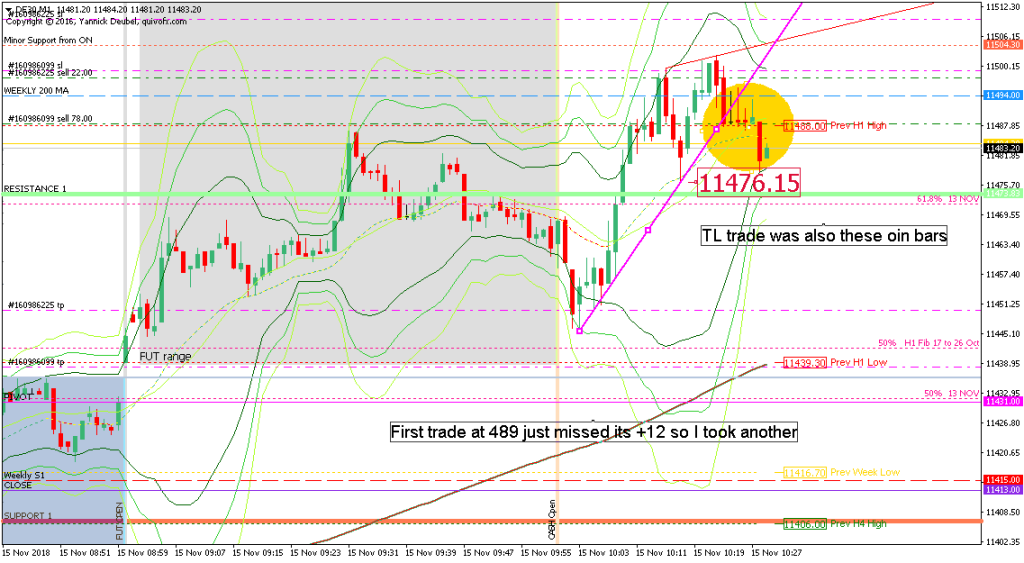

This has been tricky and inconsistent so far. These M1 TL breaks can be magnificent trades when they work, and they can get me positioned for a major TL break lower down or higher up – without having to risk being stopped on a bounce at the TL.

The basic rules are:

“We don’t have to trade every squiggle on the chart” GL

- Trade in the direction of the trend – unless I have a really good reason not to. ‘Good reasons’ include great levels to trade away from such as weekly pivots and gaps combined with strong levels to trade towards. Also when a strong c-trend move is setting up.

- Don’t take counter-trend TL breaks in the middle of nowhere – it’ll get stopped and it’s too weak a set up to use my precious ammunition on.

- Counter-trend includes not trading against a breakout level that has been accepted unless there’s a strong level to trade away from and towards (see the gold circle on the righ on the chart above).

- However, some of the very best M1 TL trades set up when the market has moved fast into a level – usually a gap – and then reverses. I would trade this with a 3Min Bolli but I can add to the trade using the M1 T break, which will set up very clearly when the market makes this kind of move.