5 Oct – TL supporting corrective retrace breaks

5 October 2018

30 Oct – Up down, up down, false breaks abound

30 October 2018What happened

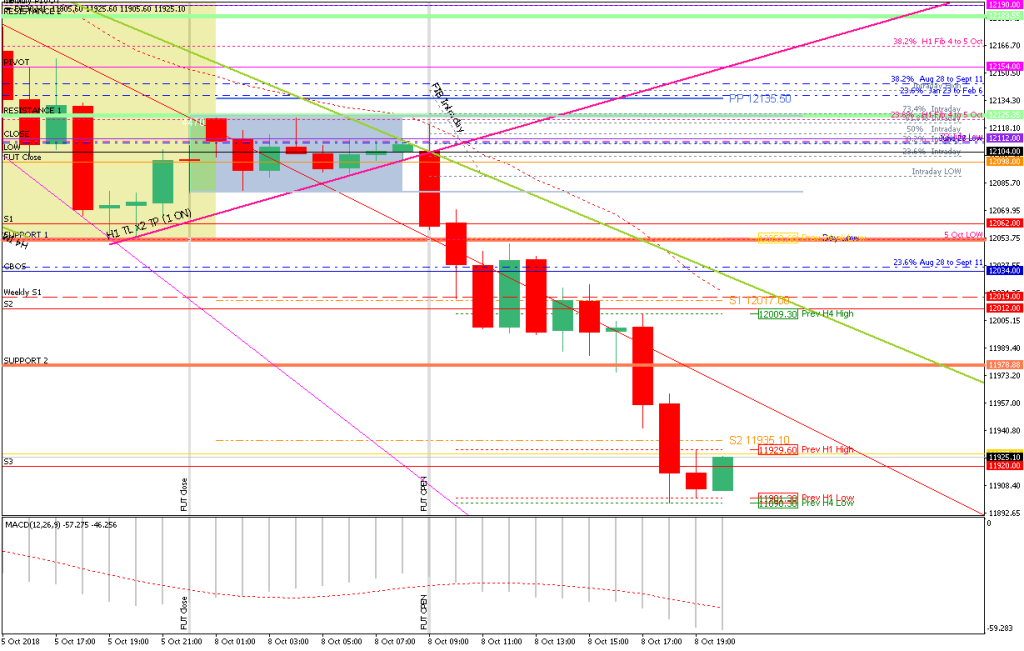

After a big down day on Friady the ON action had been corrective, providing a very clear and eays to identify TL. The only thing that made it less valid was that it was formed from ON action. But does this matter?

Possible scenarios

At this point, what I need to work out is:

- What PA will tell me that the trend is continuing?

- What PA will tell me that the trend is reversing?

And once I have established that, I can make a plan to trade it, and the trades will test out my scenarios. In this example, if the TL supporting the corrective PA breaks and stays broken we have another trending day ahead. On the other hand, if prices break up out of the impulse channel and say there we will see some positive corrective action. If it flip-flops about, making false breaks and responding to the 169 on the M1 then we have a ranging day ahead and need to change plan accordingly. Only if we see a new D1 swing high will I consider the down trend to be over.

How the PA evolved

The TL (pink) support the corrective action broke as soon as market opened.

Then it stair-stepped down all day, giving several opportunities to add to the trade using M1 TL breaks of corrective retraces.

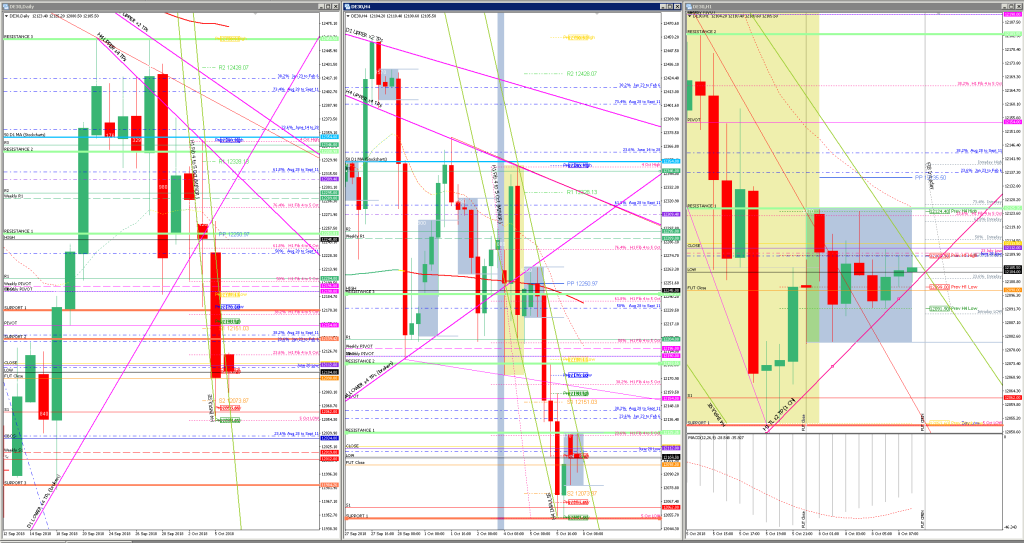

By the end of the day the market looked like this

How I traded it

The answer to this is ‘very badly..’. As usual when things goes awry I document the mistakes I made or what I missed so that I can monitor myself and learn from the errors. And see progress – am I making the same mistakes over and over and if so, how can I fix this?

See Mistakes that turned a winning day into a loser.

The trade plan should have been this:

- Break of H1 Corrective TL on the H1 with PA SL (30pts) – this went 5:1 but I got 0:8R

- Break of H1 Corrective TL on the M1 with 10pt SL – this went 15R!! but i missed it.

- 3min Bolli Reversal – neeed a precise entry but mananged 2R

- Compression at KL on M1 – multiple 2 and 3 R trades