @ 10440 | M1 TL Triangle by hand| P&L = +3.3R

11:11 Sell x 76 @ 10455 | 3Min Bolli | P&L = -1R

11:22 Sell x 91 @ 10459 | 169 fade | P&L = -1R

11:25 Sell x 82 @ 10478 | Mistake | P&L = -1R

11:39 Buy x 82 @ 10478 | M1 TL Retest fade| P&L = -1R

11:42 Buy x 81 @ 10470 | M1 TL Fade by hand | P&L = +2.6R

* at exactly the cash market open the screen froze. This doesn’t excuse these trades as I should have stopped trading but it does tell me that my kit is a piece of crap and needs to be replaced.

TOTAL = +0.9R — # Trades 17 — Winners 5

Today’s most gorgeous setup

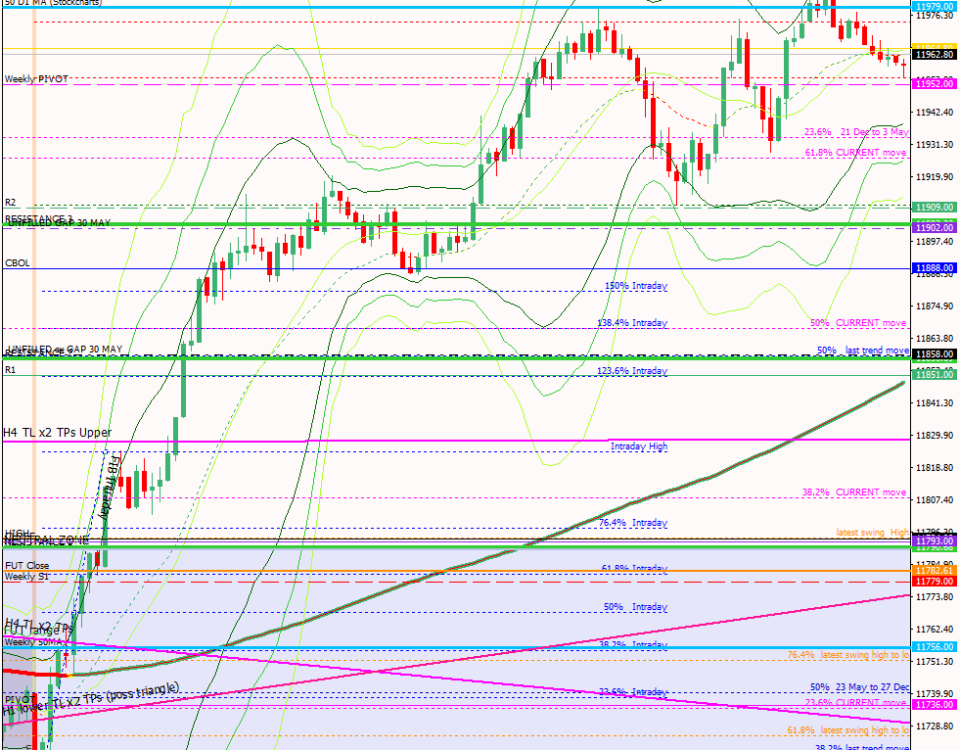

The 3-legged stool was a lovely trade this morning and captured the low of the day perfectly.

For reference: 3 month cash chart at COB yesterday