4 Jan – Monster rally

4 January 20198 Jan – H1 Compression holds for the morning session then breaks up for 90pts

9 January 2019Pre-open Scenarios

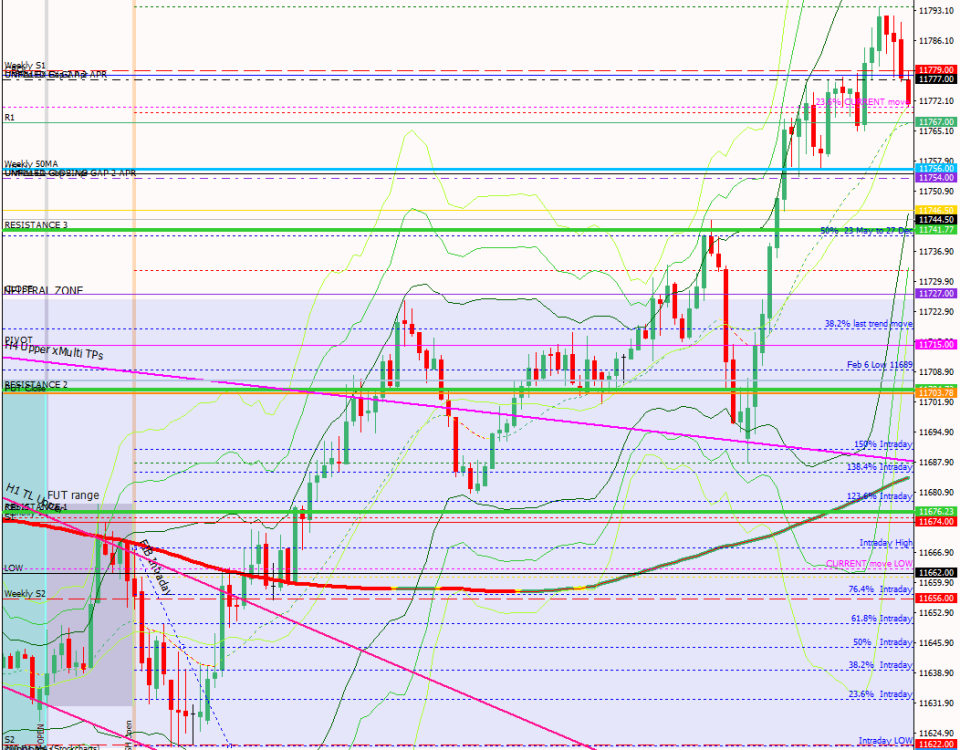

We are already 700 points above the lows. Will the market stage an early fake out to attract more buyers and then retrace before continuing upwards? If so where are the likely targets on the upside and reversal levels on the downside? Overall, with the ON action strong and up to new highs, I need to get long, but where from?

I feel disorientated today – haven’t had my normal bulletproof coffee. In Biesenthal and feeling claustrophobic so proceed with caution. Not nearly enough sleep.

The futures opened with a 61pt gap up and held gains during session so that the cash gap was +67.

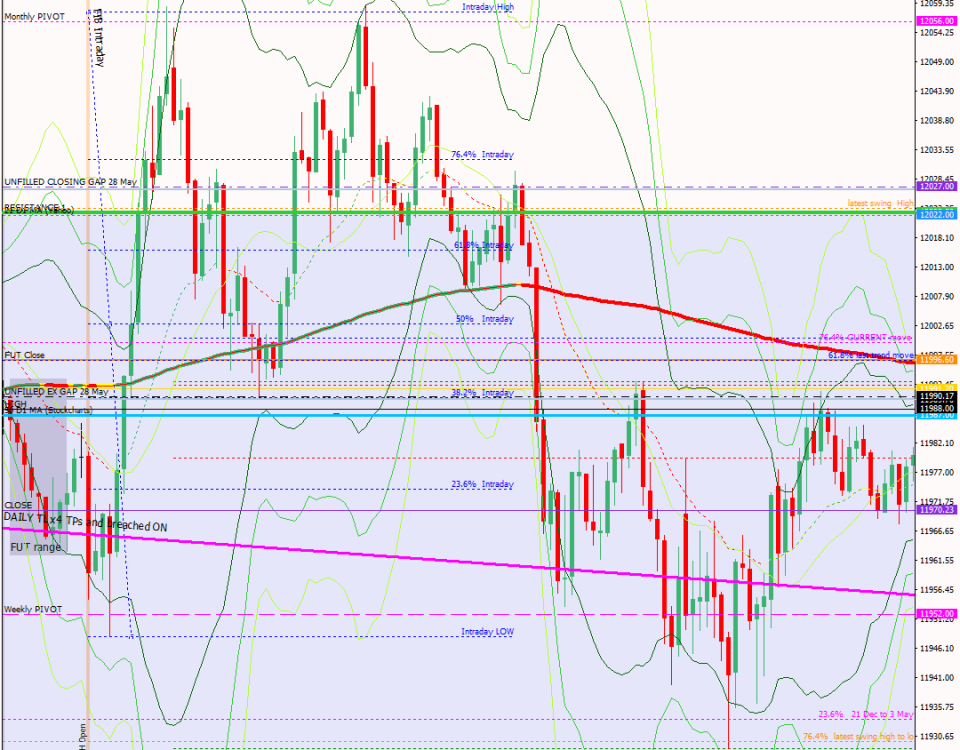

What the market looked like at the end of the day

Key points about today’s PA and setups that worked

- I took a view that after Friday’s rally, the market wouldn’t do much and would probably be difficult to trade, therefore I was looking to fade levels.

- A breakout below the ON compression happened as a soon as the cash market opened but there were the ex-gap and cash gap just below, making the trade less obvious.

- Once that level was broken, the market didn’t fit the definition of a ranging market any more as levels were being broken and price was moving away from the 169.

- Although it was breaking levels, the ex-gap fill and cash-gap fill both saw reasonable 20pt bounces.

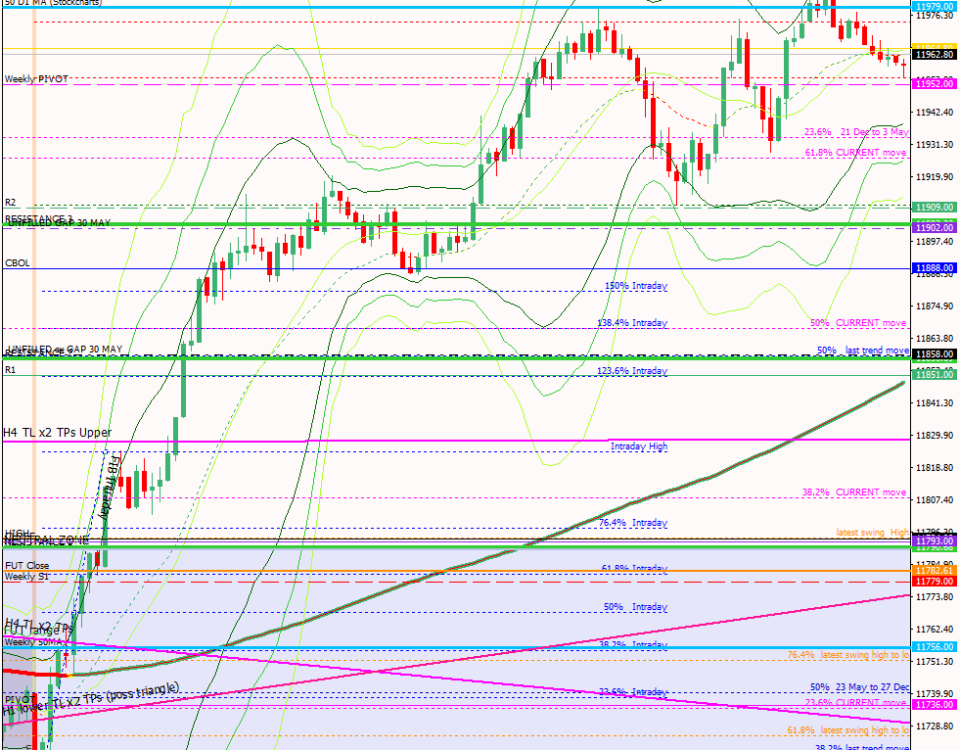

- There was a lot of activity at the level circled in pink on the H4 chart above but the low of the day was the pivot.

- The day’s action formed a long, slow rounded bottom and would have fitted the criteria for a long J-Lo entry.

How effective was my Neutral Zone? The lower edge of the Neutral Zone was at yesterday’s high and there was one false break below it, two retests of it one price was back inside the zone and then a break out of it for 107 pts. The upper TL was rejected during the futures session

How precise were my levels? RES 1 was the futures session high and didn’t get retested in cash hours. 10830 was a much better level and could have been traded for 150 pts at the cash open. SUP 1 broke in the first few minutes of the cash session but then acted as precise resistance. SUP 2 saw a lot of trade and bounced for 30pts on first hit but the real level was the 61.8% FIB retrace of Friady’s rally.

What I did

09:03 Buy x 81 @ 10808 | Cash open spike | P&L = -1R

09:07 Buy x 96 @ 10793 | Futures gap fill fade | P&L = -1R

09:15 Sell x 87 @ 10783 | Mistake | P&L = -1R

09:23 Buy x 47 @ 10797 | Mistake | P&L = -0.3R

09:23 Sell x 86 @ 10791 | Retest of level on M1 | P&L = +3.1R

09:31 Buy x 95 @ 10792 | Ex-gap fill fade | P&L = -1R

09:38 Buy x 96 @ 10770 | Gap fill fade | P&L = +0.3R

09:53 Sell x 87 @ 10759 | Break on M1 | P&L = -1R

10:02 Sell x 86 @ 10773 | Retest of level on M1| P&L = +2.4R

TOTAL = +0.5R | # Trades 9 — Winners 3 — BE 0

Today’s most gorgeous setup

Take break below Neutral Zone and be comfortable with making two attempts at the trade.

For reference: 3 month cash chart at COB yesterday