Obviously the defining features are that ranging PA is not directional while trending PA is directional, but while I am inside the PA itself, this is not always obvious until it’s too late, so it’s important to know what to look for so that I use the correct setups.

First of all, what does ranging PA look like?

- price respects levels by reversing when it hits them

- high highs and lows get sold and bought

- moves outside the Bolli Bands revert to the mean

- 169 running straight through the middle of the PA

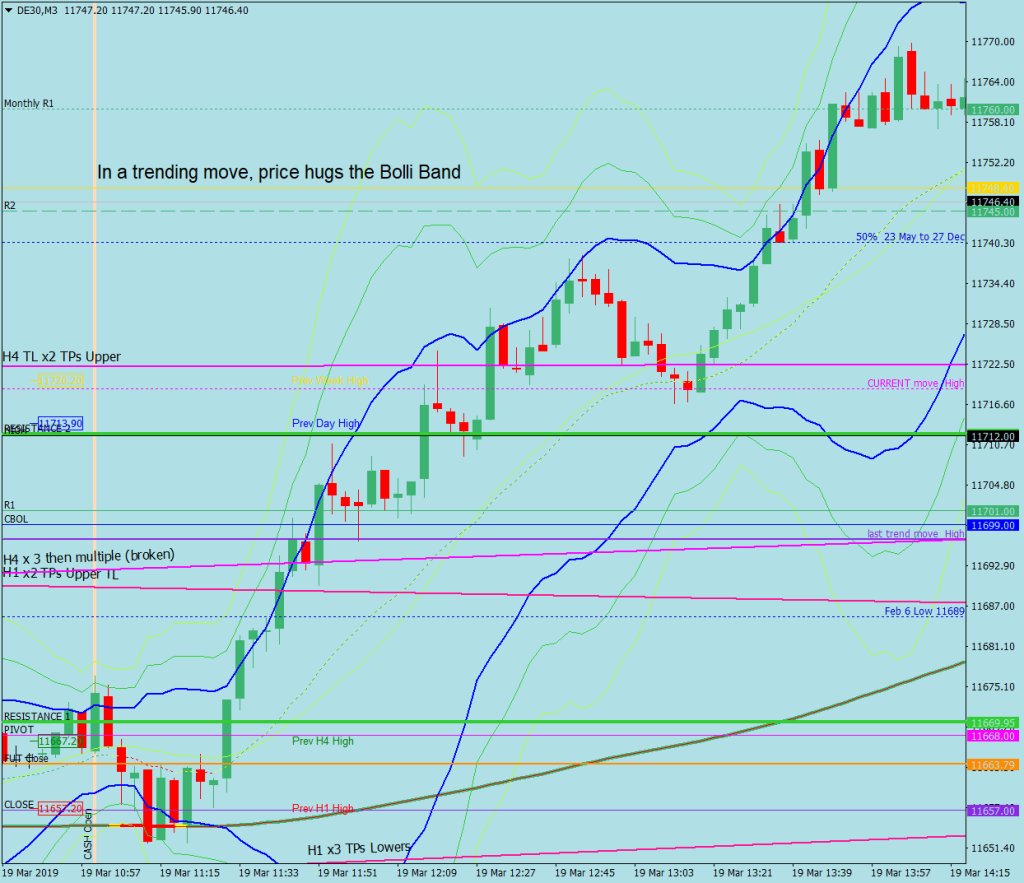

And what does trending PA look like?

- the market breaks levels and they stay broken

- hugs 3Min Bolli the whole way up or down

- the 169 is far away

- often – but not always – makes a shallow retest of a broken level to form an igloo or J-Lo

- there is a strong level to aim for e.g. a daily cash chart level or old, unfilled gap

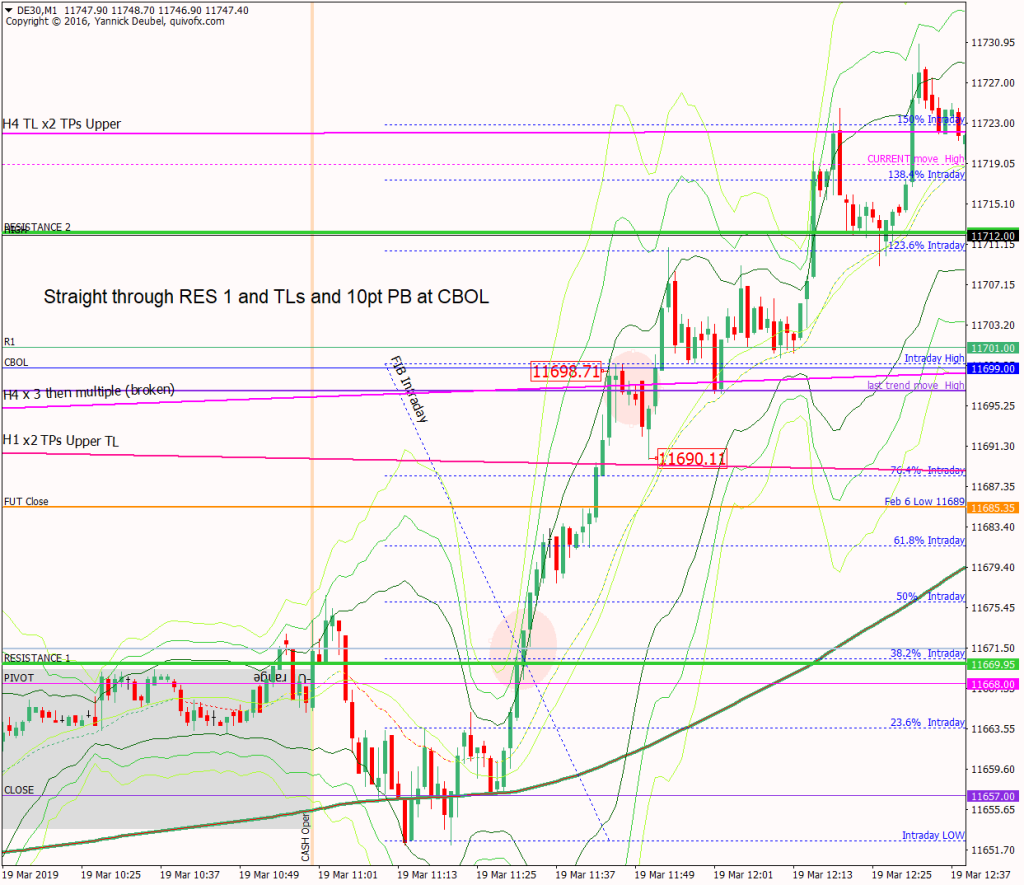

In the chart above, the market is trending once it breaks RES 1 and then continues up the next KL/TL. If it powers through with shallow PBs only to KLs/TLs, then I know more upside is likely.

In trending PA, 3Min Bollis will fail which H-C-Bs, Imp-Corr structures and J-Los/Igloos work well.