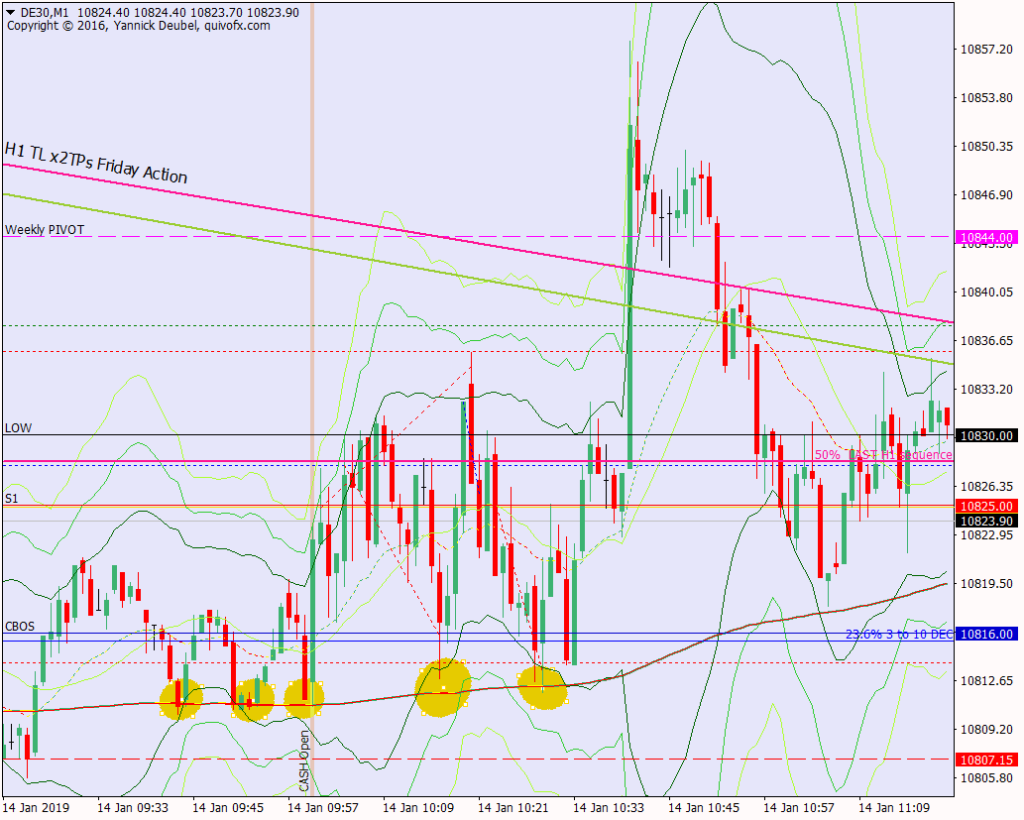

The observation that the market is bouncing every time from the 169 tells me what kind of market it is. There’s an 80 or so gap down but the market is also finding buyers. In this indecisive situation, the 169 works wonders.

When the market is tight and directionless like this, I need to think the opposite way around and look for value insteda of breaks

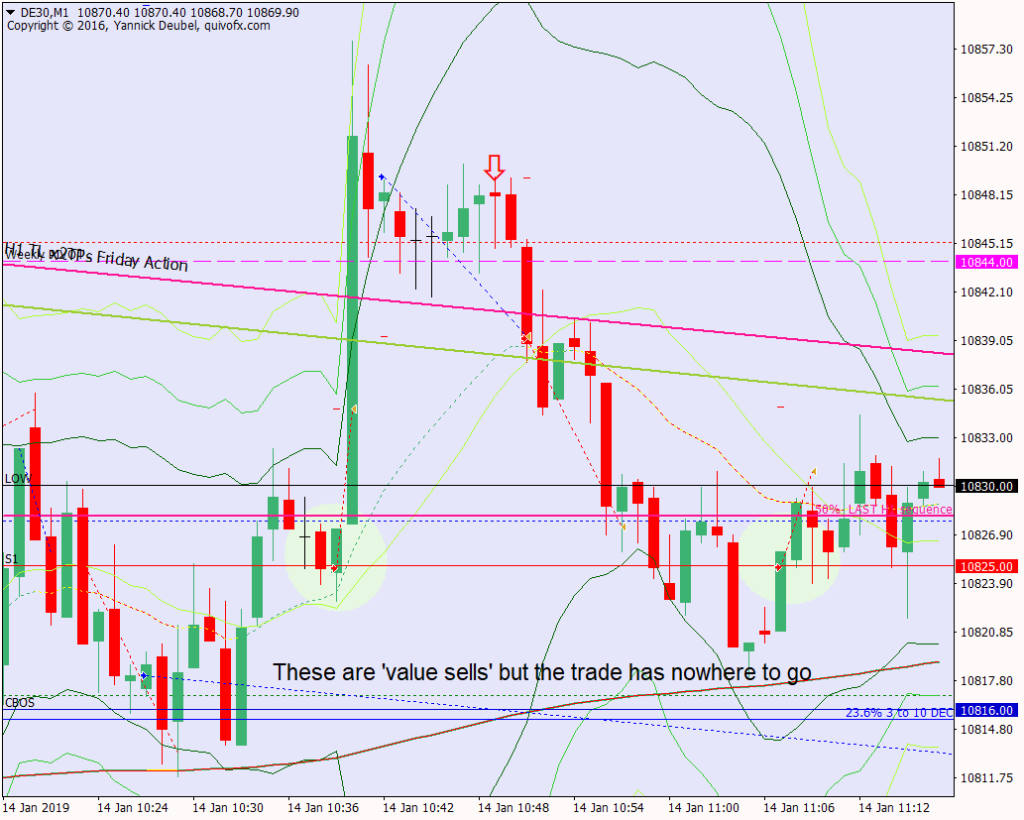

I can see that later in the session I am looking for ‘value sells’ rather than breaks, but these trades have nowhere to go, and until the 169 breaks, it looks like the upside, towards gap close, is favoured.