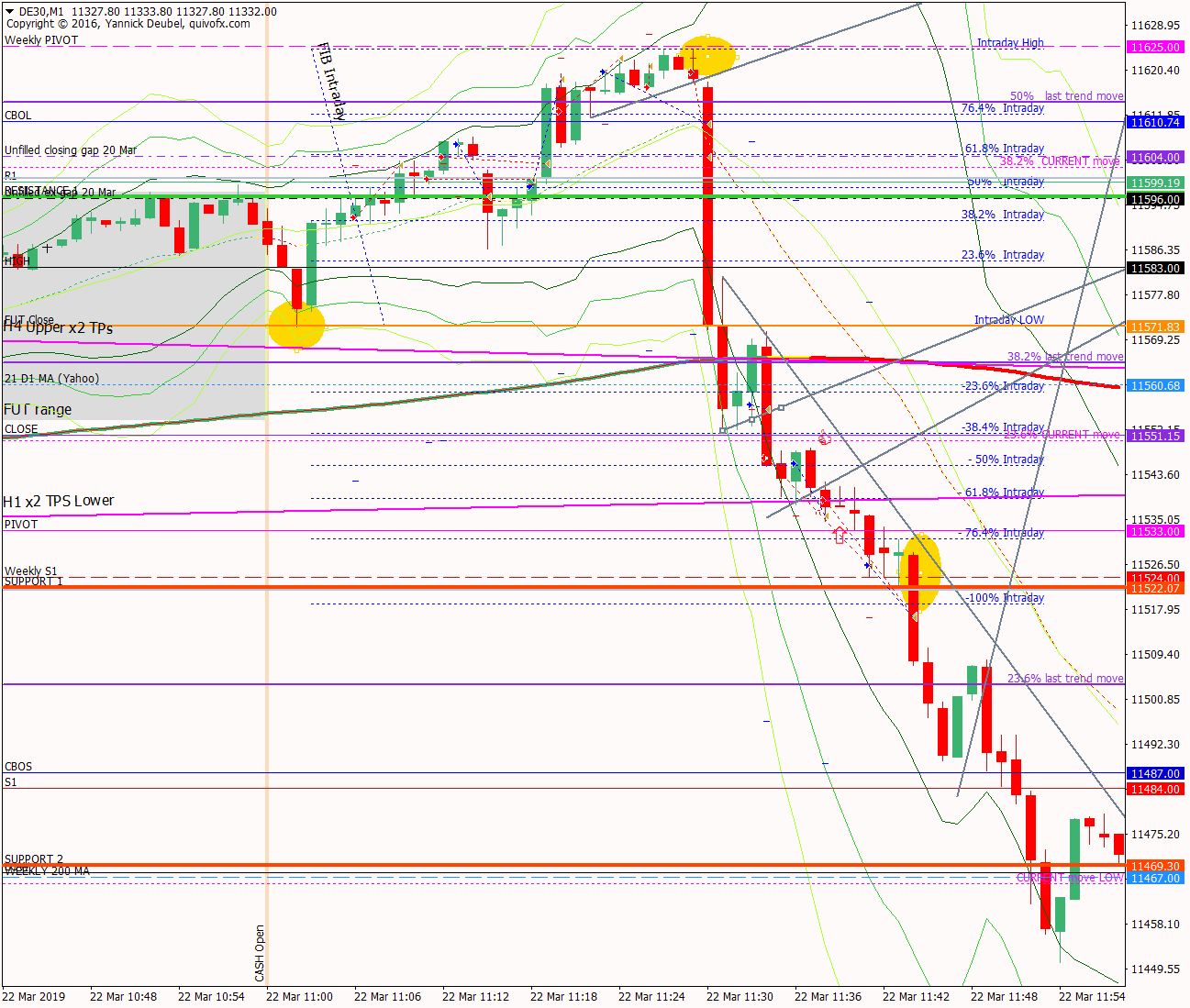

22 Mar – Fills 20th March gaps then crashes through TL

22 March 2019

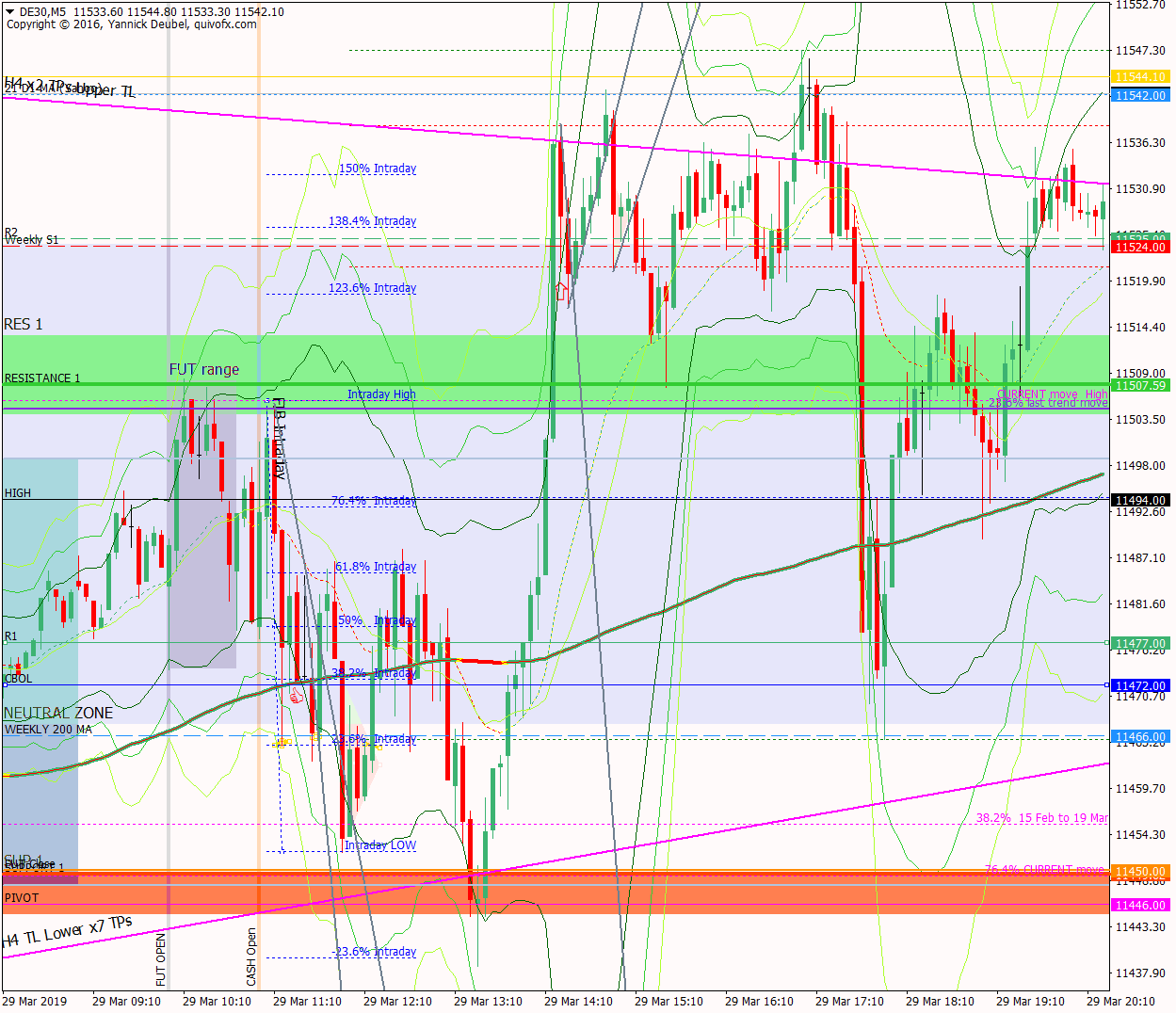

29 Mar – Tests the supporting TL then breaks above 11500 to daily 21MA

29 March 2019Physical/body

Sleep – what time did I go to bed? 23:45 so 7hrs sleep

How much coffee have I had? Half medium pot

How do I feel? Quite confident but not excited by the PA

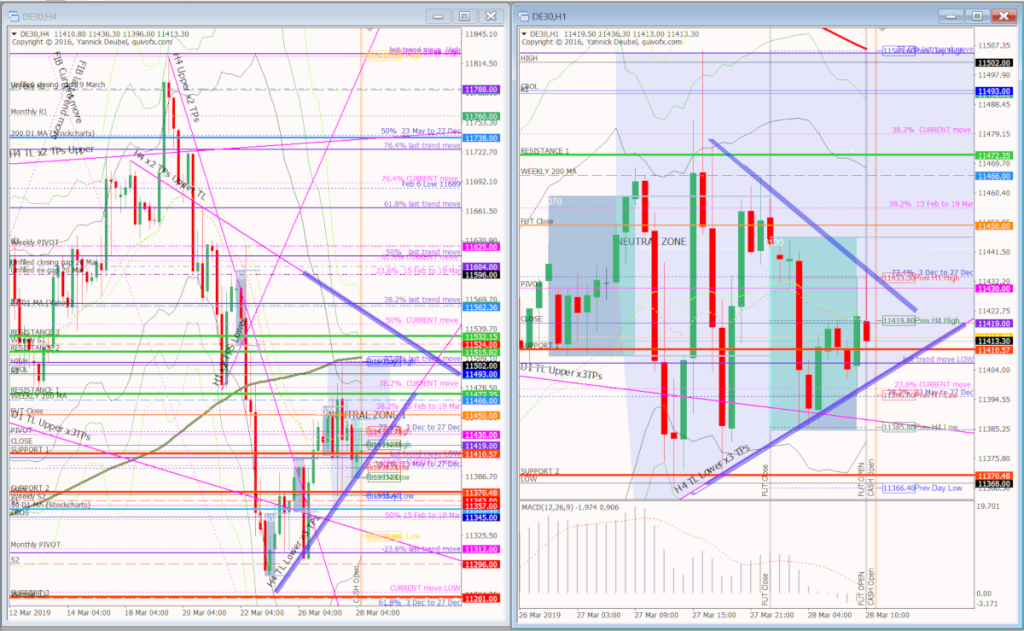

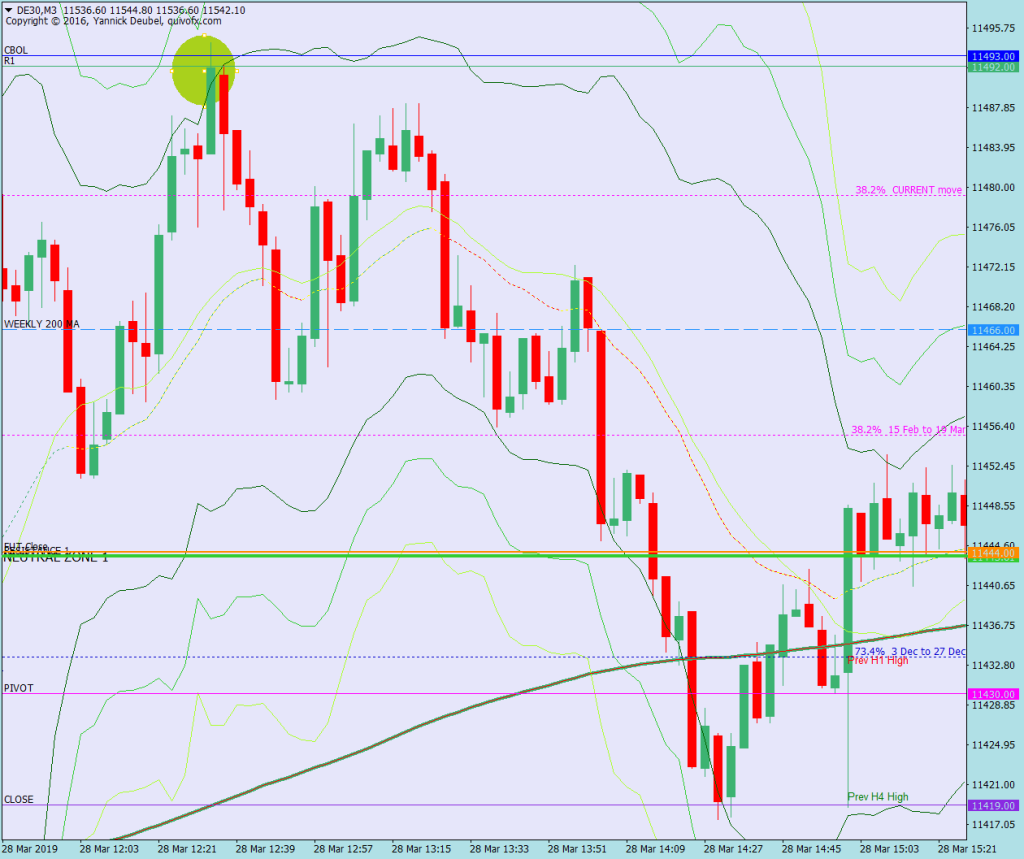

H4 and H1 charts from the morning futures session

Scenario 1: climbs to 11500 and reverses, then ranges all day and stay above the H1 TL SPOT ONScenario 2: breaks H1 TL early on and then sees declines or goes back a few retests before making its move.Scenario 3: continues range bound and/or makes false breaks either side of the Neutral Zone

What the market looked like at the end of the session

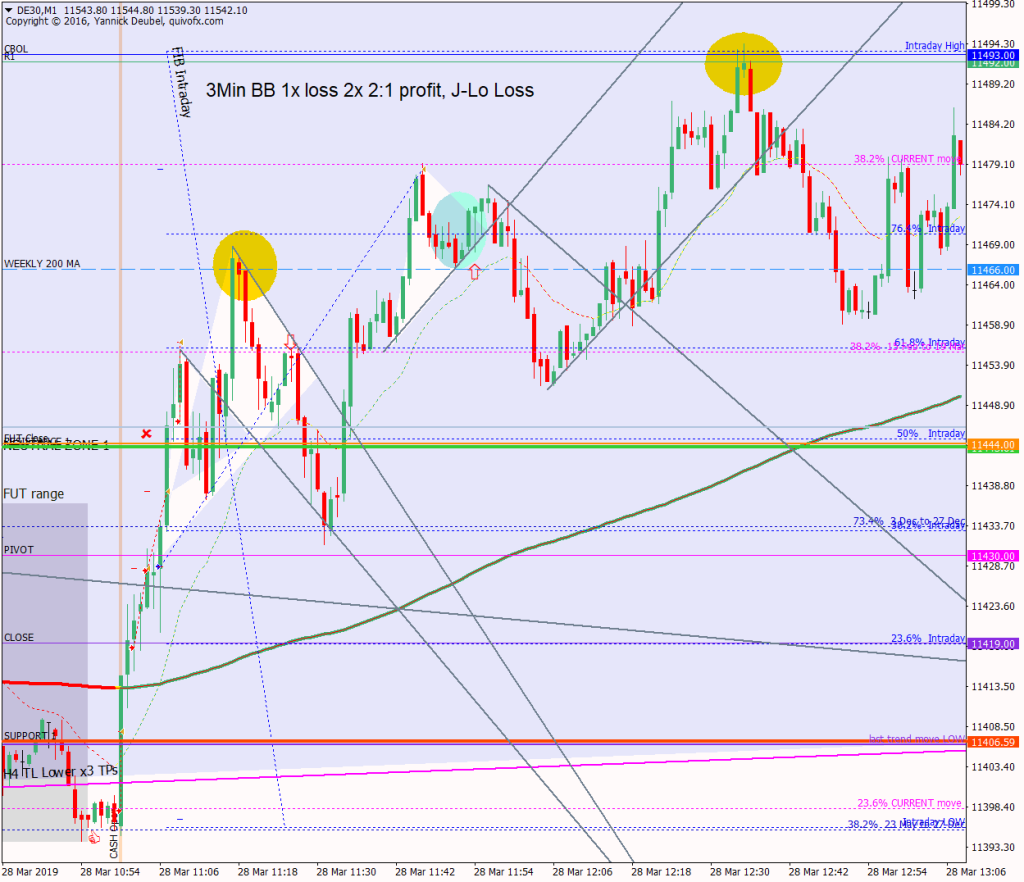

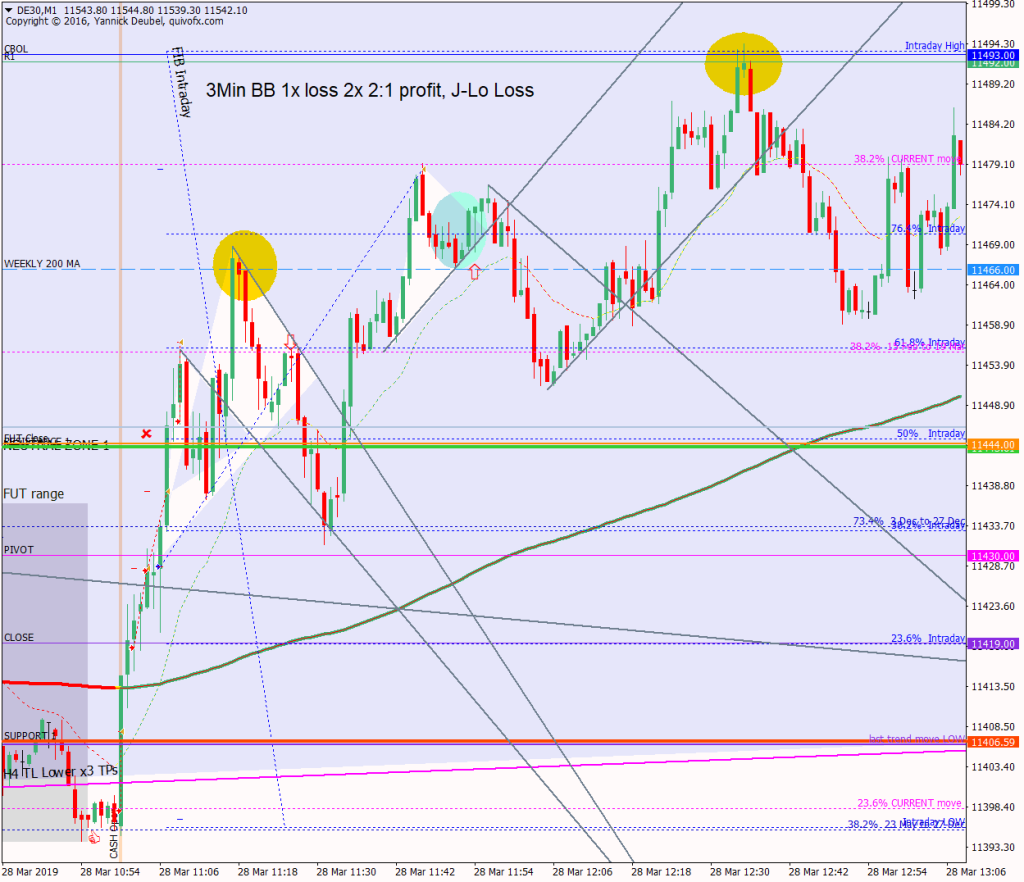

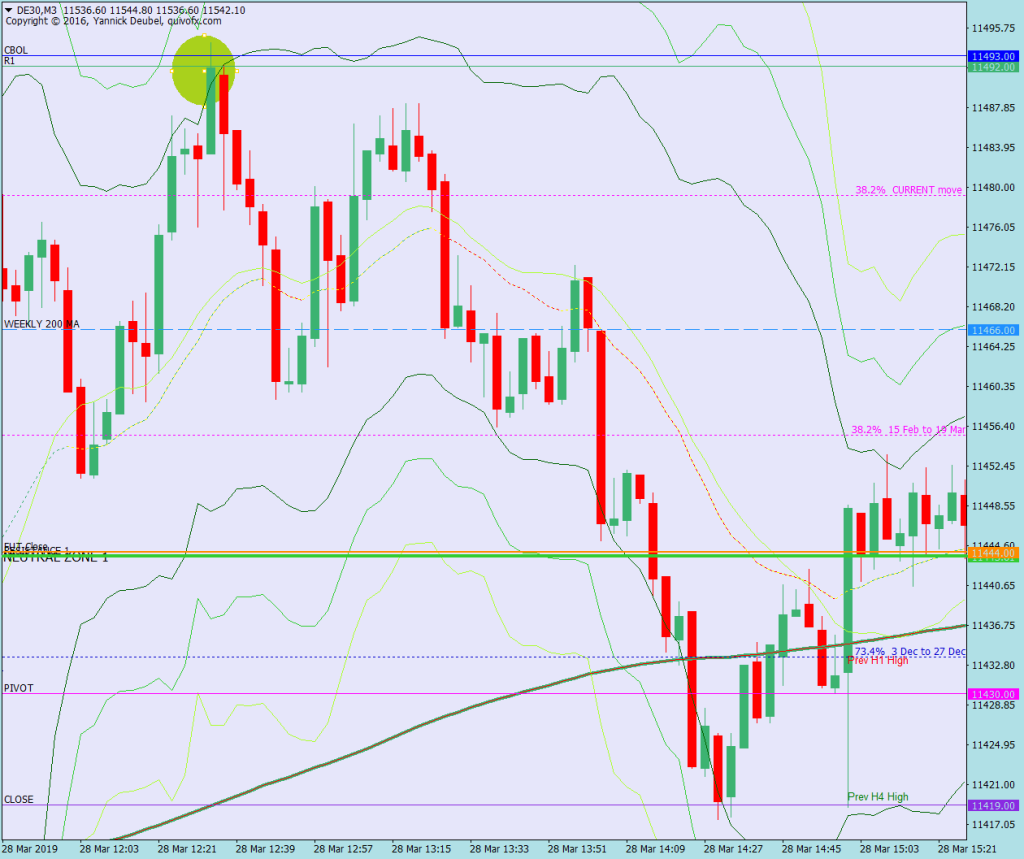

PA during my trading hours

Key points about today's PA and setups that worked

The market saw some powerful buying off the TL test at the start of the session and then made to 11500, respecting and pulling back at KLs as it made its way upwards.

- the supporting KL is nice and clear and was at the confluence with the 11400 BNR so it was an obvious level to trade – although it didn’t quite set up as a 3Min Bolli but was a Jigsaw using Rule of 3.

- the weekly 200MA was also an obvious level to trade today and that set up as a 3Min Bolli

- The PB from this level went to daily pivot which was also the opening 5MB high and an area of fib confluence

- the first H-C-B entry at the weekly 200MA failed but the second one worked

- the market went straight through RES 1 and weekly 200MA on the second hits and then repeated the PB pattern at the 38.2% of the current move

- the HOD was at CBOL+R1+BNR

How effective was my Neutral Zone? The upper bound of the Neutral Zone wasn’t in play, but ion reflection, it should have been 11500. The lower bound was the supporting TL which was tested at at the cash open and then again during the afternoon session and this was spot-on.

How precise were my levels? SUP 1 was broken during the futures session and I should have adjusted it to be the Fut session low; RES 1 was in the wrong place and the accurate level was the 38.2% fib of the last major trend

What I did

TOTAL = -5.9R | # Trades 16 | Winners 2 | BE 2

Average R per winner = 2.2 | Losses > 1R = 0 | Scratched (loss<1R) = 1

R-multiples: trades 2:1 or more = 2 | trades 5:1or more = 1

Outcome using standard TP strategy and same trades:

(STE at 1:1 50% off at +20 and 50% off at +50)

2:1 trades (2R) + 5:1 trades (1 x 2.5R) + BE (0R) + Losses (-11R) = -6.5R

Variance vs. SYS = +0.5R

ON TILT trades: 5

Today's most gorgeous setup

It doesn’t get much easier than this: two KLs and BNR plas a 3Min Bolli setup. With such robust levels this would have also been a valid 2nd Chance 3Min Bolli, which would have seen 2:1

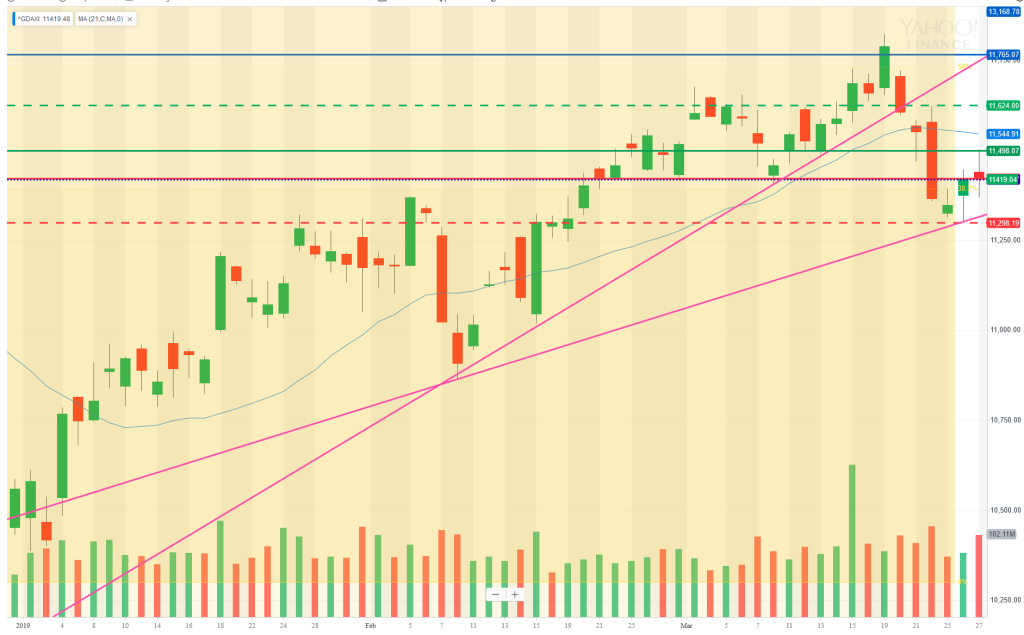

For reference: 6 month cash chart at COB yesterday

Pre-open scenarios

The market has been in a tight range since break the major TL last week. It bounced at around 11300 and then found major resistance with a lot of sellers at 11500, so for now, it’s stuck between these two BNRs. On the H1 chart, a clear lower TL has formed and if this breaks, it could be the start of the next leg down. To see upside, the market has to get a good grip of levels above 11500 – which is an obvious trading level so it will be interesting to see the PA around it if the market does get there – we could see some false moves coming in to maximise trade before the market accepts or rejects the level.

The daily cash chart 50MA is at 11353 so that is in sight on the downside today and the market has been reacting to this level all week so far.

Futures opened at 11419, leaving a gap of 0pts against the cash close and -25 against the futures close. The futures open was within yesterday’s range so there are no ex-gaps.

Physical/body

Sleep – what time did I go to bed? 23:45 so 7hrs sleep

How much coffee have I had? Half medium pot

How do I feel? Quite confident but not excited by the PA

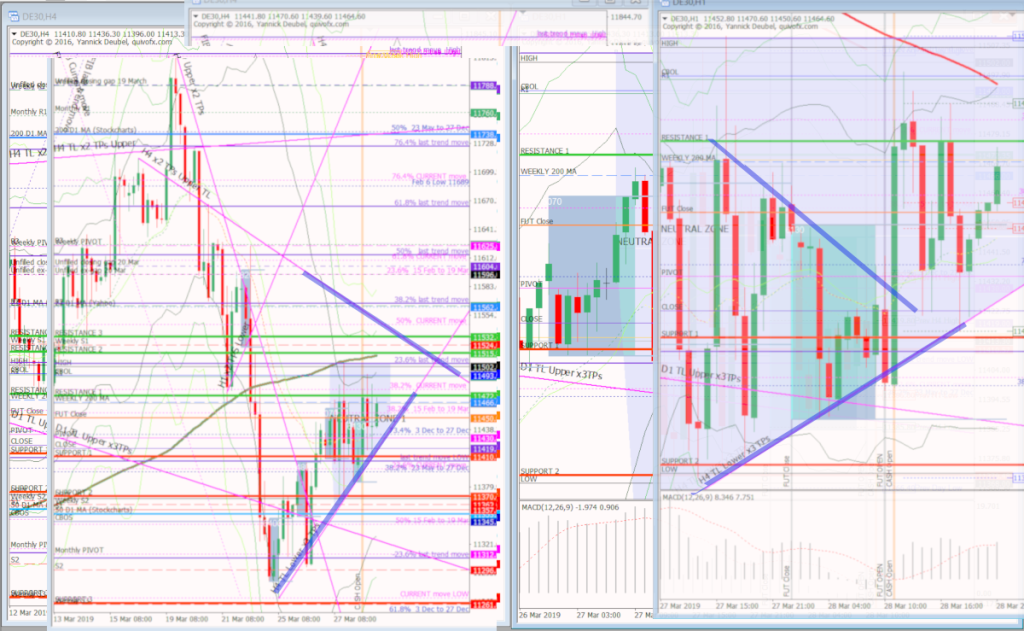

H4 and H1 charts from the morning futures session

Scenario 1: climbs to 11500 and reverses, then ranges all day and stay above the H1 TL SPOT ONScenario 2: breaks H1 TL early on and then sees declines or goes back a few retests before making its move.Scenario 3: continues range bound and/or makes false breaks either side of the Neutral Zone

What the market looked like at the end of the session

PA during my trading hours

Key points about today's PA and setups that worked

The market saw some powerful buying off the TL test at the start of the session and then made to 11500, respecting and pulling back at KLs as it made its way upwards.

- the supporting KL is nice and clear and was at the confluence with the 11400 BNR so it was an obvious level to trade – although it didn’t quite set up as a 3Min Bolli but was a Jigsaw using Rule of 3.

- the weekly 200MA was also an obvious level to trade today and that set up as a 3Min Bolli

- The PB from this level went to daily pivot which was also the opening 5MB high and an area of fib confluence

- the first H-C-B entry at the weekly 200MA failed but the second one worked

- the market went straight through RES 1 and weekly 200MA on the second hits and then repeated the PB pattern at the 38.2% of the current move

- the HOD was at CBOL+R1+BNR

How effective was my Neutral Zone? The upper bound of the Neutral Zone wasn’t in play, but ion reflection, it should have been 11500. The lower bound was the supporting TL which was tested at at the cash open and then again during the afternoon session and this was spot-on.

How precise were my levels? SUP 1 was broken during the futures session and I should have adjusted it to be the Fut session low; RES 1 was in the wrong place and the accurate level was the 38.2% fib of the last major trend

What I did

TOTAL = -5.9R | # Trades 16 | Winners 2 | BE 2

Average R per winner = 2.2 | Losses > 1R = 0 | Scratched (loss<1R) = 1

R-multiples: trades 2:1 or more = 2 | trades 5:1or more = 1

Outcome using standard TP strategy and same trades:

(STE at 1:1 50% off at +20 and 50% off at +50)

2:1 trades (2R) + 5:1 trades (1 x 2.5R) + BE (0R) + Losses (-11R) = -6.5R

Variance vs. SYS = +0.5R

ON TILT trades: 5

Today's most gorgeous setup

It doesn’t get much easier than this: two KLs and BNR plas a 3Min Bolli setup. With such robust levels this would have also been a valid 2nd Chance 3Min Bolli, which would have seen 2:1

For reference: 6 month cash chart at COB yesterday