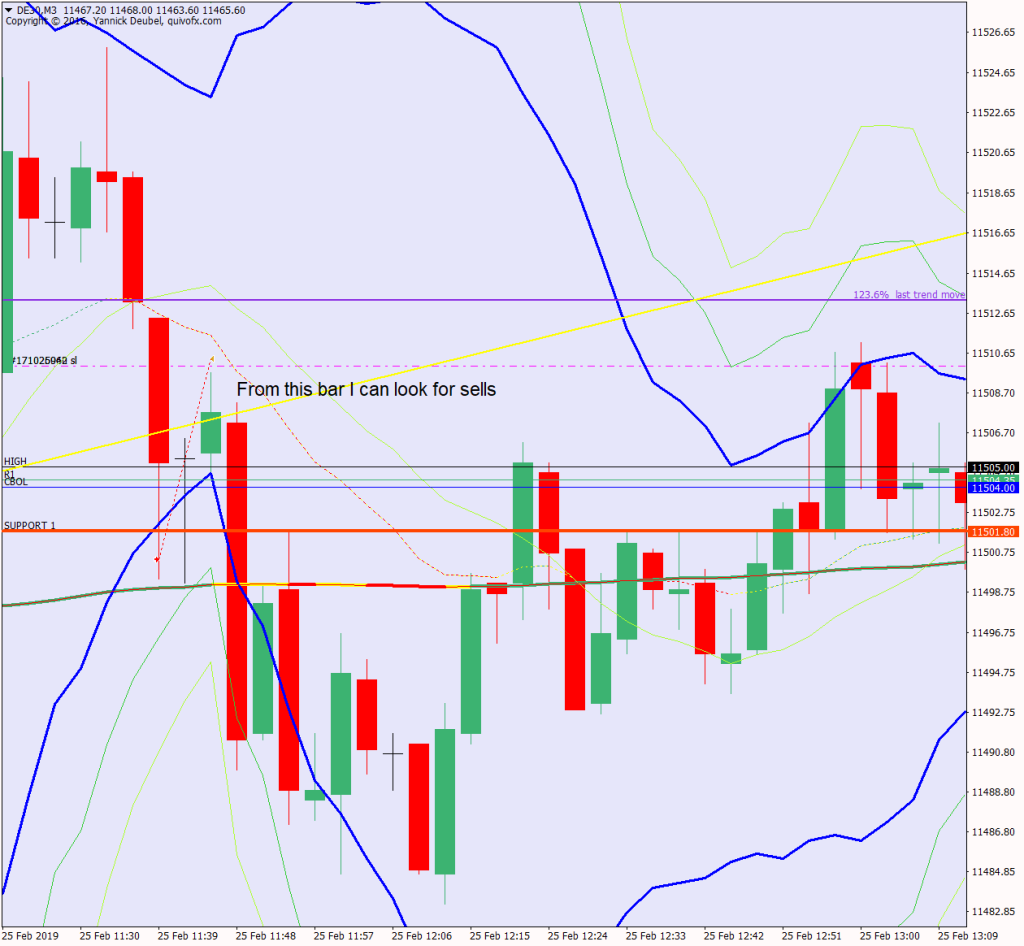

So far today (25th Feb) the market has broken below SUP 1 and then reversed back above it and is now breaking down again. The riskiest entry is the straight break because (1) it maybe a false break and (2) with a 10pt stop, I can easily get stopped during the reaction to the level even though the trade is correct.

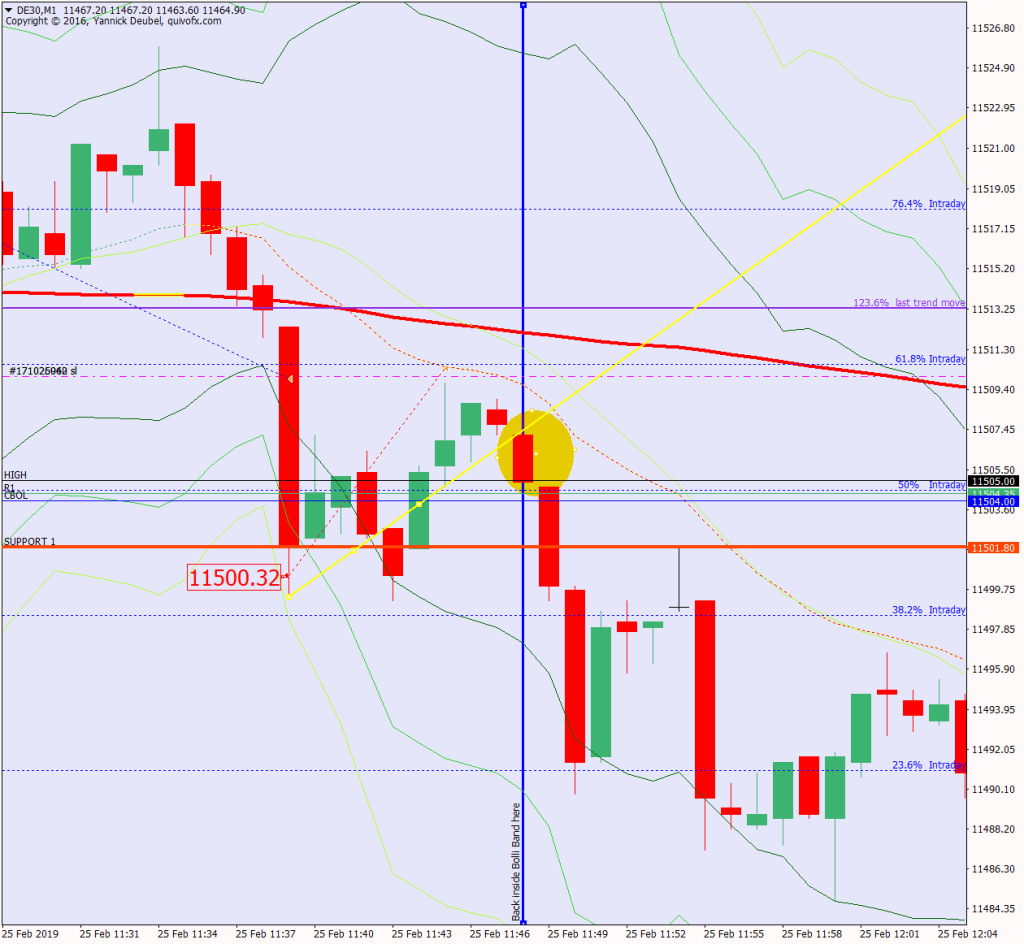

M1 chart and shows the market making a dip below the level with a big red impulsive candle – this is ther break but then prices correct and retrace around 61.8% of the candle a move of 10pts which stops out the break entry. When price breaks the SUP 1 level it is outside the 3Min Bollis

To reduce the risk of trading false breaks, I do not take these trade as straight breaks but wait for price to get back inside the Bolli Bands on the M3 chart.

This means that the market has corrected slightly from its initial push through the level, and the entry is a break of the TL supporting the corrective move. This has three big advantages

- taking a short pause gives the market more fire-power as it has absorbed some of the buy orders waiting at the level and is therefore in a stronger position to make the break

- the entry is higher up so has less work to do

- the Stop level is obvious

If that doesn’t happen, I have missed the trades and have to look to the next level.