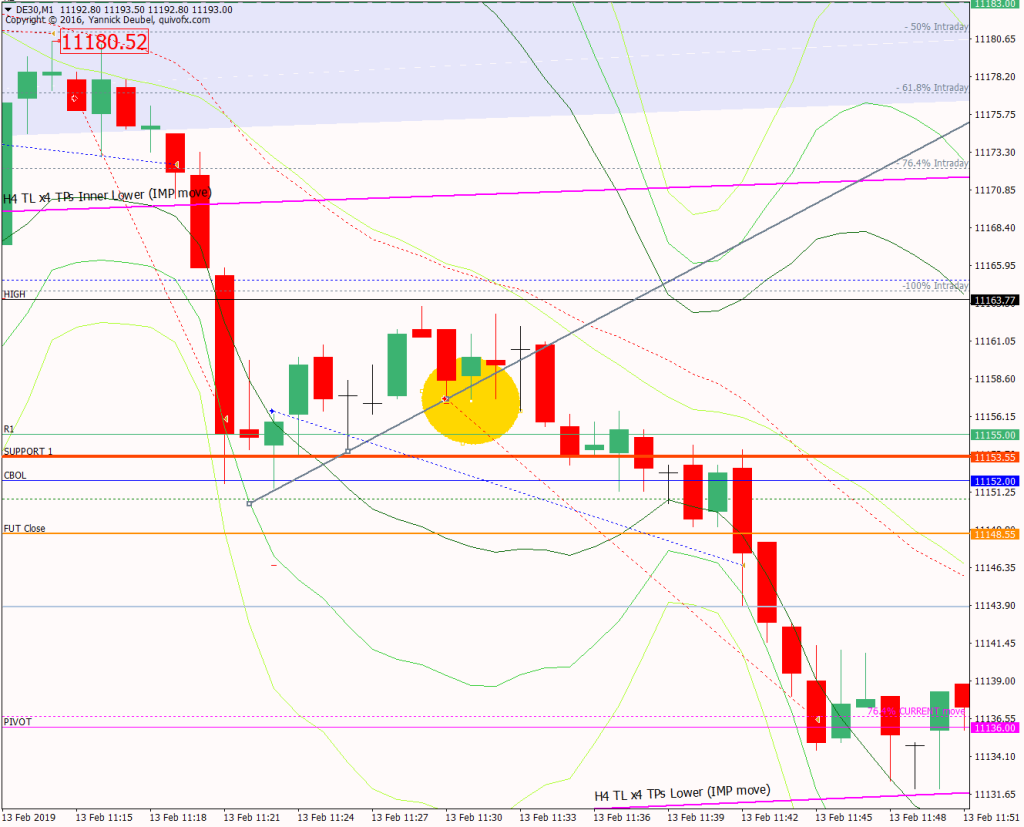

I haven’t really noticed this before, but in last few sessions it’s become so clear: the place to enter a break of a level isn’t a few pips beyond the levels – no, it’s before it breaks, using triangles, compressions and Impulsive-Corrective structures.

This trade now has a name Hits-Corrects-TL breaks and these are the rules that define it:

- level hit or very nearly

- price stages a small move in the opposite direction, but corrective in style and hopefully to a KL or fib

- buy or sell into the level when the TL supporting corrective retrace of compression breaks

See also this related post Using probability thinking to trade a break-out/

My results for trading these in the conventional way have been quite poor.

Results for taking breaks of KLs and TLs between 9:00 and 11:00 since mid-October: loss -10009 (-9.9%), 36 trades; 25% make 2:1 or more and 10% make 5:1 or more. 44% make it to 1:1. Even if I take full profits at 2:1, it still loses (18R + -27R) 9R.

Of course, the trend will eventually reverse and the last trade in the sequence will lose. When this happens, the trend is either over or making a more signficant correction – and I need to know the levels that need to be broken or respected in order to determine which way it’s most likely to be going.