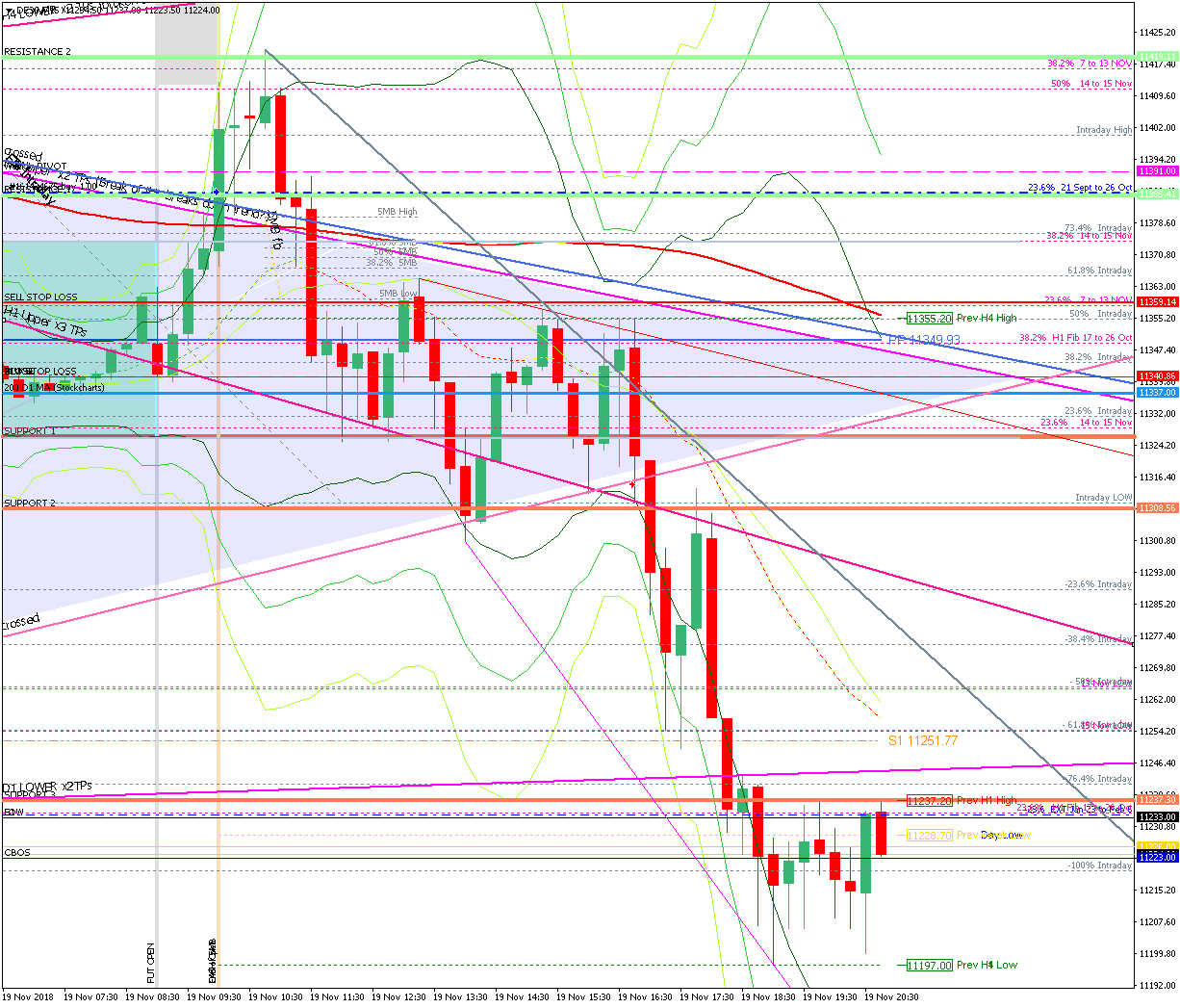

19 Nov – Break long a damp squib, break short +100 and still going

19 November 2018

21 Nov – a lesson in spotting and trading a bounce in a strong downtrend

21 November 2018I wasn’t trading today but here’s a summary of what happened.

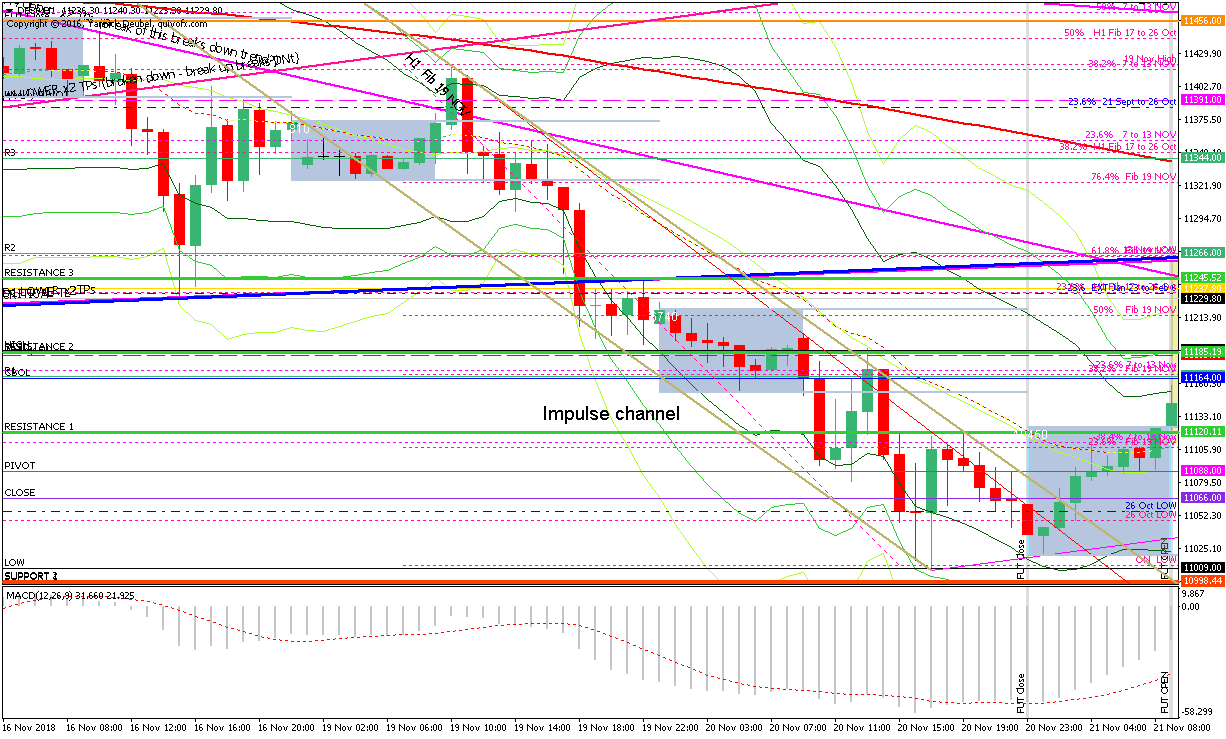

A critical cash chart TL broke late in yesterday’s session. The line was briefly retested ON but then the market opened with a big down gap.

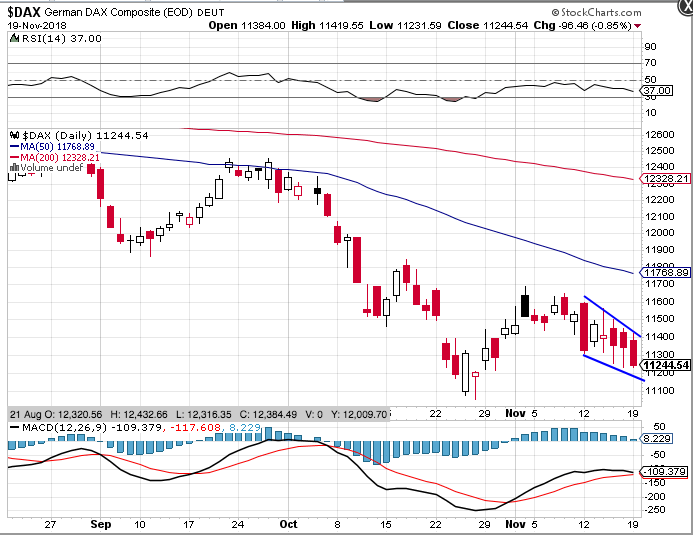

This is the cash chart at the end of Monday 19th, showing the falling wedge that broke during the evening session.

This is what the market looked like by the close of business on Tuesday. Prices have formed a new impulsive down channel which is cleaner on the upper side than on the lower.

This looked like a tricky market to trade as levels were not respected, implying continuing downward trend and then we saw a sudden reversal. I nice trade this morning, which is not in my plan, would have been to sell the brief move up to the 11200 BNR just after the futures open.

What’s most interesting about today’s is how fantastic the 169 is as a level to trade against. It’s a cracker every time – and especially when the market fails to make a new high of the day and puts in two LHs instead.

It’s also good to note how fib extensions can be used as levels when there is very little price information on the left of the chart.