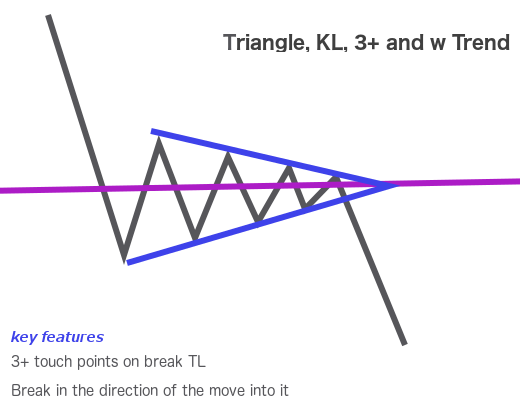

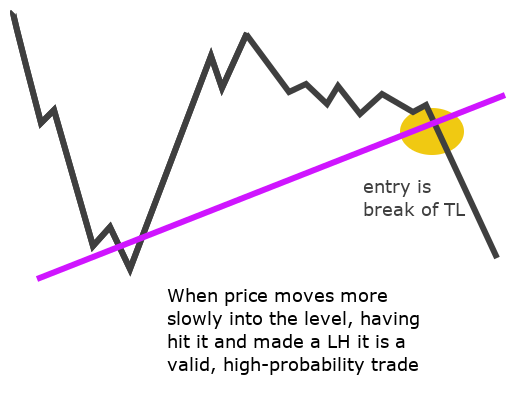

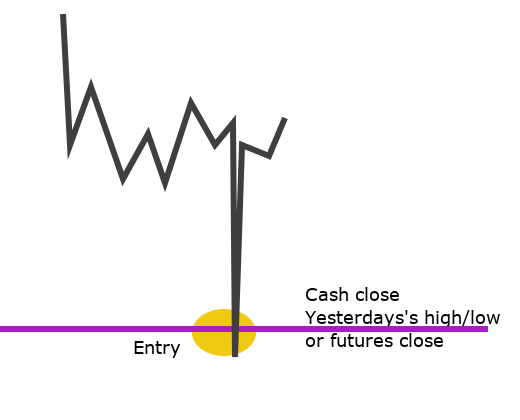

Key Level (KL) and Trendline (TL) breaks

28 March 2019

Gap fill fade (Futures, Cash and Ex-gaps)

29 March 2019Summary

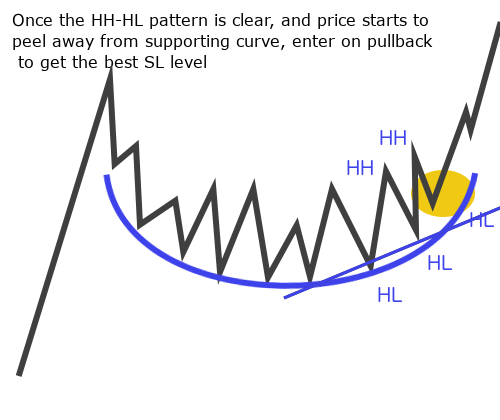

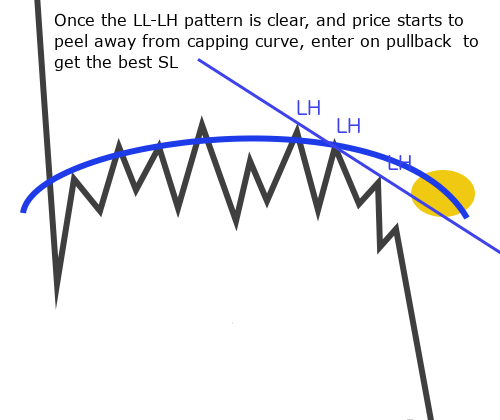

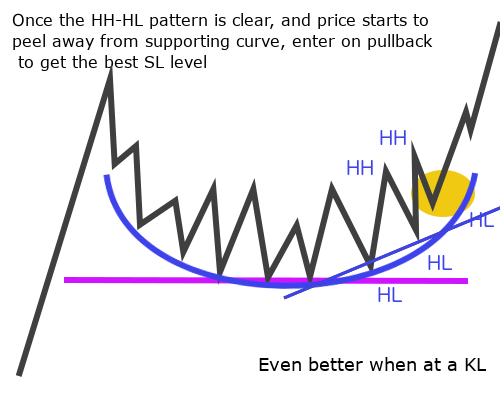

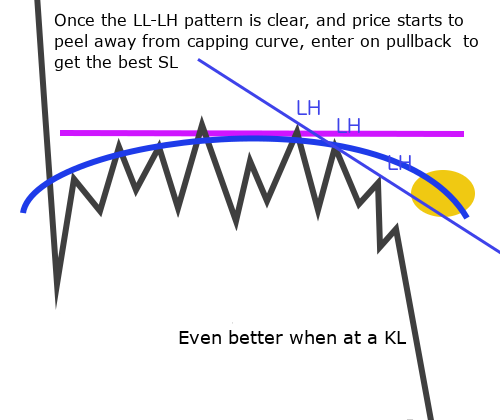

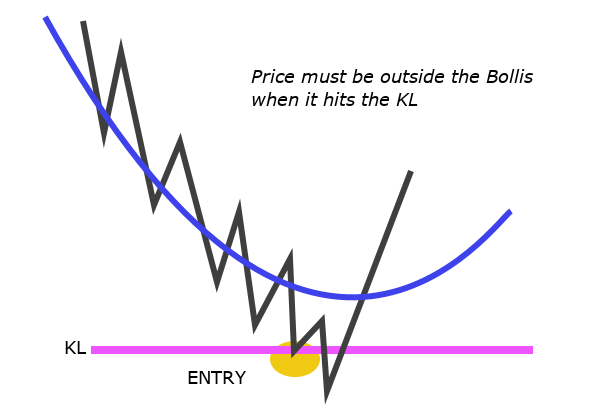

This is a trend continuation trade which uses a pause in the trend to enter the market. The J-Lo is an entry in a bull trend an Igloo is a bear trend entry. The failure of this trade is also a good indication that the trend has run out of steam.

Entry: once the PA has formed a clear curve and then makes HH-HL (J-Lo) or LL-LH (Igloo) enter on a pullback so that the SL is below the most recent H or L

Exit: stop loss is 10pts and the stop is automatically moved to entry at +10pts.

Take profits: use standard TP strategy with 50% off at 2:1 or 20pts and the rest at 5:1 (50pts)

Results

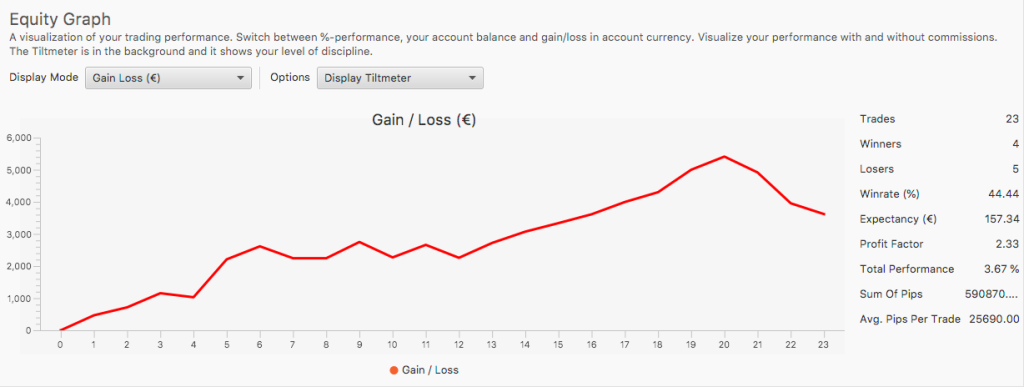

Trading between 9:00 and 11:00 mid-Oct 2018 to end-Feb 2019. From March 2019, one of my targets is to trade this setup consistently and with the usual 10pt stops – I started trading this with 20pt stops, and it’s unnecessary.

| Setup | # of Trades | Total PnL EUR (%) R=1% | Average R/winner | Losses # (%) | Reached 1:1 & reversed # (%) | Achieved => 2:1 # (%) | Achieved =>5:1 # (%) | Achieved 10:1 +# (%) | Pnl using standard TP strategy | Theoretical PnL vs. Actual PnL |

|---|---|---|---|---|---|---|---|---|---|---|

| J-Lo and Igloo | 17 | 4,027 (3.67%) +4.5R | 2.33 | 4 (23%) | 8 (47%) | 5 (29%) | 4 (23%) | 1 (6%) | -4+5+(2.5x4) = 11R | 6.5R |

These stats are from Edgewonk. Number of trades is different from the value shown value in the table because Edgewonk counts closed trades, and the figures in the tables represent opened trades.

Why it works

When the market makes an impulsive move it will inevitably be met with a large number of orders in the opposite direction – new trades, stops and take profits – which cause the market to reverse. If the impulsive move is supported by enough buyers or sellers to become a trending move, the reversal will be shallow and most likely short-lived because the orders against the trend are overpowered by the new entrants. Market players (algos and people) are looking at the same levels and if the level in question sees only a muted reaction – perhaps a retrace back to the 76.4% fib – that will attract new entries in the direction of the trend so that the shallow pullback becomes a self-fulfilling prophecy.

If a J-Lo or Igloo fails, it is a good sign that there simply isn’t enough new buying or selling power for the trend to continue, at which point it makes sense to look for reversal entries.

Skills and qualities required

- patience to wait for the trade to set up to avoid early, invalid entries

- patience and confidence in my PA reading to use a pullback entry

- flexibility to trade in the opposite direction if the trade fails

Filters

PA context that supports the trade

The is trade more likely to work and more likely to run if:

- it forms around a KL

- the trend is quite fresh with plenty of MOM

- there is white space above and confluence and corrective action below

PA context or other factors that cancel the trade

- a tired or confused trend

- too many levels to trade into – although it’s fine to open the position into the KL around which the setup form

Open issues

- is the failure of this setup a valid trade in itself or do I need to wait for a new setup?

- is it necessary to have the SL below the low of the supporting/capping curve or is 10pts enough?