This works especially well if the market has made an attempt on a level, just missed and then gone back to collect more fire-power.

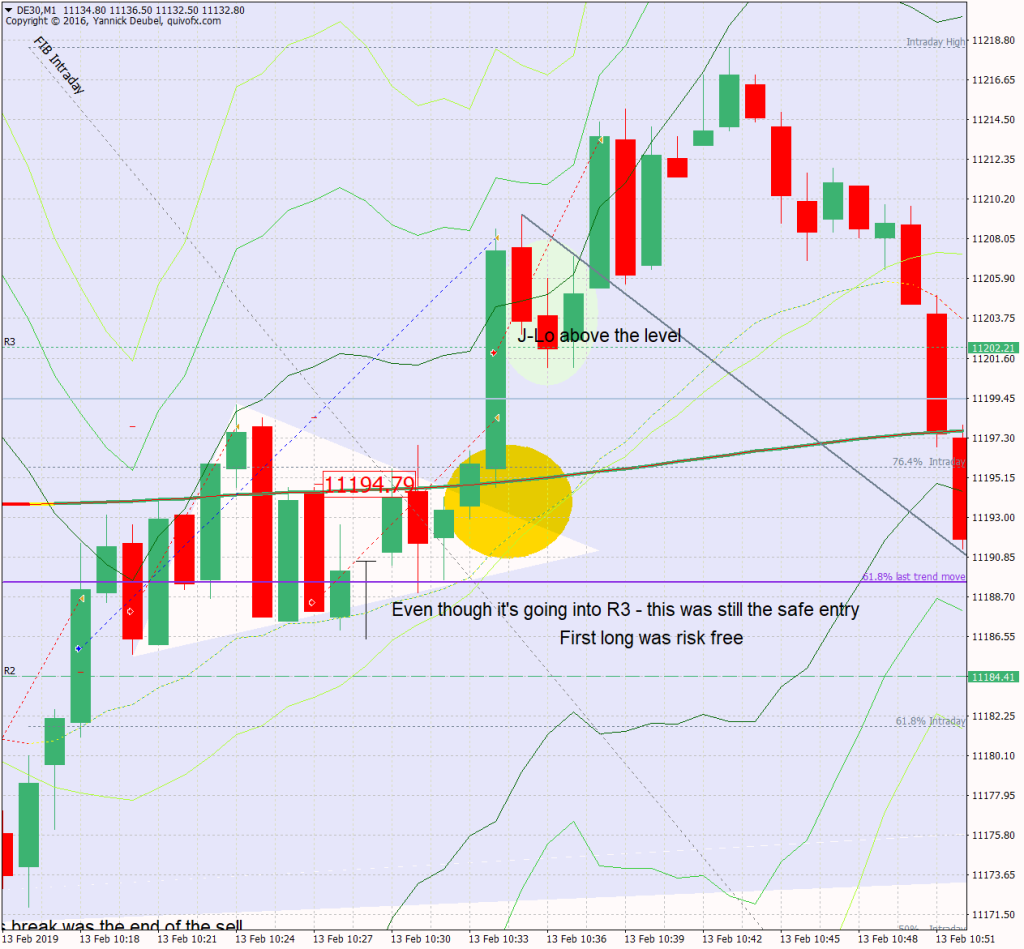

This pattern is so common that I have given it a name: the Hits-Corrects-TL Breaks entry. The setup below is ideal because it has a reason to compress (the 169), the break up is in the direction of the ST trend and which the entry where it is, there is a very good chance I will get to 1:1 and therefore be able to take risk off and be positioned for the break.

The point of this trade is to make the entry before the level breaks so that my entry does not get slipped and so that I can use STE at 1:1 and allow a retest of the level.

This entry needs filters but the key is that it must only be used with trending PA and in the direction of the trend.

Once above the level, a J-lo is an excellent way to enter a trade, especialy if the market creates a big impulse candle at the break and then makes a shallow retrace back down to the level.