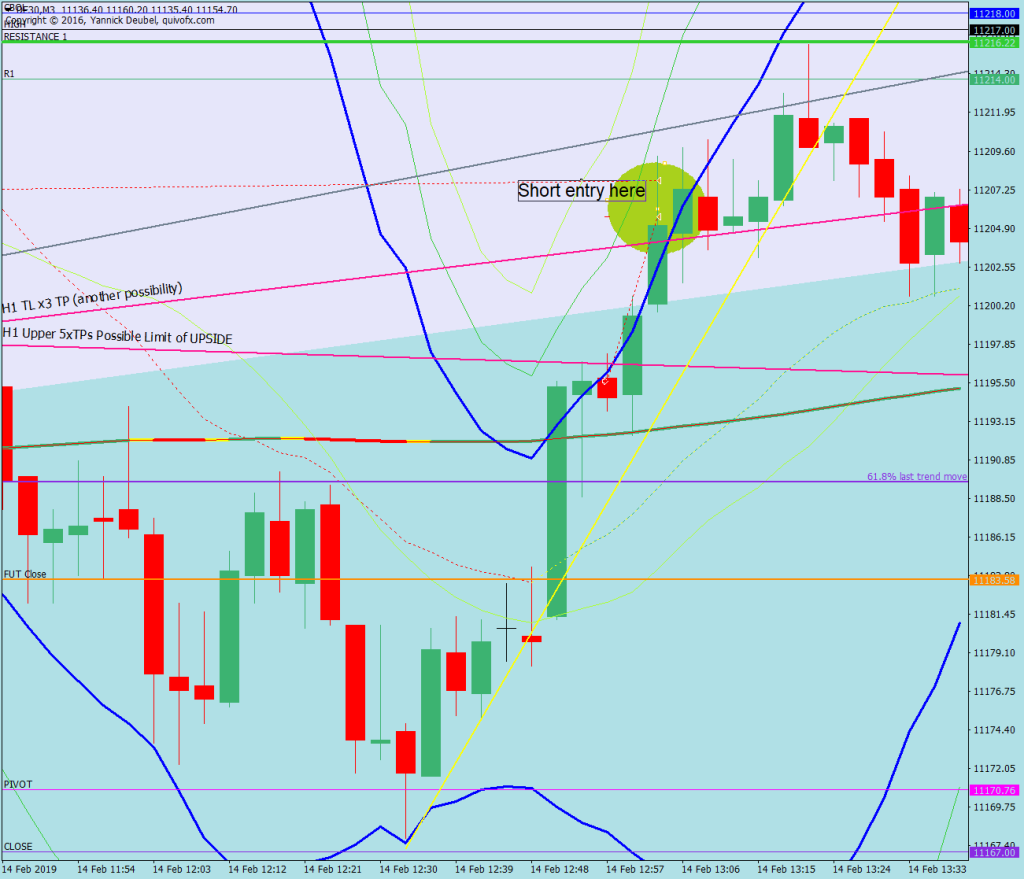

When this trade – a 3Min Bolli at a TL and the 169 – setup the Bolli Bands were not open in the way they are in the screen shot below. Even though there were levels above, the trade was valid. With this kind of structure though, it’s necessary to be on the look out for the 3Min Bolli to morph into a Imp-Corr stucture as it does here.

With so many levels above, I shouldn’t be looking for a second short here – unless the first has STE. The chances are that there are too many orders waiting above for the market to resist the pull upwards – perhaps after it’s collected the orders it will make a more significant reversal.

The chart below (M1) shows how the triangle form below the 169 and TL. It’s also above the last trend move fib and an intraday fib – all of which makes it an ideal long set up to target the KL above.