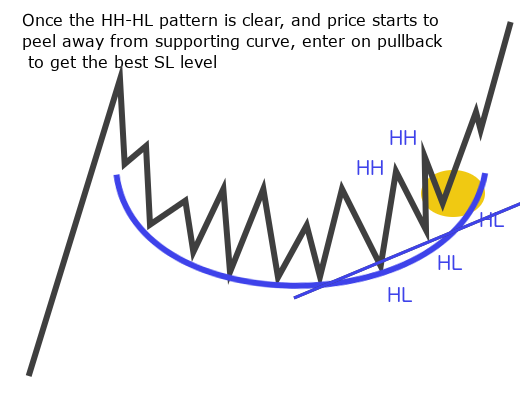

J-los and Igloos (trend continuation)

29 March 2019

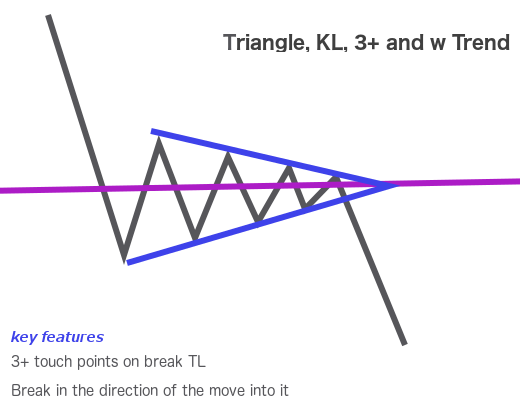

Triangles and Reverse Broken Triangles

30 March 2019Summary

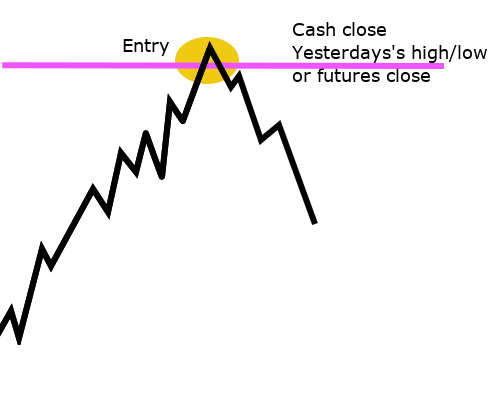

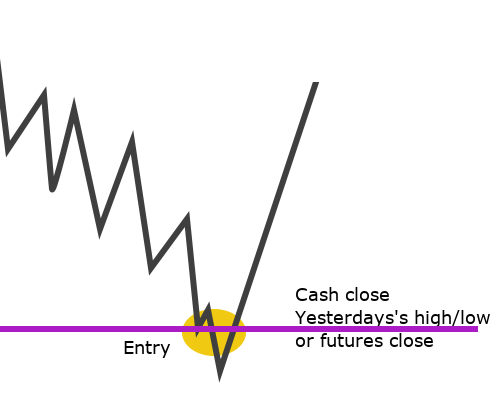

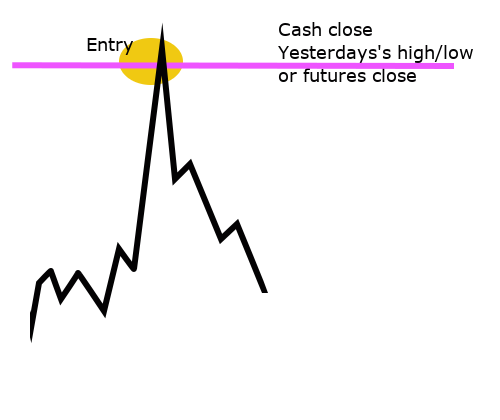

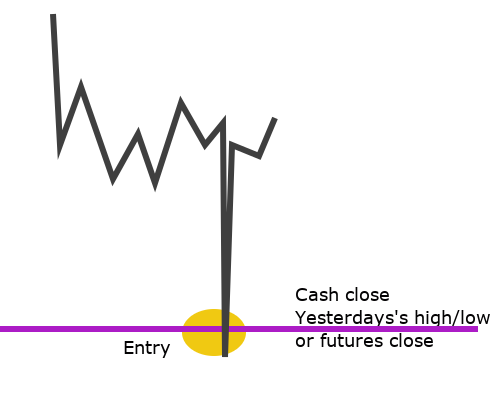

The trade sets up when price hits an unfilled gap. This can be a closing (cash) gap, an ex-gap or the futures close gap from the previous day or historical gaps left open for days, weeks or even months. Historical unfilled gaps act like magnets in the market and therefore make excellent profit targets.

Entry: as close to the level as possible; wait for the subtlest sign that the level is active.

Exit: stop loss is 10pts and trade is automatically STE at 1:1

Take profits: 50% at 2:1 and the rest at 5:1

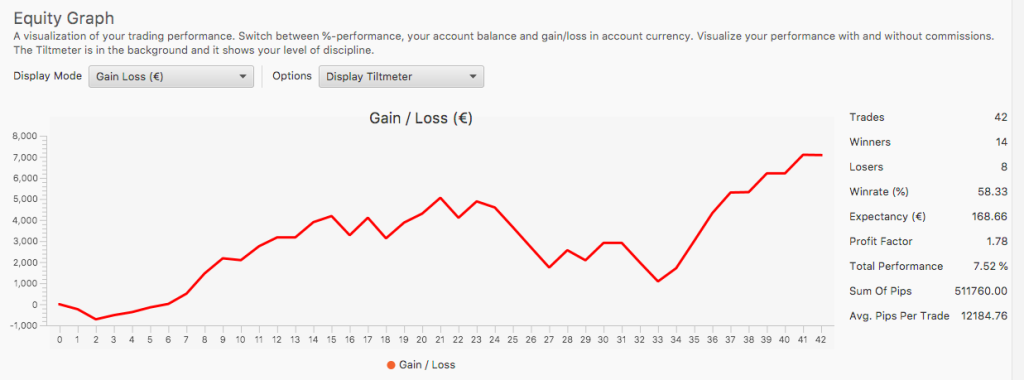

Results

Trading between 9:00 and 11:00 mid-Oct 2018 to end-Feb 2019. The stats during 2018 are likely to be less accurate as I was developing my journaling process over this period. * This includes trades that would have been STE at 1:1, so it should be reduced by 25% to be conservative.

| Setup | # of Trades | Total PnL EUR (%) R=1% | Average R/winner | Losses # (%) | Reached 1:1 & reversed | Achieved => 2:1 # (%) | Achieved =>5:1 # (%) | Achieved 10:1 +# (%) | Pnl using standard TP strategy | Theoretical PnL vs. Actual PnL |

|---|---|---|---|---|---|---|---|---|---|---|

| Gap fill fade | 24 | 7,083 (7.5%) (+7.9R) | 1.78 | 10 (42%) | 4 (17%) | 10 (42%) | 4 (17%) | 4 (5%) | -7+10+(2.5x4) =13 | +5.1R |

Why it works

The market’s function is to trade and maximise trade. If price gaps up or down at today’s open versus the previous days’ closes and/or High/Low, there will be a price range in the market where no trade has taken place. The market will return to these untraded levels as if attracted by a magnet. The move towards to the level may therefore not be driven by any factors other than the markets’ impulse to close the gap and if this is the case, it will reverse when it gets there, creating a trading opportunity.

Skills and qualities required

- keep track of all historical unfilled gaps

- keep track of previous day’s three possible gaps and their relationship with today’s open

- read ST and LT trend and exhaustion moves to determine the probability of a reversal at gap fill

- make precise, decisive entries against fast moves

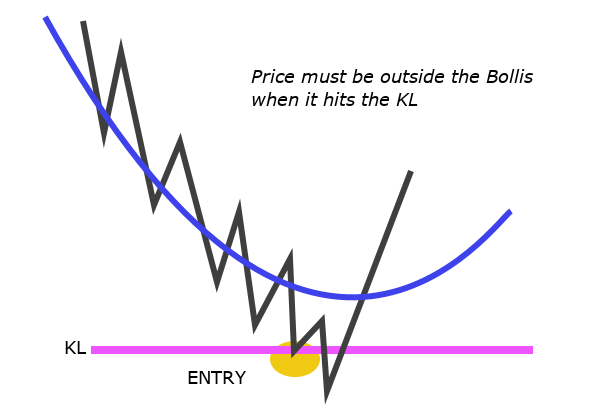

Filters

These are fantastic trades but they must be selected carefully. A fast move into the level inside my Neutral Zone is a perfect setup but a fast move into the level, when price has just broken out of my Neutral Zone is likely to be a disaster.

PA context that supports the trade

- it setups up within my Neutral Zone,

- it is outside my neutral zone but price has started to range after breaking a level, and especially if the trade is in the direction of the overall trend.

- the gap or ex-gap is a level of confluence and when trade is in overall market direction; in this case, it will perhaps set up as a 3Min Bolli as well

PA context or other factors that cancel the trade

- do not trade against the first impulse after a KL or TL break

- do not trade a stair-step down into the level if the trade is against the overall direction of the market.

Open issues

- how to select these trades?

- if the trade also sets up as a 3Min Bolli, do I double risk?

- CM used a method where he would only take it counter-trend, DMs would only take it if there was a fast move into it

- sometimes the market will test these levels more than once and when that happens, do I trade it? In what PA does it work to keep trading this level?