When to fade the 169 and when not to is not a clear cut decision; the general rules are:

- If it’s in the current HH-HL or LH-LL sequence it’s generally a good idea.

- It’s also good to trade if it is hit outside the Bolli bands

- And definitely when there’s a compression around it.

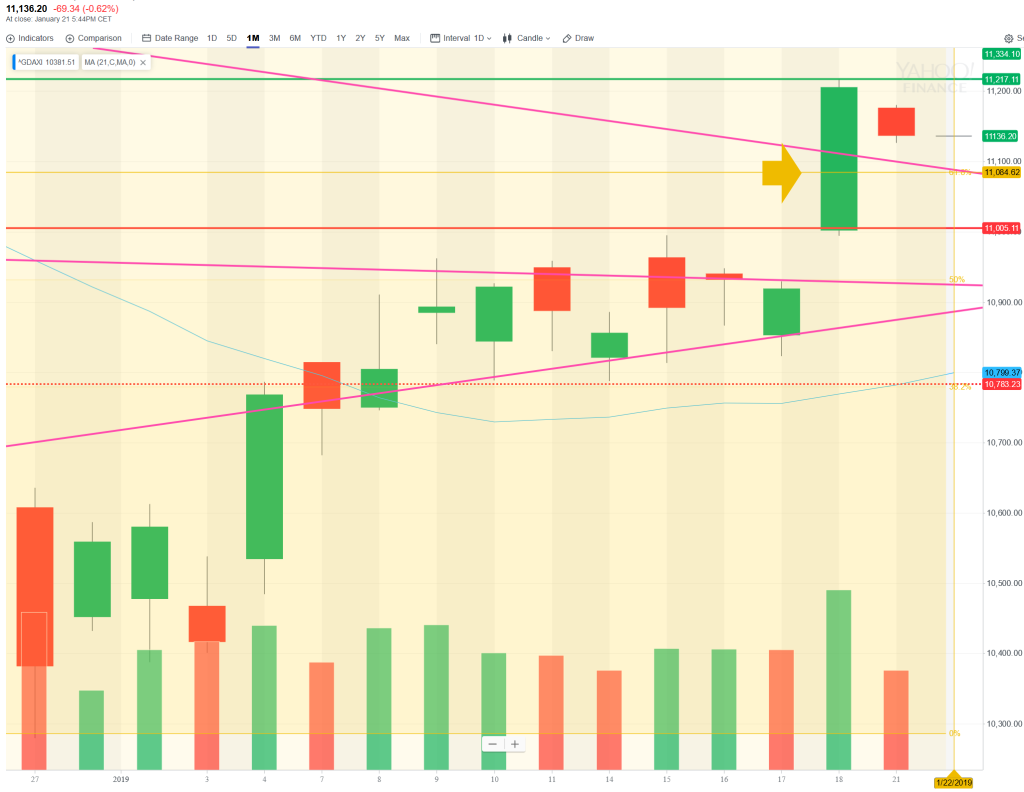

In this case, taking a long at the touch of the 169 would have been a 5R trade with no heat; this is the PA context.

- The trade would have been in line with the current sequence, but it was below CBOS; CBOS had seen some acceptance above though and was not immediately rejected

- There was a TL at the same level, adding power to the level

- I already knew that 11090 was a hugely important level from the daily chart, and this trade offered a means of entering long at the level.