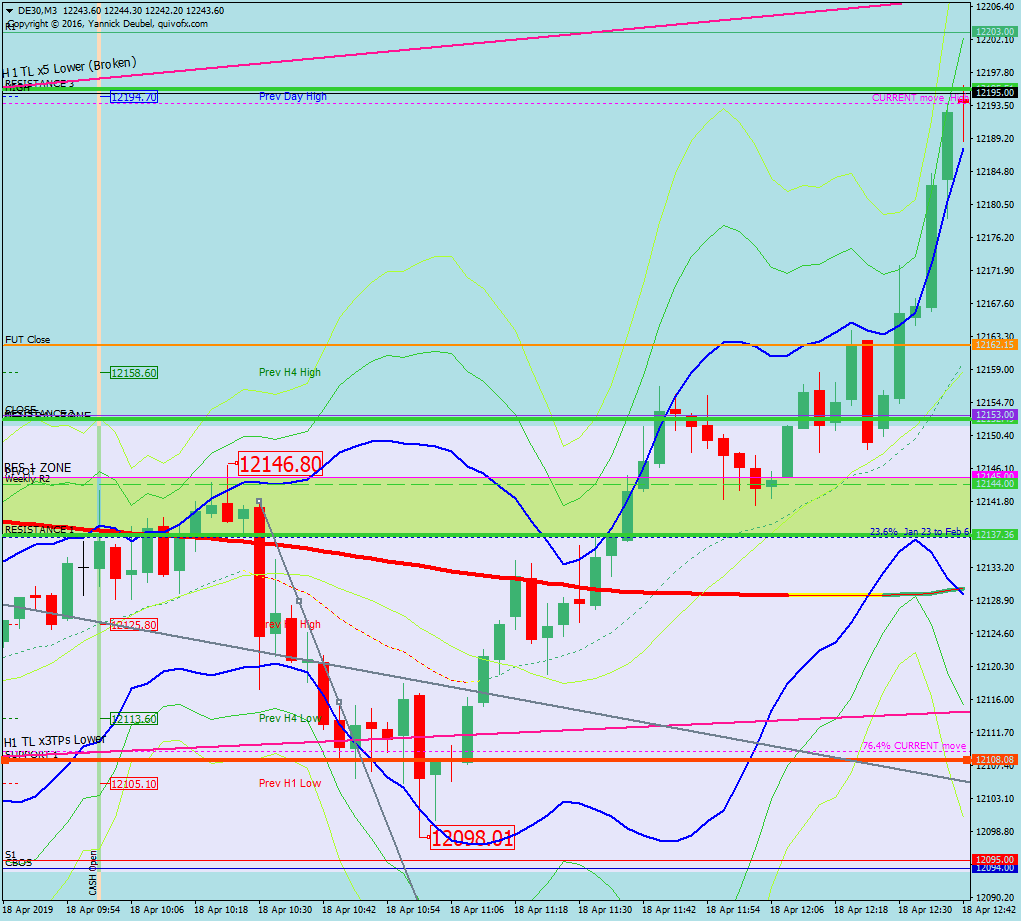

My RES 1 line was a fib level from Jan/Feb, but 7pts above that was weekly R2 AND daily pivot. The confluence was a must-trade level but a single fib isn’t – unless it appears in the middle of nowhere and the market is looking for levels.

My solution to this issue was to use a RES 1 range, and it could very easily have been the case that price did not quite get to the strong, strong level (weekly R2), in which case, selling above Jan/Feb fib would have got me into good trade that would otherwise have been missed.

There was a similar issue at SUP 1. I had my SUP 1 line at the 76.4% fib of the current move, which was also an H1 TL. But 13pts below that, there was S1+CBOL confluence which is s strong, strong level and therefore also a must-trade. The buy at SUP 1 was correct, but I also needed to have a plan to re-enter if stopped and then the market it hit or nearly hit S1+CBOS and then spiked off the level.

TRADE PLAN: sometimes it’s essential to have two goes at 3Min Bolli trade. When the levels set up as they did today, the best strategy is to use RES/SUP zones and then if the market overshoots the zone by a point or two and the candles support it, I should re-enter the 3Min Bolli, or even add to an existing trade.

Similarly, where important levels are more than 10pts apart, I can apply the same principle: I trade the first level, but if I’m stopped – and especially if it’s a spiked candle that hit the stop – then re-enter the trade. or add to a position.

The worst thing I can do with this PA structure is to enter before the first level in the zone as that is almost guaranteed to get stopped.