The opening buy on 1Apr – which setup as a jigsaw spike down to a KL – was a lovely trade for 10R. However, I traded it as a sell at a weekly pivot and 169. For the sell, the entry needed to be perfect to get to BE, whereas for the buy, the entry could be quite sloppy and still get 10R. So why not make life easy and trade in the direction of the trend?

When Jigsaws also setup as a 3Min Bolli, they really are no brainer; but they must be a level to trade against and a spike – taking one of these trades in no-mans land is like jumping in front of a steam train and hoping it will break in time.

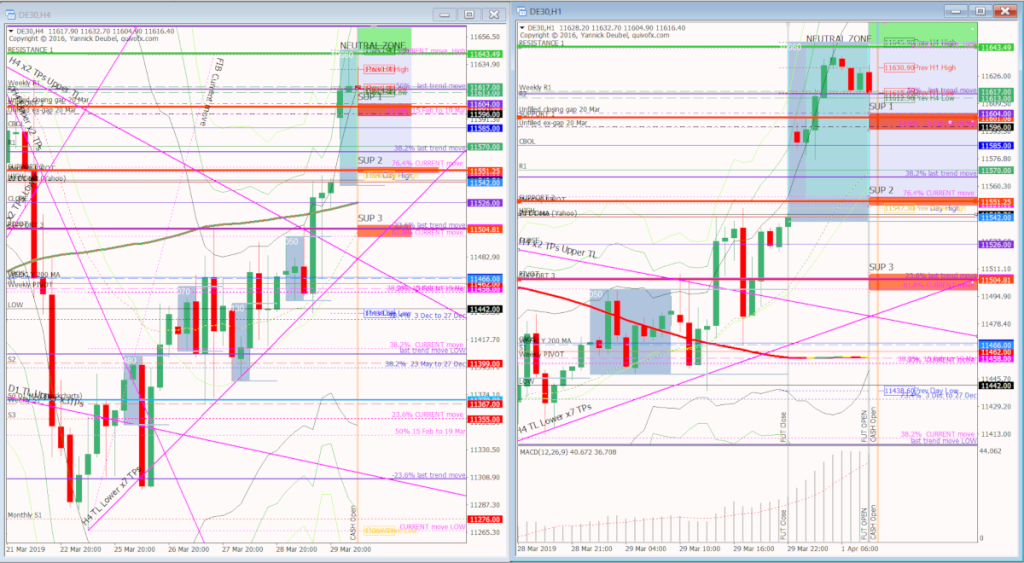

Just to put these trades in context – here’s the H4 and H1 charts from 1 April. And the first day of the trading month is not usuall a day to go short.