First of all, let’s look at today’s P&L in terms of Longs and Shorts

EDGEWONK STATS:

LONGS Profit: 4690 EUR, 10 trades

5 (50%) losers, 2 (20%) BE, 3 (30%) Winners (1 x 3:1, 2 x 10:1)

R/trade 0.47, R/winner 2.75 and Win rate 30%

SHORTS Profit: -3846 EUR, 11 trades

6 (54%) losers, 3 (27%) BE, 2 (18%) Winners (1 x 3:1, 1 x 2:1)

R/trade -0.35, R/winner 1.1 and Win rate 18%

By watching the video of the first 20mins of trade, shorts were OK during this period, given the PA context and the setups presented. But once the market made an HL above the pivot, shorts where off the table

The issue with the trades during this compression is that I was trading on the incorrect principles for the PA – the market had only moved 40pts in the first 30min and then a bar appeared out of nowhere that engulfed 30mins of PA in one minute.

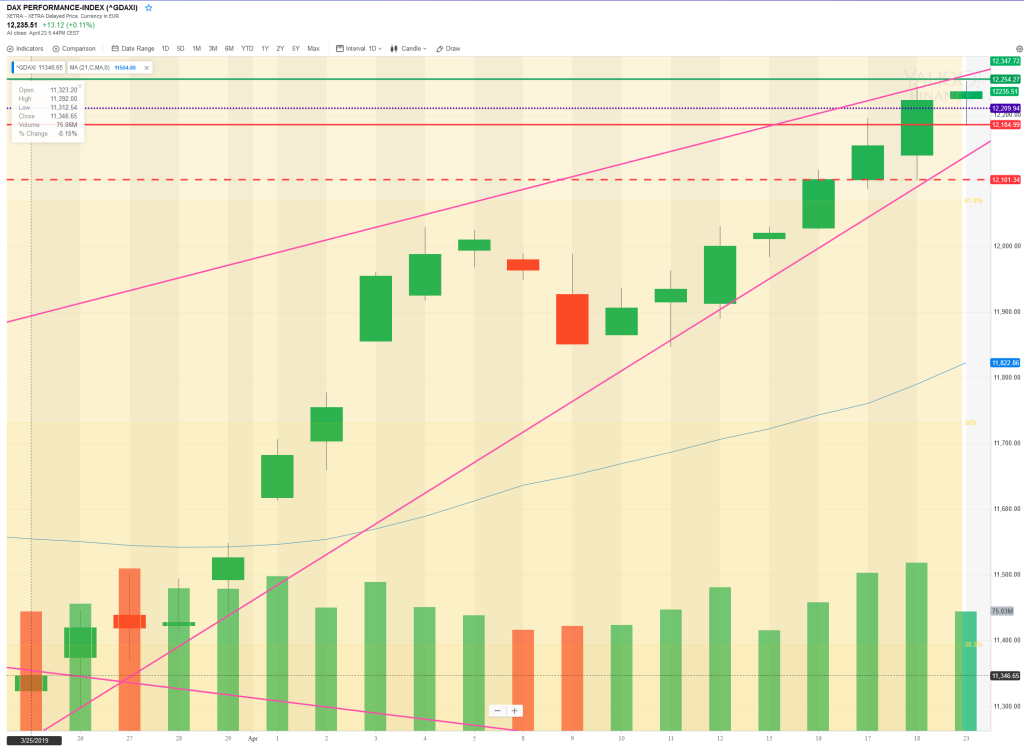

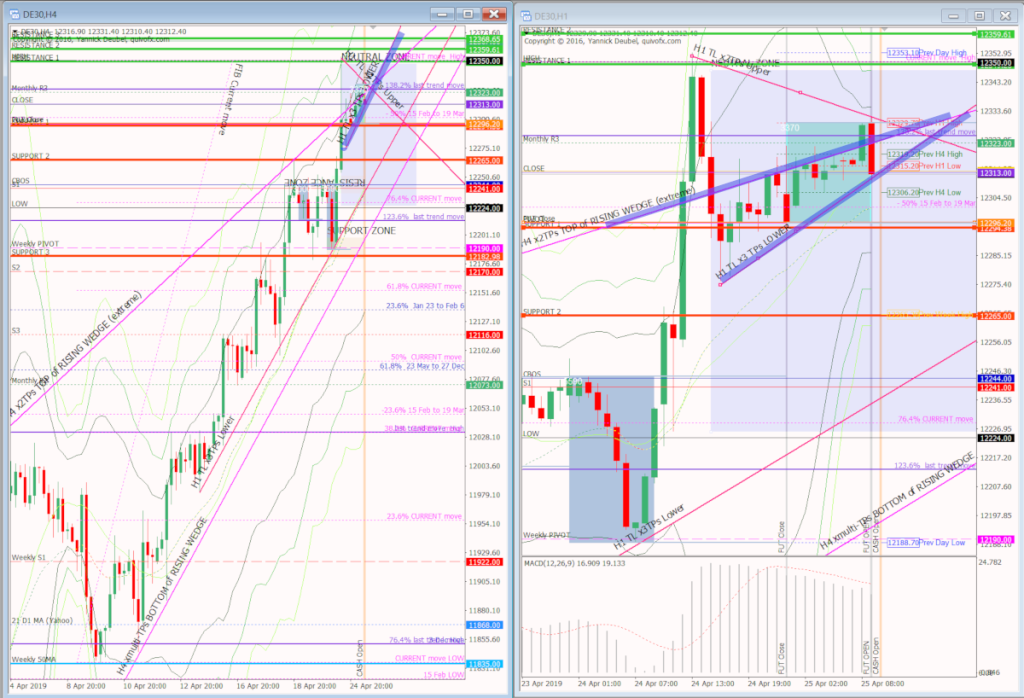

And here are a couple of charts to show how the PA looked pre-open on 24 April. There is no doubt that this market is in an uptrend but it is equally true that I need to be on the lookout for the lower TL of the rising wedge to break – but until that happens – it’s a case shorting at very precise levels but focusing on ‘buy the dip’.

Here’s the PA as it unfolded:

PA context on daily, H4 and H1 charts #