Retest-reversals of a KL or TL

9 March 2019

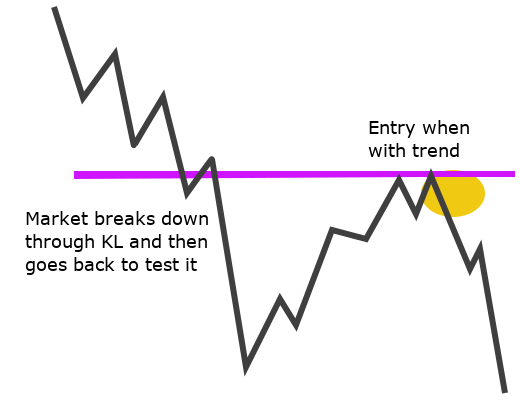

Key Level (KL) and Trendline (TL) breaks

28 March 2019Summary

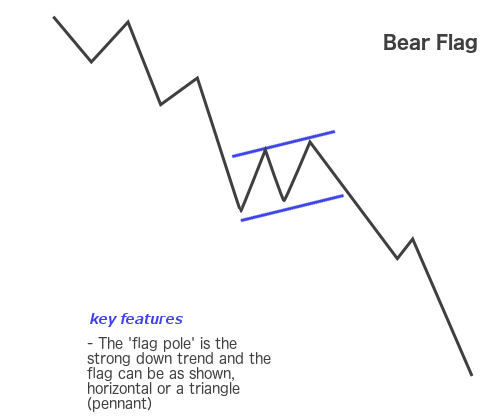

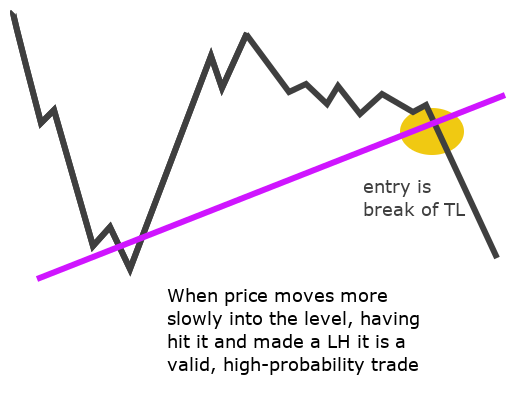

For this trade to set up, the market must be clearly trending – this is not a trade to take in ranging action even though an apparent corrective phase pattern can develop. This is a continuation trade, to it trades in the direction of the trend and enables me to build a position in a trending move. To trade this successfully; I need to trade it consistently and when the trade starts to lose, it’s an indication that the trending is reversing or a longer retrace is forming.

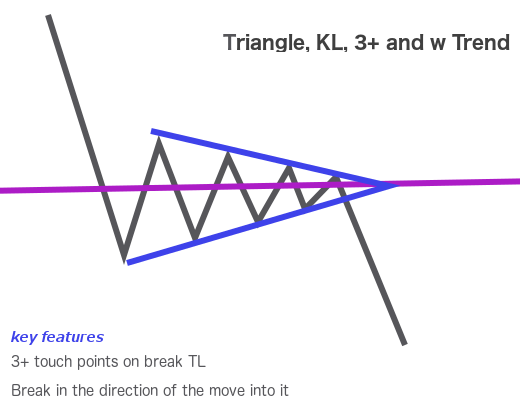

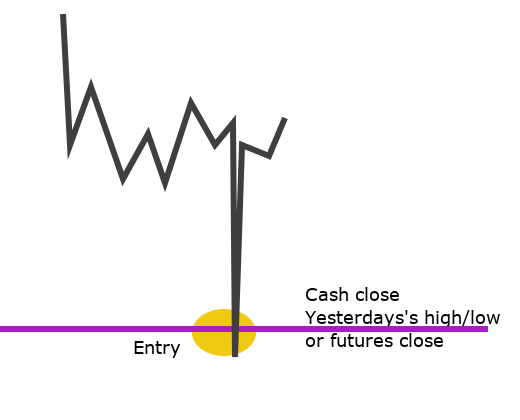

Entry: break of the TL supporting or capping the corrective move

Exit: stop loss is 10pts and the stop is automatically moved to entry at +10pts.

Take profits: this trade can easily run, so the standard TP strategy applies, but I can also look for extended targets for the final 10 or 25% to build a risk-free position during the trend

Results

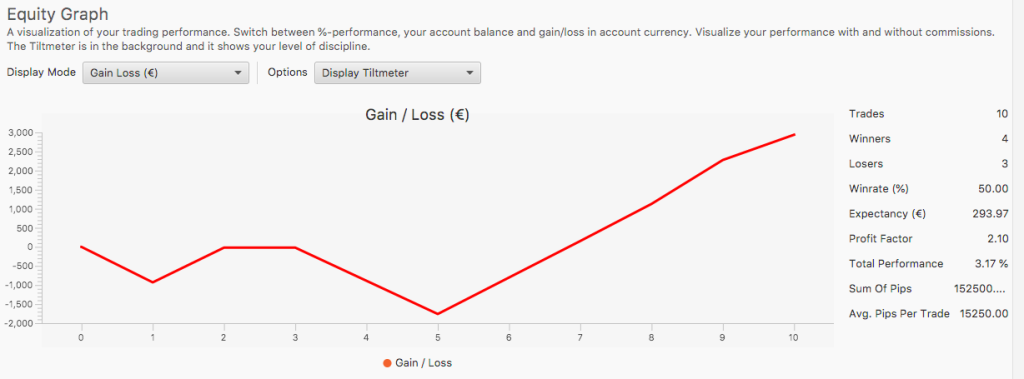

Trading between 9:00 and 11:00 mid-Oct 2018 to end-Feb 2019. There are too few trades for these results to be significant – from March 2019, one of my targets is to trade this setup consistently.

| Setup | # of Trades | Total PnL EUR (%) R=1% | Average R/winner | Losses # (%) | Reached 1:1 & reversed | Achieved => 2:1 # (%) | Achieved =>5:1 # (%) | Achieved 10:1 +# (%) | Pnl using standard TP strategy | Theoretical PnL vs. Actual PnL |

|---|---|---|---|---|---|---|---|---|---|---|

| Imp-Corr structure | 6 | 2,939 (3.2%) +3.3R | 2.1 | 3 (50%) | 0 (0%) | 3 (50%) | 1 (17%) | 0 (0%) | -3+3+(2.5x1) = 2.5 | -0.8R |

These stats are from Edgewonk. Number of trades is different from the value shown value in the table because Edgewonk counts closed trades, and the figures in the tables represent opened trades.

Why it works

Markets generally don’t move in straight lines. Even the strongest trend will see some pullbacks or retraces. For the market to trend sellers must vastly outweigh buyers or visa versa. Using a market in a fresh bear trend as an example, what is happening here? Institutions who shorted during the ranging phase are sitting on nice profits, as are traders who shorted the break and these players will be looking for take-profit levels. On the long side, there will be those who are trapped by the move against them – when they finally capitulate, they add to selling pressure. On the sidelines, there are traders wanting to get long and looking for buy levels and longs who were stopped by the break looking to re-enter. These buy orders will mostly be executed at levels such as pivots, previous day’s H/L/C, fibs etc. and cause the market to make a small retrace. If buyers turn out to be thin on the ground, this will be signalled by a shallow retrace which will attract more sellers and when this happens, the trade will work.

Skills and qualities required

- ability to identify a trending market

- trade this pattern consistently and without hesitation until it fails (meaning that the ST structure has changed)

- patience to wait for breaks and then retests

Filters

PA context that supports the trade

The trade more likely to work and more likely to run if:

- the trend is fresh and new with plenty of momentum

- the corrective phase is clear a short-lived

- it sets up at a minor level

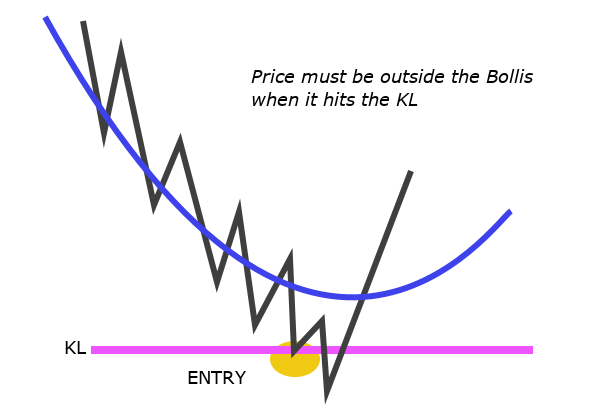

- PA is within the Boilli Bands on the M3 chart

PA context or other factors that cancel the trade

By it’s very nature, this set up has to be taken until it fails but there’s no point in taking an obviously bad low probability trade

- if the trend has become confuse and the structure is unclear

- if it is going into conflúence or a strong level

- if price is outside the Bolli Bands on the M3

Open issues

- this trade is very similar to the H-C-B, but is usually at a less significant level and doesn’t require a 3Min Bolli in the sequence

- if it sets up a KL it could also look like a triangle or compression

- J-Los and Igloos are also continuation trades which work much better for me – what am I missing, and why are these trades not making money?