Impulsive-Corrective (continuation)

28 March 2019

J-los and Igloos (trend continuation)

29 March 2019Summary

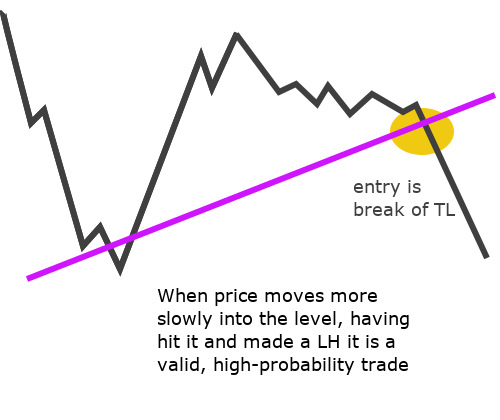

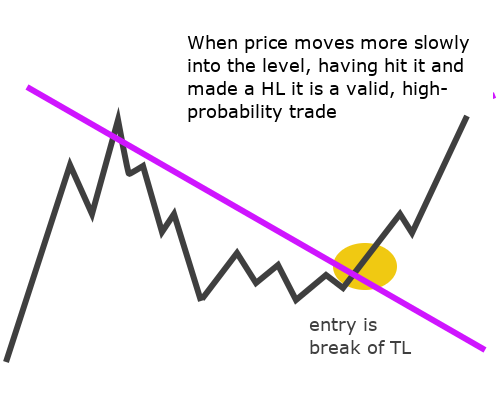

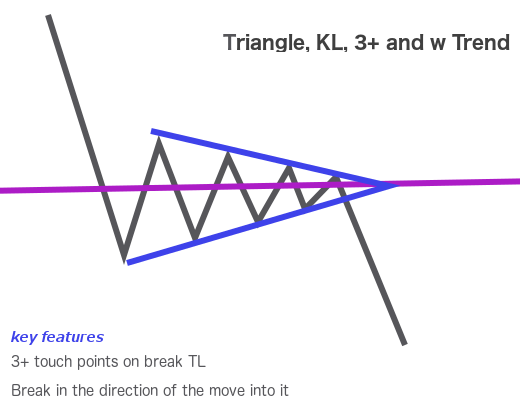

This trade triggers when a trend line (TL) is broken; the TL can be intraday for based on the H1 or H4/D1 charts.

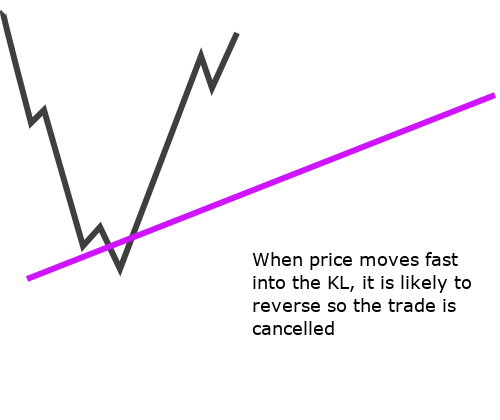

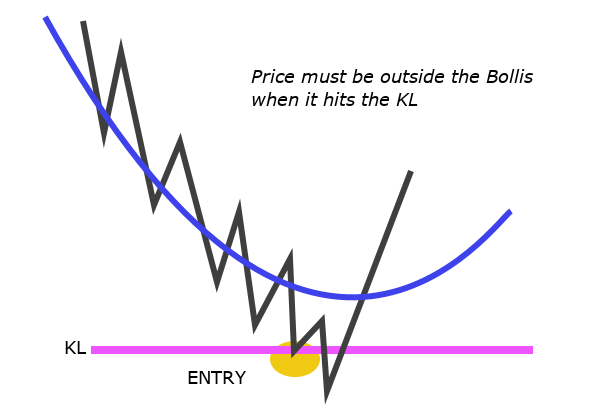

During the development period, I categorised KL and TL breaks together and the results of these trades were poor. I had phases of taking repeated straight breaks of KLs when the PA was actually just vibration around the level. Then I reacted to the losses generated by these trades by revenge trading the level.

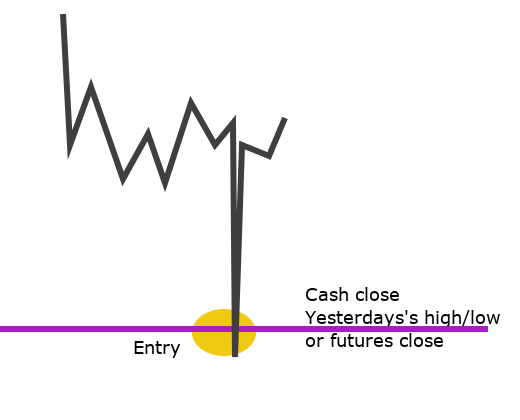

Entry: straight break of valid TL unless it breaks with a big bar, in which case, wait for it to close and retrace

Stop loss: 10pts and automatically STE at 1:1

Take profit: use standard TP strategy with 50% off at 2:1 and 100% at 5:1 (50pts)

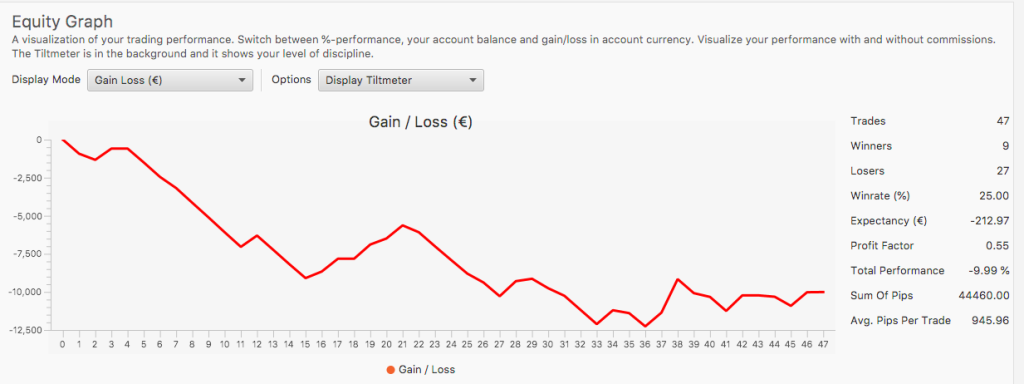

Results

Trading between 9:00 and 11:00 mid-Oct 2018 to end-Feb 2019. This trade was a disaster, mainly because I would start doing battle at the level and keep trading, driven by fear of missing the break rather than any real trade rationale. Using STE at 1: would have drastically decreased the losses on this trade.

| Setup | # of Trades | Total PnL EUR (%) R=1% | Average R/winner | Losses # (%) | Reached 1:1 & reversed | Achieved => 2:1 # (%) | Achieved =>5:1 # (%) | Achieved 10:1 +# (%) | Pnl using standard TP strategy | Theoretical PnL vs. Actual PnL |

|---|---|---|---|---|---|---|---|---|---|---|

| Breaks of KLs and TLs | 45 | -11,007 (-9.99%) -12.23R | 0.55 | 28 (62%) | 7 (16%) | 10 (22%) | 4 (9%) | 0 (0%) | -22+10+(2.5x4) = -2R | -10.23R |

Why it works

Traders and algos are looking at the same levels and it’s often possible to tell fairly early in the session whether a TL is active (i.e. if it sees a reaction). When price moves through an active KL, it will often attract new entrants in the direction of the break (as well as stops and take-profits) which will result in a fast move away from the TL. Several touches, rejections and/or false breaks indicate a very active KL that is likely to see a strong reaction if it does break. The key to the success of this trade is being able to read the PA context and only take trades that have several factors in their favour.

Skills and qualities required

- PA reading skills to identify accurate TLs

- Skills to identify the PA context for valid straight break entries

- if the break is made with a big bar, I need the discipline to wait for it to close and retrace

- this trade should be a consistent winner, but it’s lost me money – what skill am I missing?

Filters

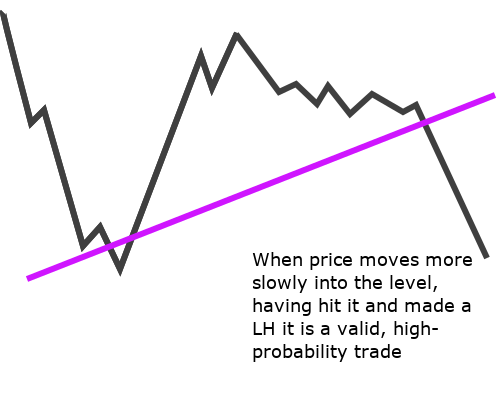

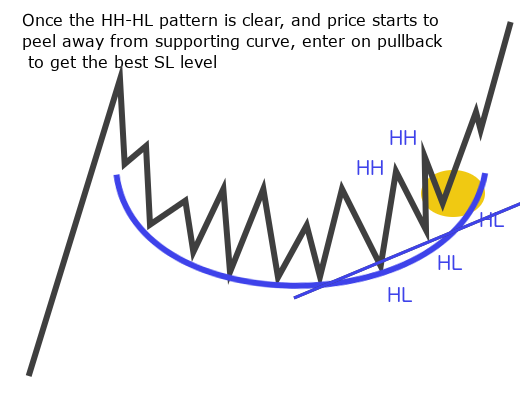

PA context that supports the trade

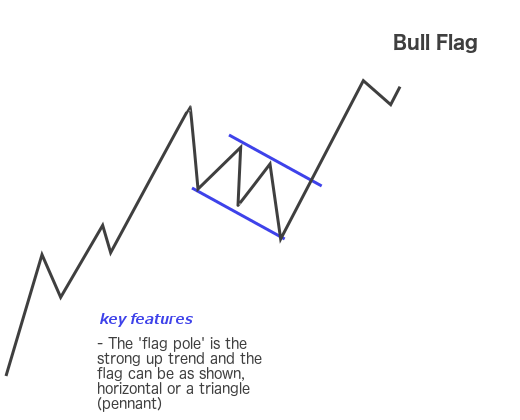

The trade more likely to work and more likely to run if:

- the TL has been rejected earlier in the session

- stair-step PA into the TL

- white space below

- in line with overall trend

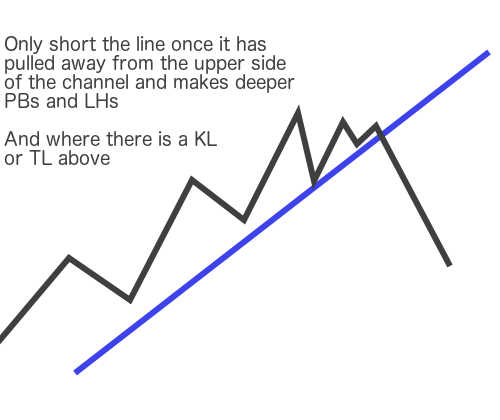

- price has made a LH or HL after rejecting the TL

PA context or other factors that cancel the trade

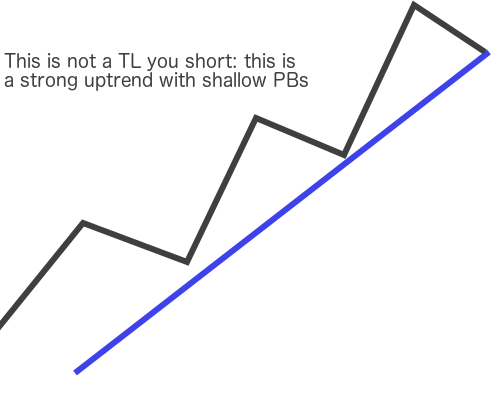

Trading all TL breaks is a disastrous strategy, and the selection of these trades is a work in progress

- the first touch of the TL in the session

- counter trend

Open issues

- breaks of TLs on the M1 chart can be very successful trades that run and run, but where are they in these stats?

- from now on, this trade includes TL breaks only

- work out why this trade is not working for me: what filters do I need? What entries work? What am I missing?