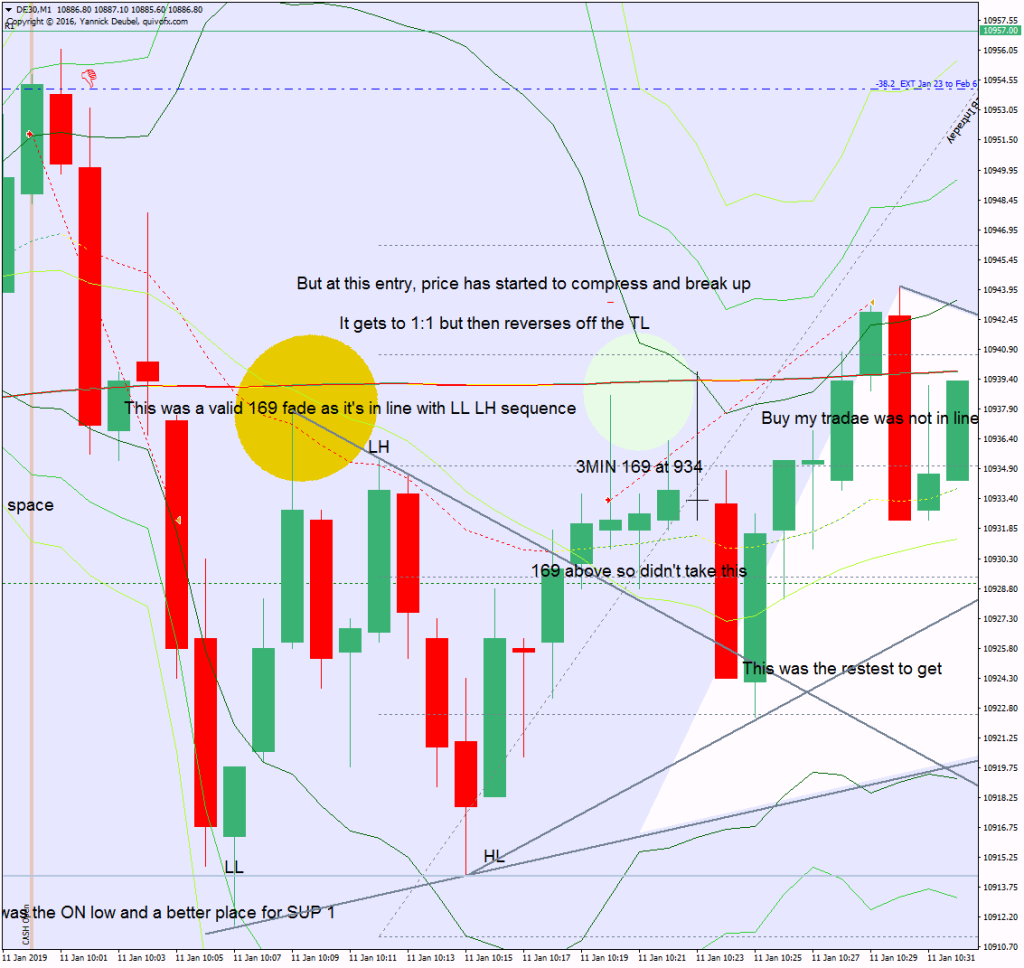

These trades need more evidence than just the 169, and these are some possibilities:

- trade only in the direction of the M1 HH-HL or LL-LH sequence

- trade when there is confluence at the level

- trade compressions and triangles at the level

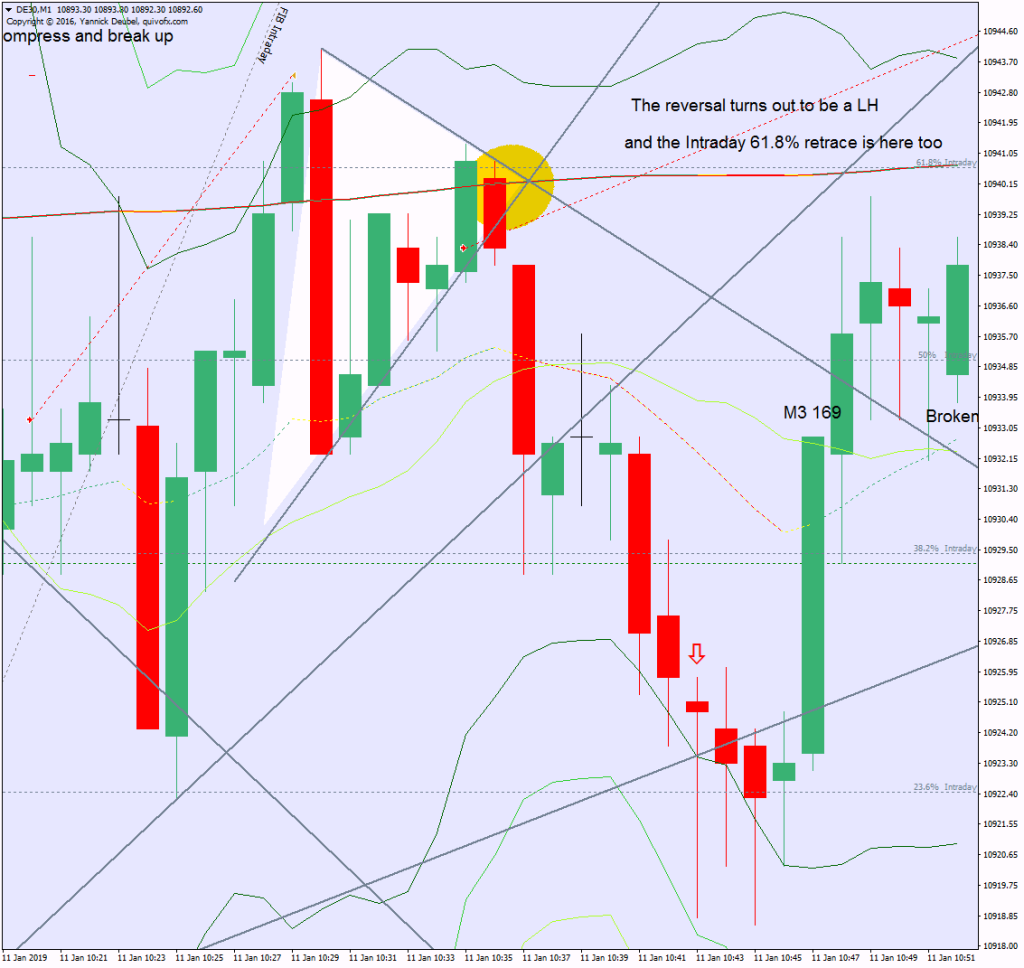

The next trade had the Intraday 61.8% retrace to support it and it just about made +20. The stops on these trades could be a lot tighter – if the trade is wrong and it gets above the 169, it doesn’t need to travel 10pts before I know it’s wrong.

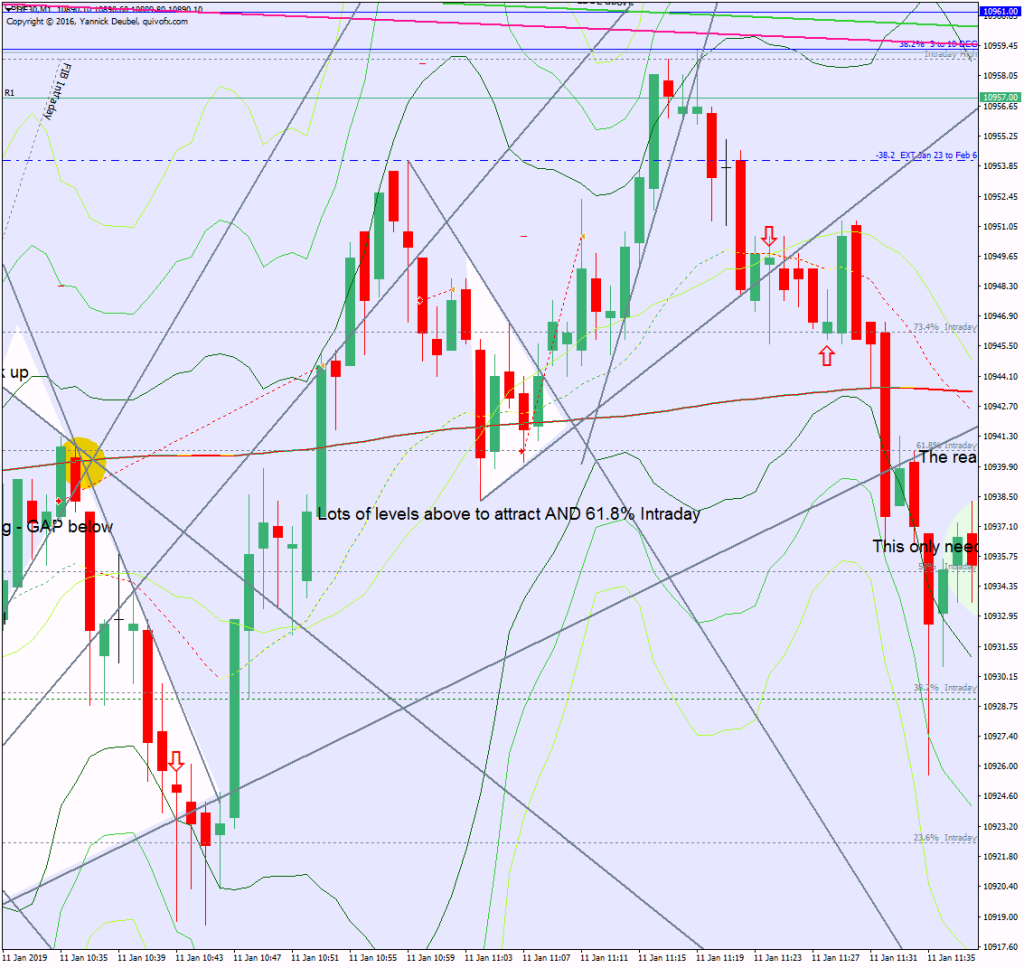

I traded this last setup the wrong way around because… closed the sell I took above at BE, then the big candle made me think it was working and I would be wrong – so I shorted again ….