This is one of those days that proves that saying ‘I think this has gone far enough‘ doesn’t make much sense on the Dax. But what were the circumstances that led to this rally?

- Corrective PA on the daily chart

- Media full of doom and gloom on the indices and smug bearish commentators

- A 100pt ON rally that showed no signs of reversing during the futures session.

- A powerful reversal at RES 1 (weekly pivot and CBOL) implying that buyers were waiting to pounce – looking for a good level to get in on the action.

See 4 Jan – Monster rally for more detail on the PA context and early action.

Setups for trading a powerful up trend #

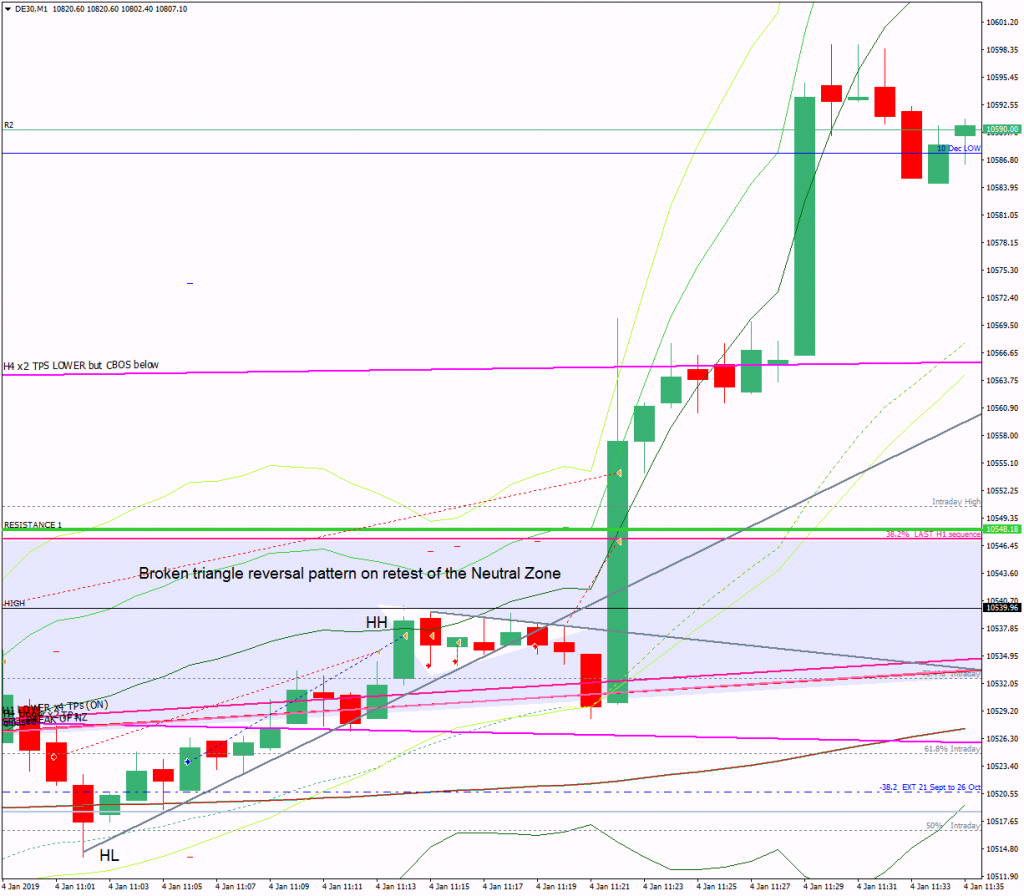

Ideally, you want to be positioned before the break and there were tow possibility for doing this: (1) using the 3Min Bolli at SUP 1 amd (2) taking a broken triangle reversal on the retest of the lowe edge of the Neutral Zone

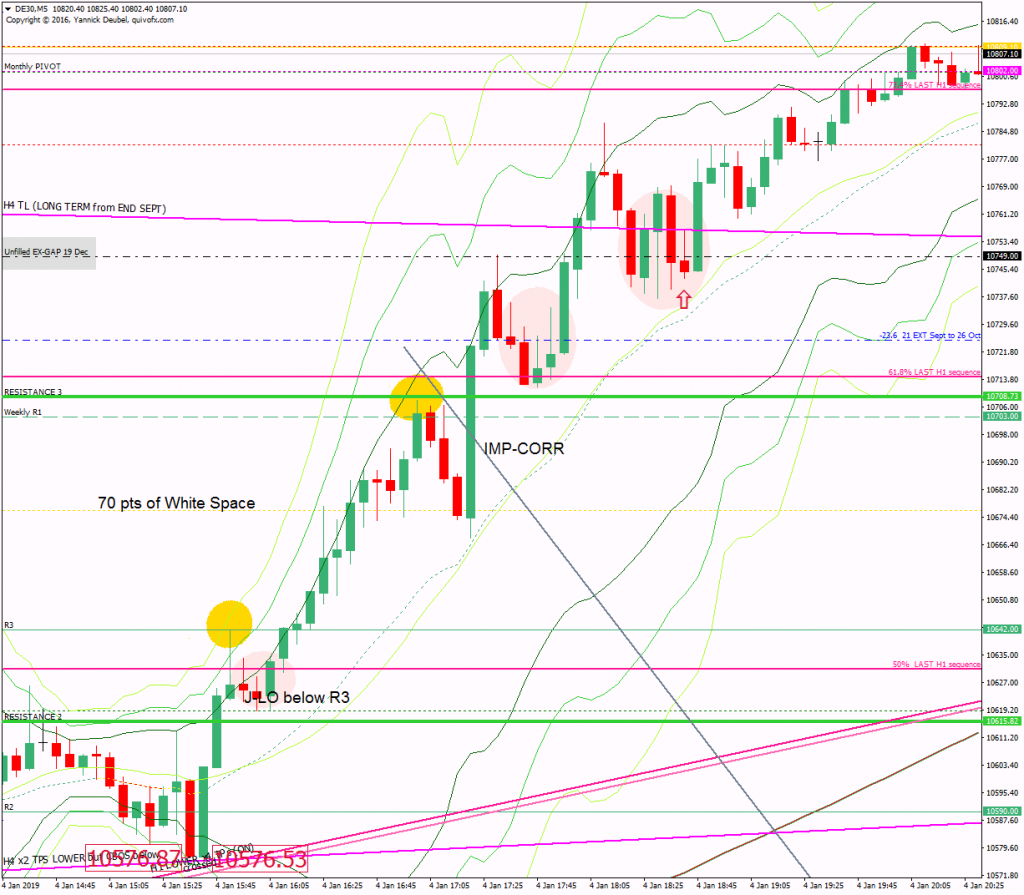

J-Los #

The J-Lo is an excellent trade for entering a trending move and when it forms around a KL or a TL, it’s an even better setup.

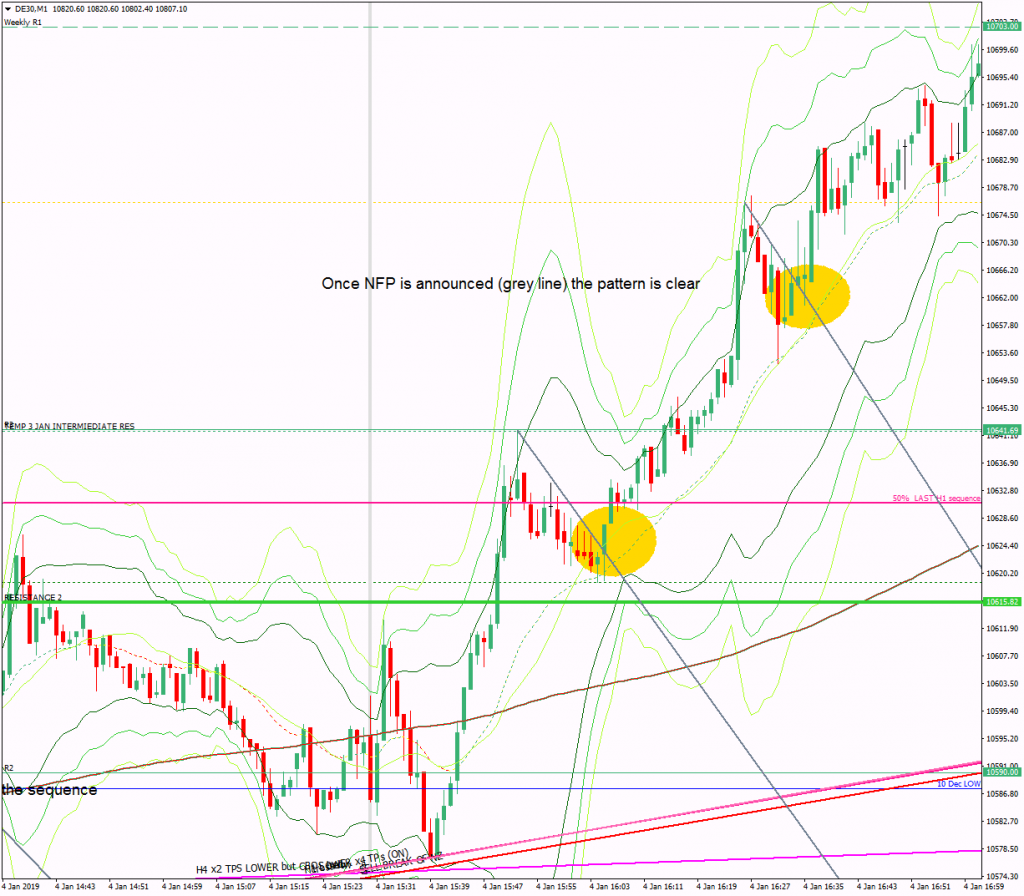

Grey vertical line is NFP – all the press said the rally was due to positive NFP numbers but the market had broken up before the figure was released.

Impulsive-Corrective structure #

Although the PA was extremely bullish, the Imp-Corr structure broke down just prior to the NFP announcement. To trade this safely you would need to take partial profits on each sequence but it’s best to stay out of the market in the hour or so before.