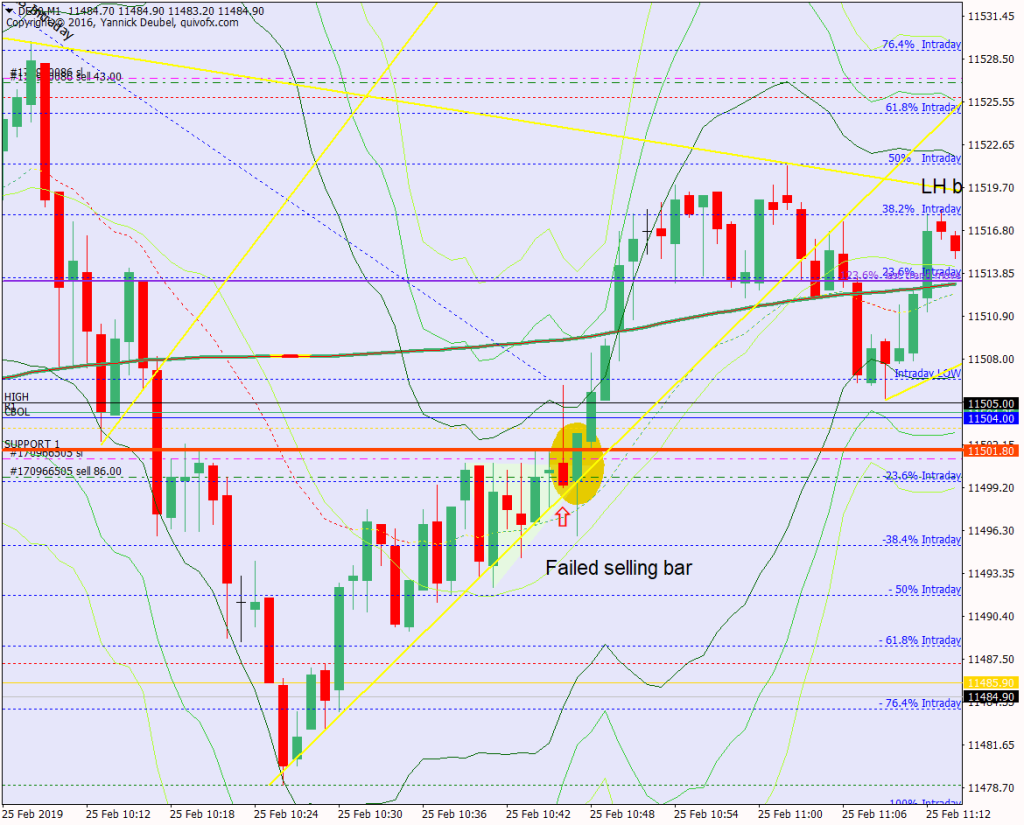

The best way to stay in tune with the market is to trade the Imp-Corr structure until it breaks – all the while giving myself the best chance of success through using retest entries. This is exactly what happens here: the corrective PA doesn’t break and instead price moves above the most recent swing high and forms a series of HH.

Once the Imp-Corr structure is broken, the next step is to look for new entries for continuation of the new trend or a reversal, using levels and compressions.

THOUGHT PROCESS: no break of Imp-Corr structure so shorts off (!) for now. So where am I going to look to get long? Where is the next level? – and what PA or levels would tell me that sellers are back in the game?

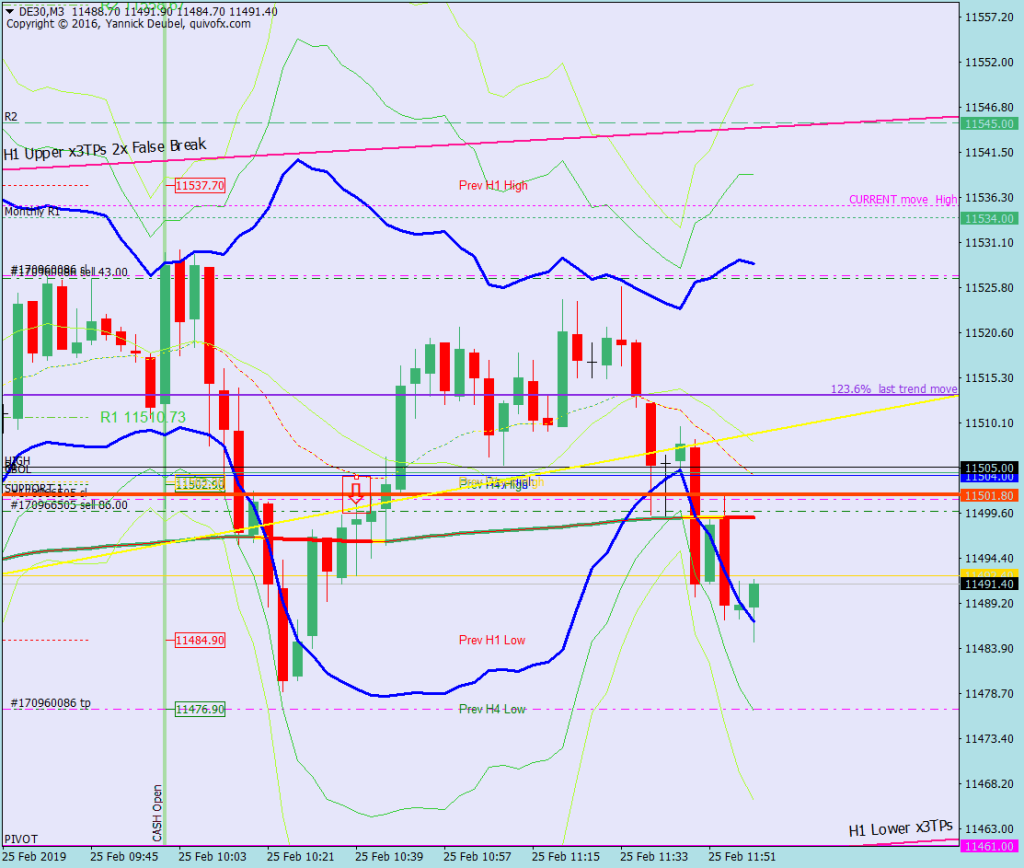

Messiness of PA inside the 3Min Bolli Bands and inside KLs #

Looking at the 3MIN cahrt of the late morning PA, it is clear how fuzzy and random it is – not the kind of PA for taking breaks as they will go 10pts and then reverse. This is confused, directionless which will take the path of laest resistance – reversion to the mean.