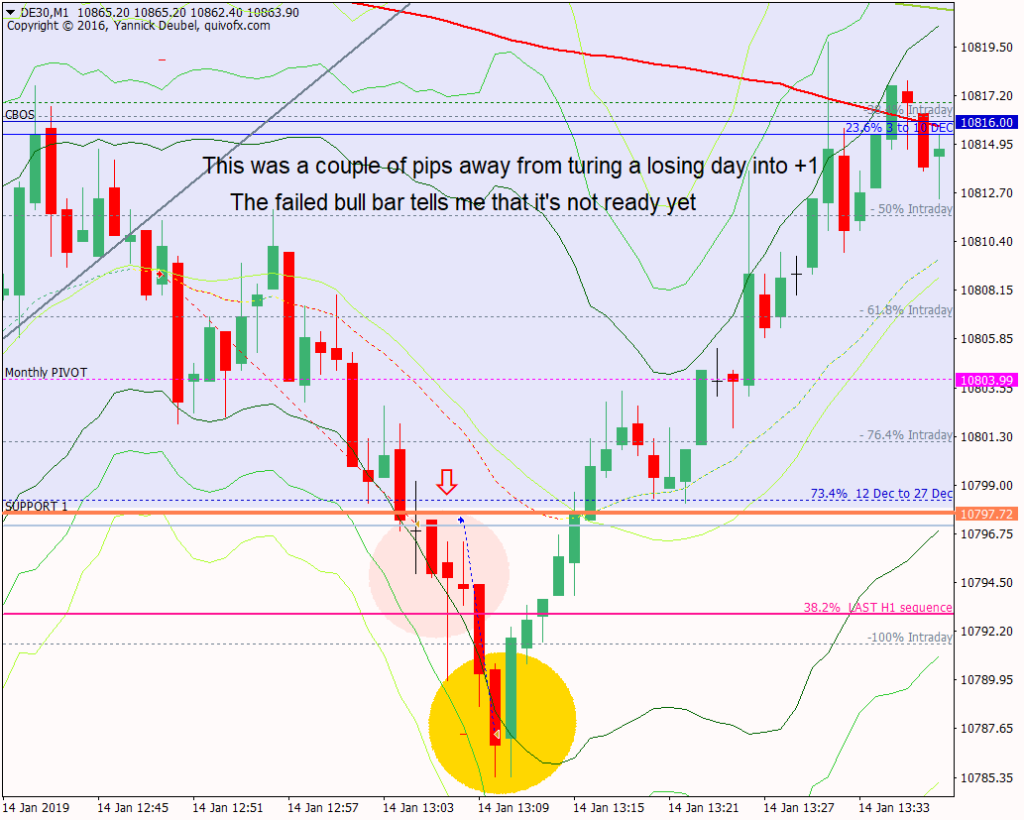

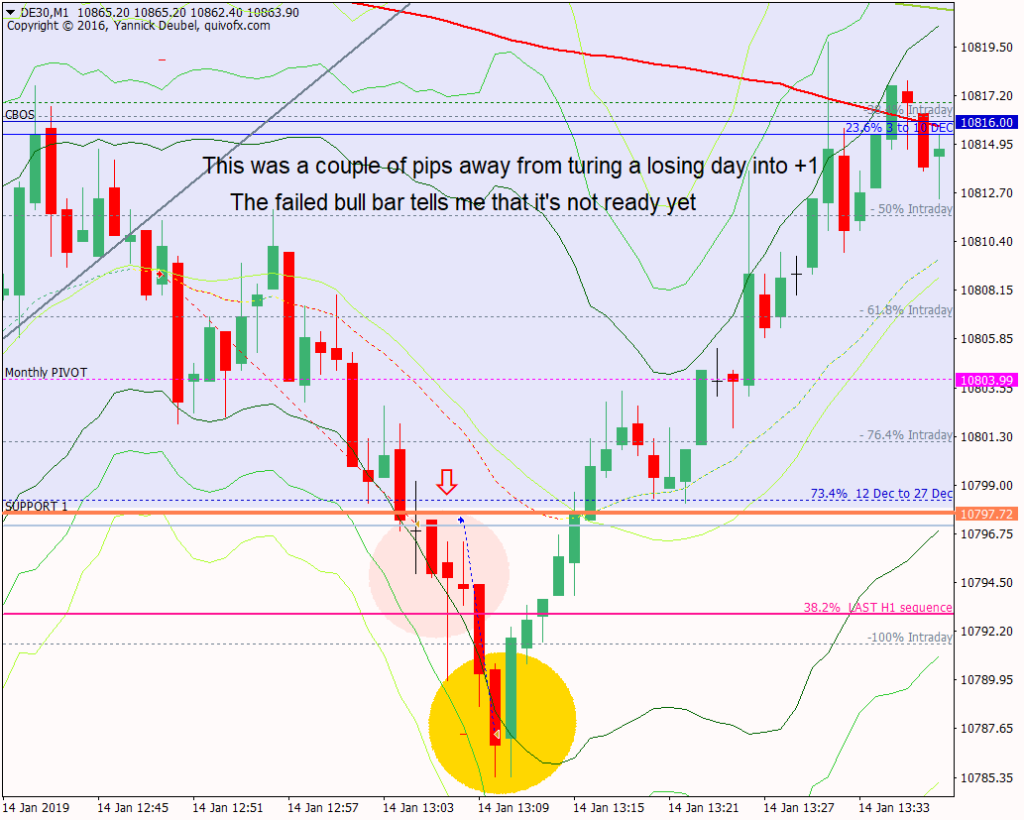

I use pin bars to tell me where price isn’t going. A failed bullish pin bar is a great short entry signal – not by itself but in co-operation with one of my setups, especially triangles.

1 min read

I use pin bars to tell me where price isn’t going. A failed bullish pin bar is a great short entry signal – not by itself but in co-operation with one of my setups, especially triangles.

Powered by BetterDocs