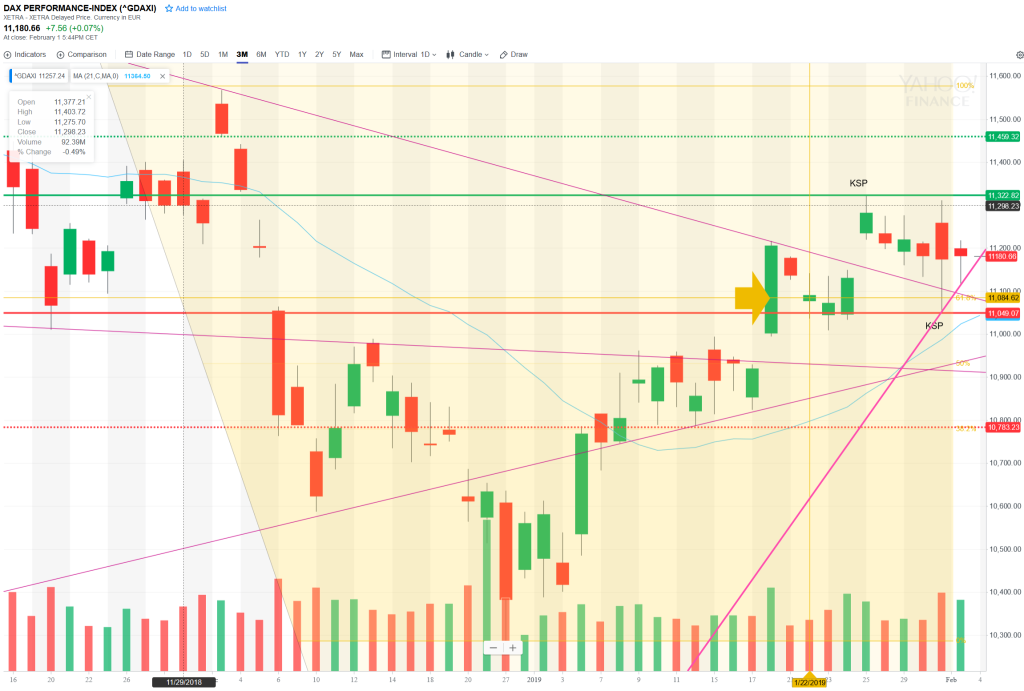

25 Jan – Enthusiastic buyers right from the open, but fails to fill Dec 4 gaps

25 January 2019

11 Feb – Regains 50MA and then adds 70pts on top of that

11 February 2019Pre-open Scenarios

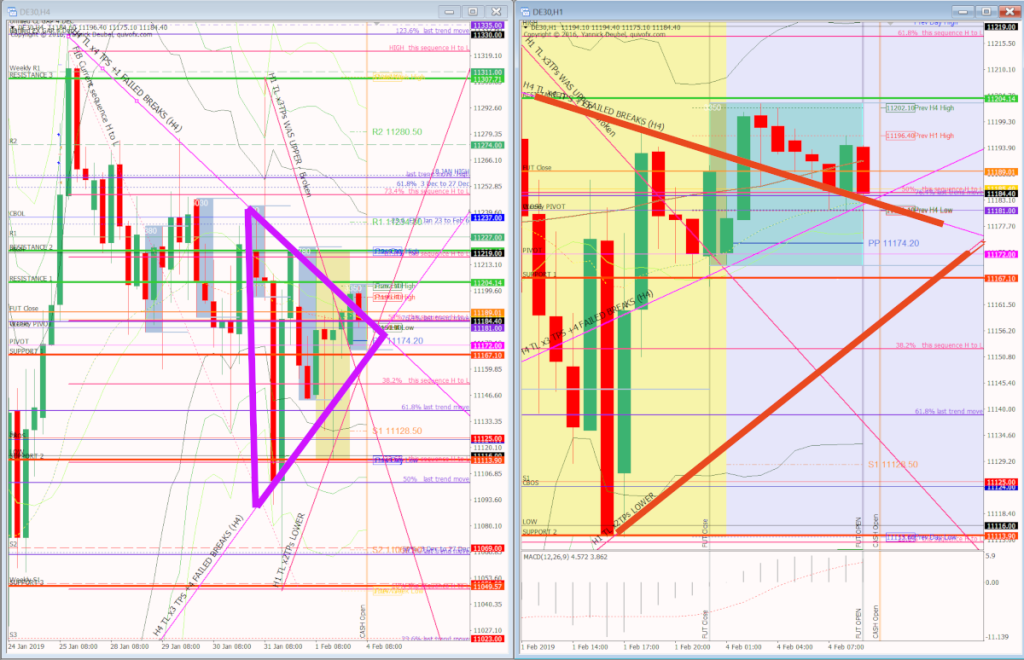

The corrective action continues. There is s subtle downward bias counteracted by the upward sloping TL. This is the lines I will be trading today and also looking for a move towards the upper bounds of the range indicated by the green line

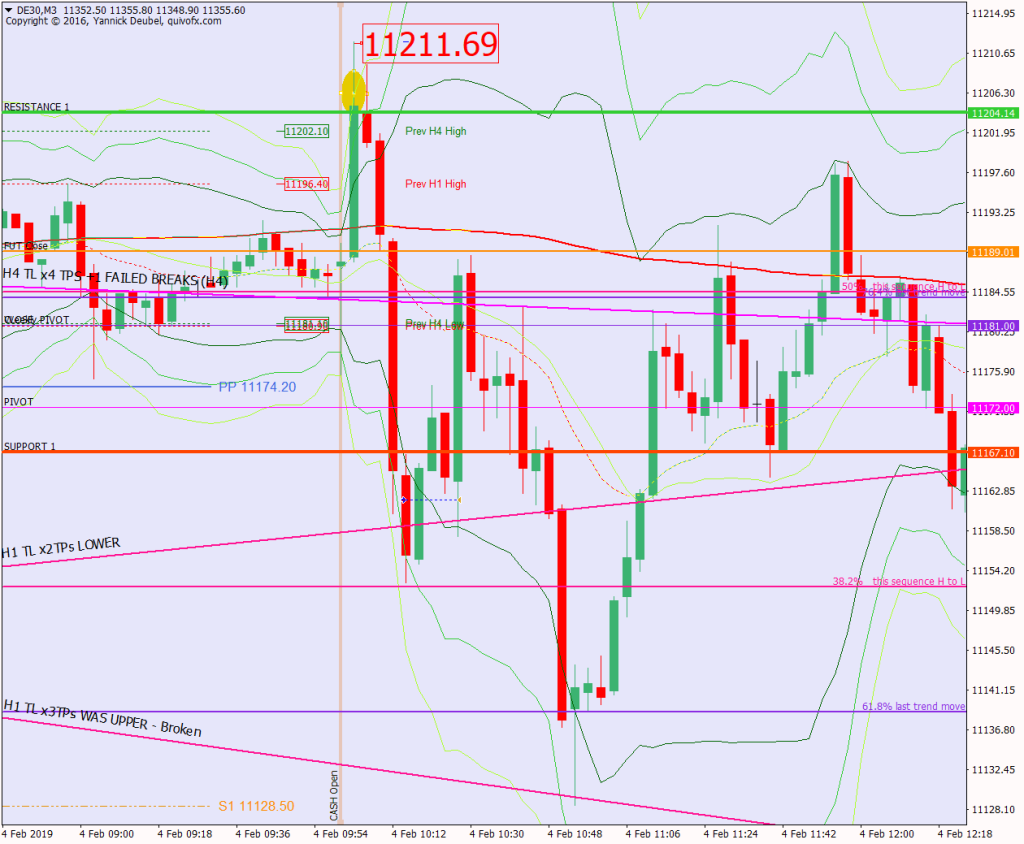

H4 and H1 charts from morning futures session

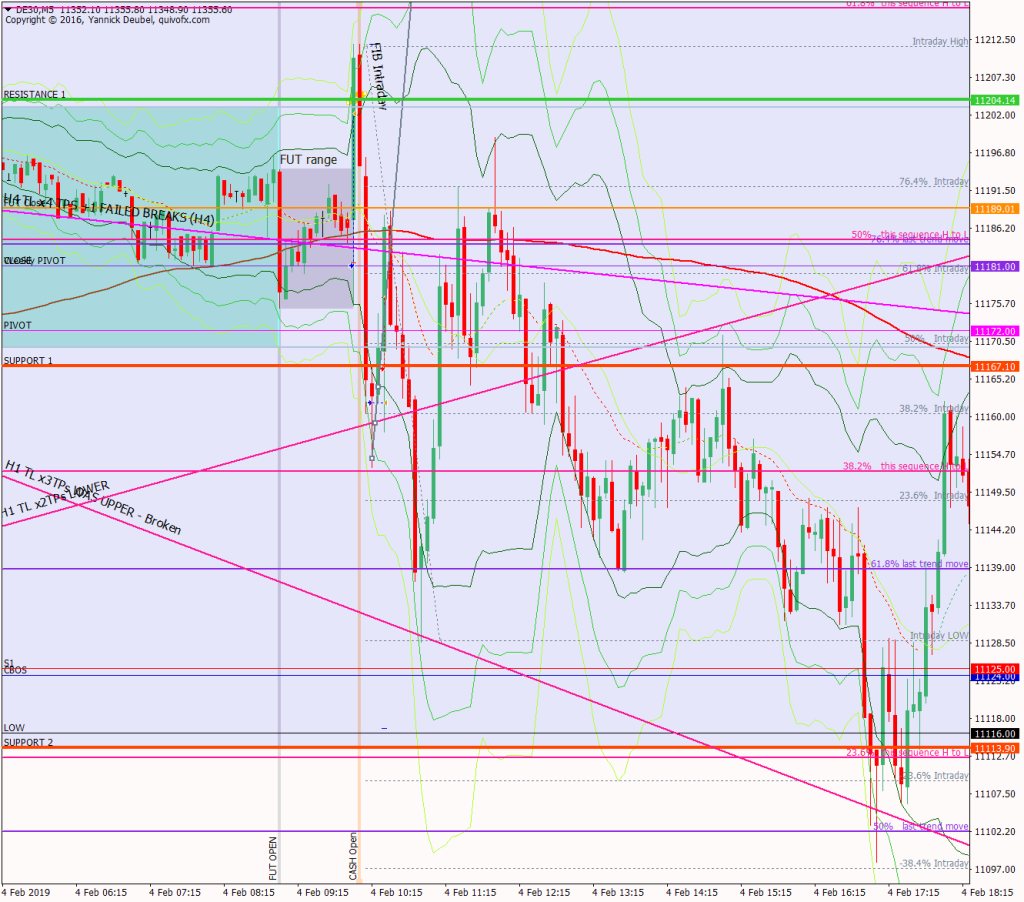

Whatt the market looked like at the end of the day

The market did fall through the TL but then reversed around 11000 an just shy of the 61.8% fib I have been watching over the last few sessions. It closed on the TL.

Key points about today’s PA and setups that worked

- Futures and ON session was positive leaving a gap that filled immediately at the open.

- Buyers pushed it up to RES 1 and that was the HOD.

- The fib levels were controlling quite a lot of the PA today – especially the 61.8% of the last trending move.

- There was a negative bias to the day’s moves, and three retests of the close area – this was also three other fib levels making it a very strong confluence area.

- The low was around 11000 and from there, there was a powerful move up to close the market at the TL, creating a daily bull candle.

How effective was my Neutral Zone? This was a maybe a little generous – the lower line should have been the TL. When there’s a clear triangle forming on the higher tfs, the TLs are more important than the KLs.

How precise were my levels? RES 1 was spot on and the HOD was 7pts above it. SUP 1 was a traded level but not a very clear one – except for the mid-afternoon retest; SUP 2 was exceeded by 15pts as the market went for the fibs below, but it was tradeable because of the fast move into it.

What I did

TOTAL = -1.1R | # Trades 11 | Winners 3 | BE 2

Average R per winner 1.6 | Losses > 1R 0

R-multiples: trades 2:1 or more 5 | trades 5:1 or more 1

Outcome using standard TP strategy and same trades:

(STE at 1:1 50% off at +20 and 50% off at +50)

1R + 3.5R + 1R + 1R +1 x BE + 5 x -1R = 1.5R

Today’s most gorgeous setup

This was seen in the first minutes of trade and it was a classic 3Min Bolli setup. The STE at 1:1, this trade had reached 10:1 by the end of the session.

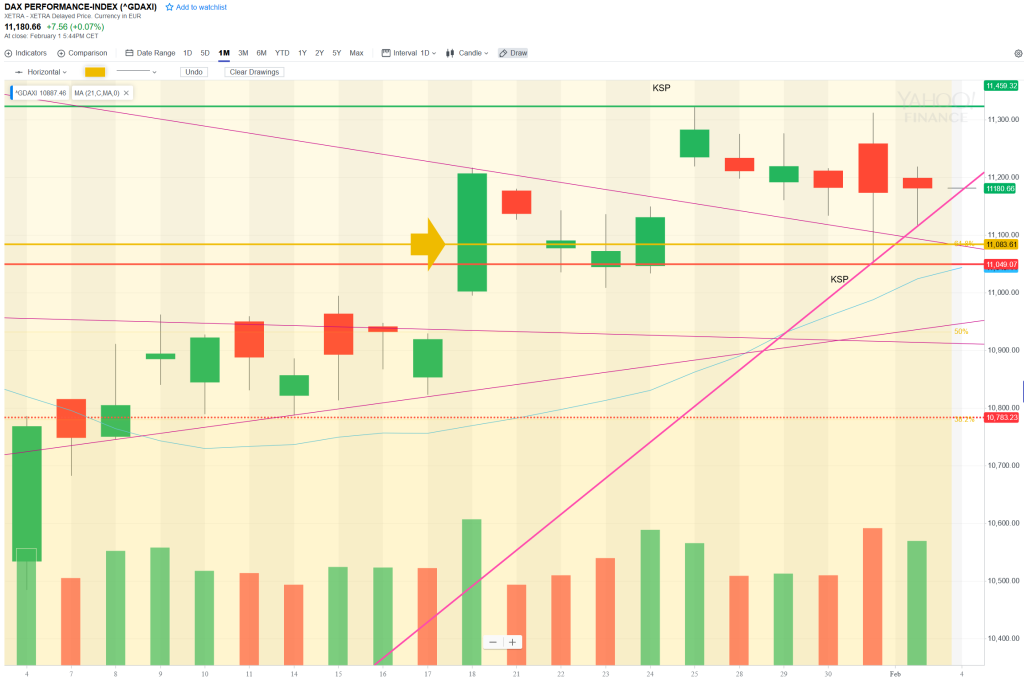

For reference: 6 month cash chart at COB yesterday