14 Jan – Indecision, a dip down then an explosive rally

14 January 2019

22 Jan – Powerful move up to gap close and then reversal to 50MA

22 January 2019Pre-open Scenarios

Last week saw lots of corrective backwards and forwards action until Friday when the market exploded upwards and filled a few of December’s gaps. Today we should see a retrace of some of that move and then a contination up to fill the next gaps at 11334. With so much momentum, it seems unlikey that the market will stage a significant reversal today. Buying at the 74.6% or 61.8% retraces of Friday’s move could work, depending on the PA going into it. A move above Friday’s highs at 11216 will be interesting – will buyers then step in and push it into the waiting unfilled gaps above?

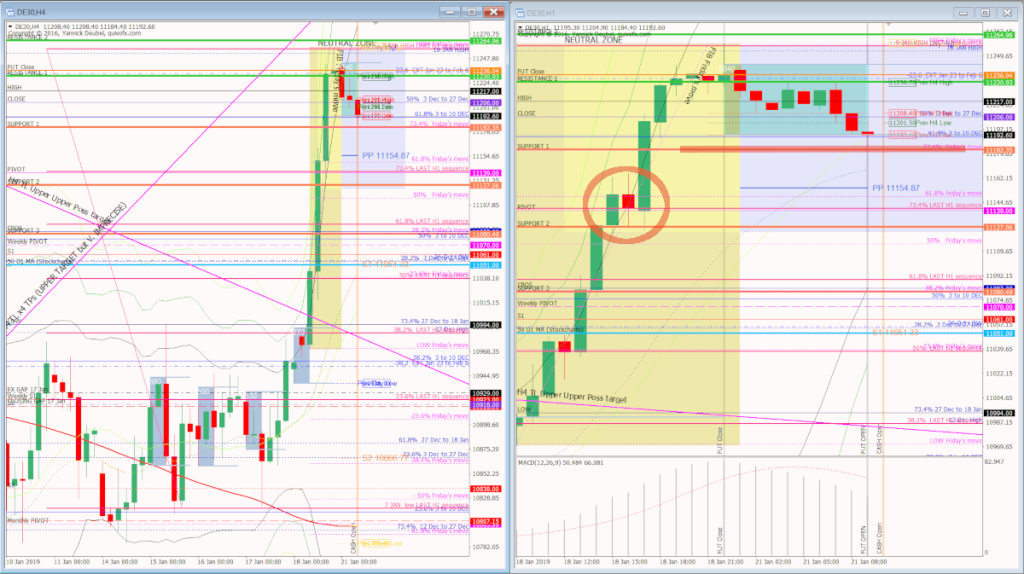

H4 and H1 charts pre cash open

Futures opened with a 10pt down gap at 11,195 and cash opened at 11193, so a 12pt gap down.

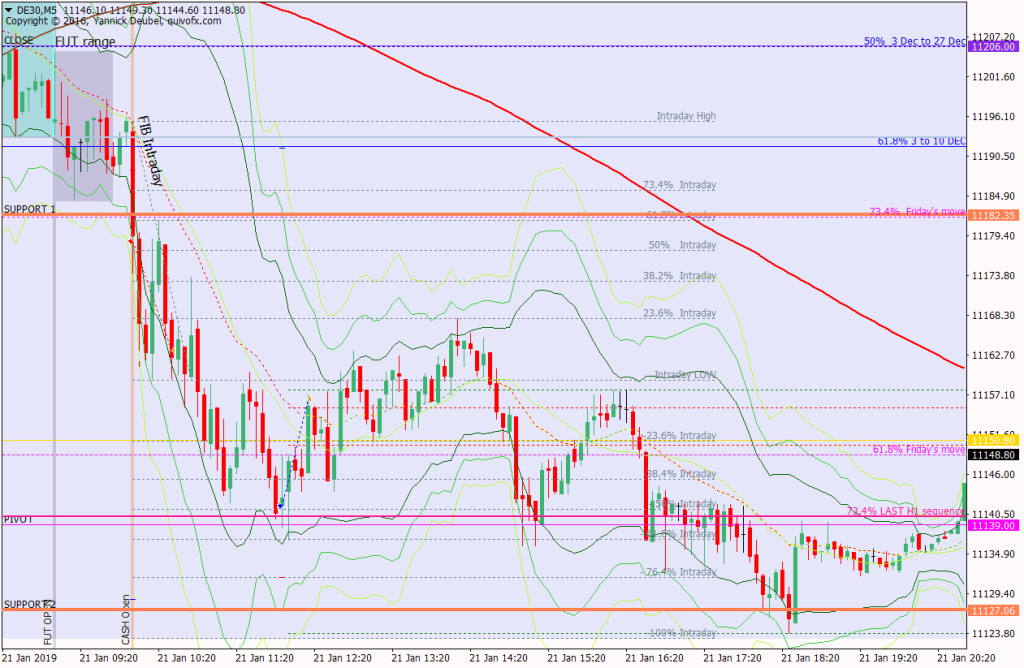

What the market looked like at the end of the day

Key points about today’s PA and setups that worked

- Cash opened with a tiny 12pt gap bit did not go up to fill it as I had been hoping – given the ON weakness, this would have been a lovely area to sell.

- Instead, it immediately sold off and broke through my SUP 1 level – which stayed broken – and straight into the levels where prices paused on the move up (see H1 chart above)

- Around 1.5Hrs into the session, it hit the pivot and retraced excatly 50% before making another slow, stair-step move into the level, from where it reversed again.

- The second bounce off the pivot made a lower high (at the 38.2% fib).

- From there is saw more decisive selling down to my SUP 2

How effective was my Neutral Zone? The upper side of my zone was not in play, but the lower edge was just touched and price reversed upwards from there, telling me that the level was spot on.

How precise were my levels? SUP 1 was broken in the first minutes and a retest of the level failed, indicating weakness through the rest of the session, so this level was correct. The same is true of SUP 2 which attacted prices and then saw a reversal so that was also sot on.

What I did

TOTAL = +0.1R | # Trades 4 — Winners 2 — BE 0

Average R per winner 1 — Losses > 1R 0

Today’s most gorgeous setup

This was the trade I took at the open: a break of my SUP 1 line. This could be traded by taking some off at the first push of +20 and then adding to the trade when the retest of the level failed.

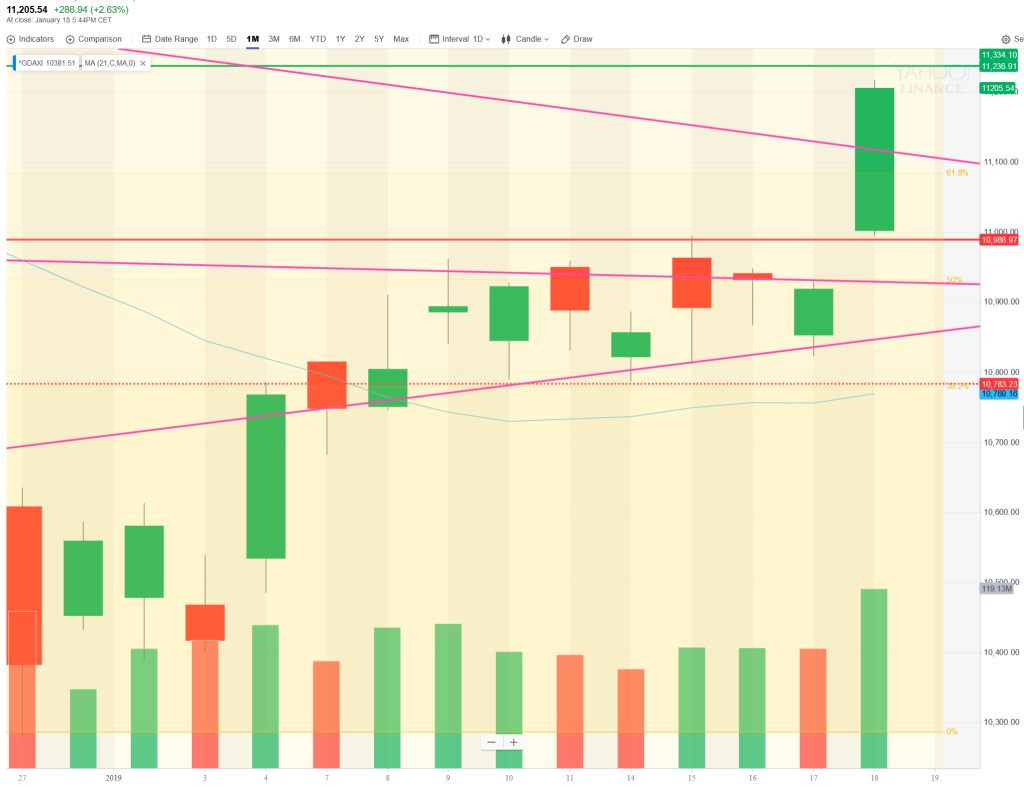

For reference: 3 month cash chart at COB yesterday