I am not yet in the habit of trading these setups and this is something that I would like to change, partly because the success and failure of these structures tells me a lot about intraday PA. They are only valid setups when:

- the market is in trending mode, indicating by its capacity to break KLs

- there is a clear HH-HL or LH-LL sequence

- the market is making LH or HL when it bounces off KLs

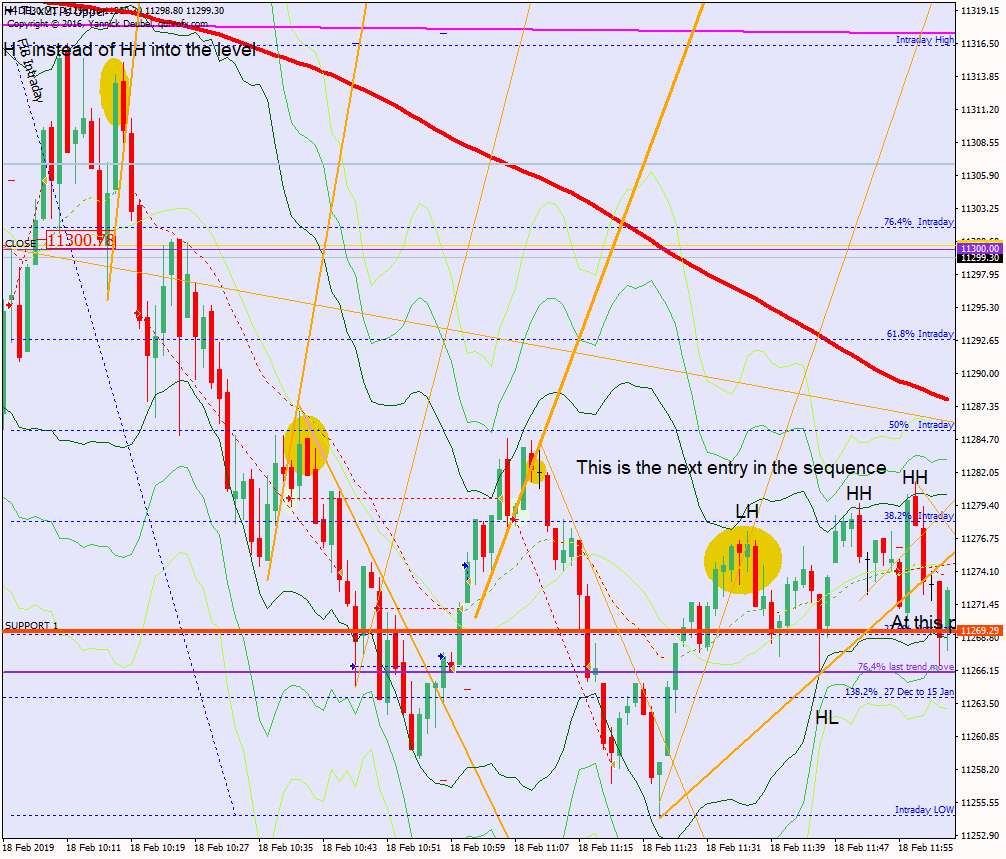

The chart above shows how the fourth entry in the Imp-Corr sequence fails when price fails to get back below the KL and instead makes a HL (and actually forms a reverse H&S)

Once this has happened I need to change strategy – no more breaks but instead use value entries requires the following thought pattern:

THOUGHT PROCESS: “OK, we have now stopped trending and now we are ranging so it’s time to buy the lower KLs/TLs and sell the higher ones – because I trade assuming that this will continue until the market tells me otherwise.”

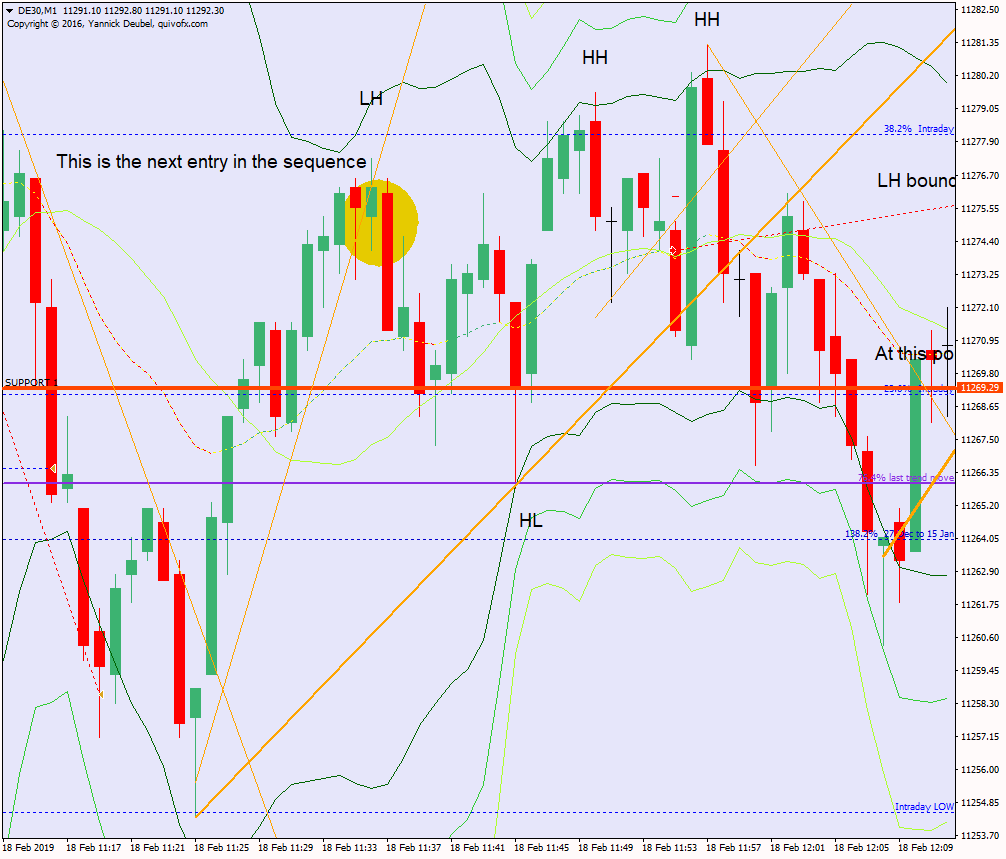

Actually, there were no good setups once the intraday context had changed and the market just ranged without much attention to levels.