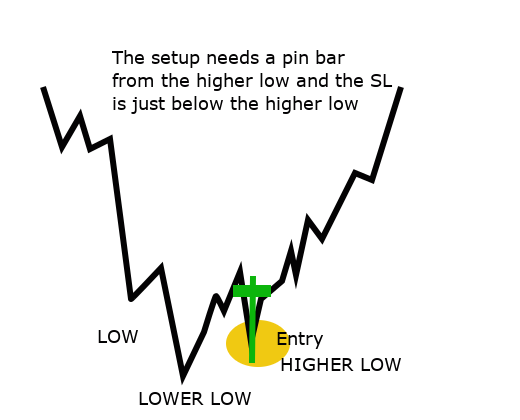

V-Shaped 3-legs Rev

3 March 2019

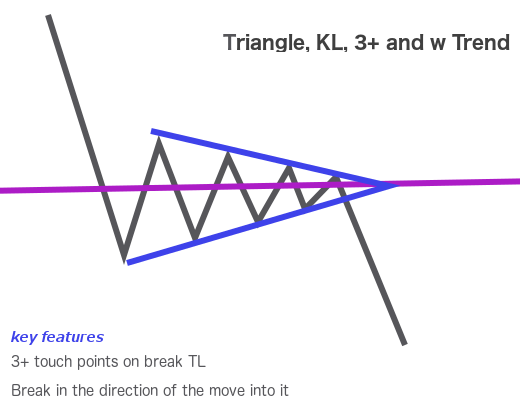

Impulsive-Corrective (continuation)

28 March 2019Summary

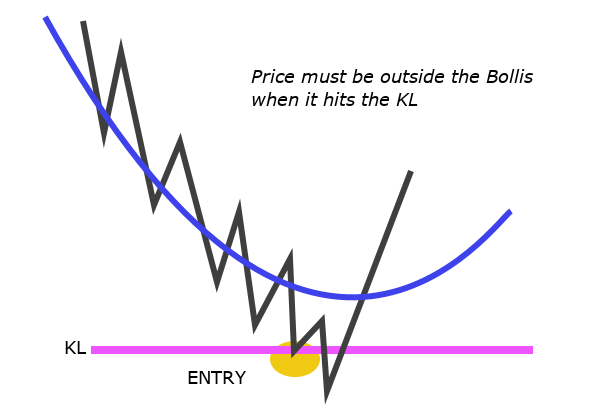

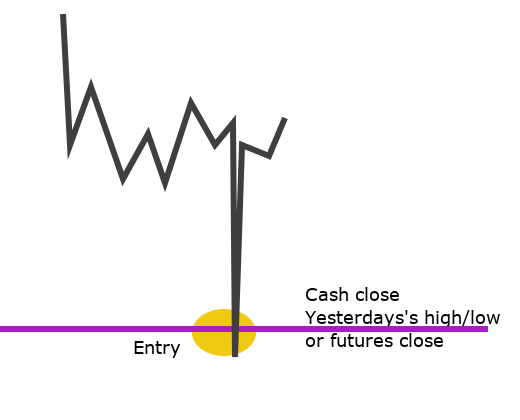

The market so frequently goes back to an important level and then reverses away from it in the direction of the original break that it is essential to have a setup to profit from this pattern. The trade can add to an existing position or open a new one.

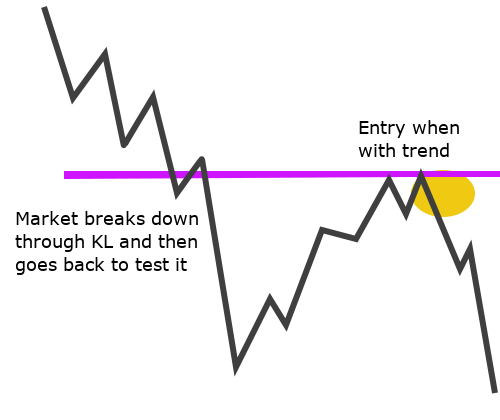

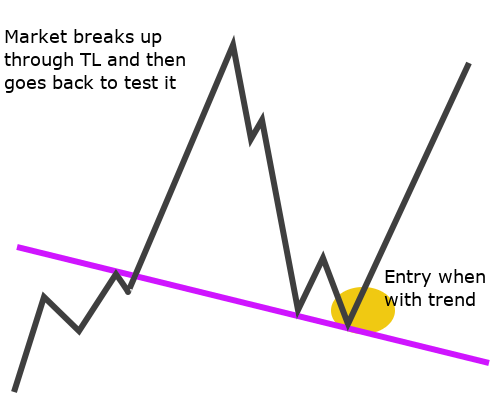

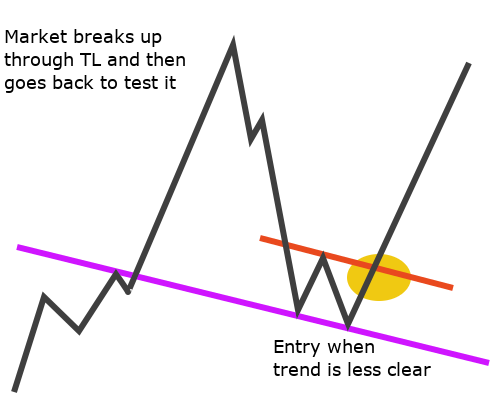

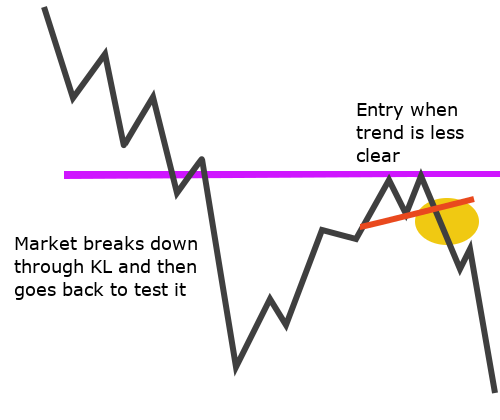

Entry: if the trade is in the direction of the overall trend and everything else is in favour of the trade, I can open the position as soon as I see some evidence of a reversal at the level; if the pattern is less clear, there must be a short corrective phase at the level in which case the entry is a break of that.

Exit: stop loss is 10pts and the stop is automatically moved to entry at +10pts.

Take profits: use the standard TP strategy of 50% off at 2:1 (20pts) and the rest at 5:1 (50pts)

Results

Trading between 9:00 and 11:00 mid-Oct 2018 to end-Feb 2019. This trade is very undefined and has had no filters or rules attached to it until now. From the stats shown here, the problem is more the TP strategy than the trade

| Setup | # of Trades | Total PnL EUR (%) R=1% | Average R/winner | Losses # (%) | Reached 1:1 & reversed | Achieved => 2:1 # (%) | Achieved =>5:1 # (%) | Achieved 10:1 +# (%) | Pnl using standard TP strategy | Theoretical PnL vs. Actual PnL |

|---|---|---|---|---|---|---|---|---|---|---|

| Retest of KL or TL | 26 | +1,864 (+2.8%) (+2.1R) | 1.23 | 16 (61%) | 3 (11%) | 10 (38%) | 5 (19%) | 2 (7%) | -13+10+(2.5x5) = 9.5R | +7.4R |

These stats are from Edgewonk. Number of trades is different from the value shown value in the table because Edgewonk counts closed trades, and the figures in the tables represent opened trades.

Why it works

This is relatively simple trade logic: once the market breaks a level, if it doesn’t find more orders in the broken out zone, it will need to reverse to collect more trades. At any break-out level, there will be new trades, stops and take profits. If the order flow is mostly stops and take profits, the move is unlikely to have legs on the first break.

The general view is that institutions build positions while the market is ranging. When the balance between buyers and sellers eventually breaks, there will be a fast move outside the range. When stops and take profits are triggered by the move and traders spot the breakout, the order flow adds momentum to it. Those with positions built up during the ranging action now have the opportunity to liquidate them at a profit, causing price to return to the break-out level at which point, the market will decide whether the break out represents the correct price level or not. If profit-taking from established positions is weak and new trades in the direction of the break is strong, the market will continue in the direction of the break.

Skills and qualities required

- read the PA context so that I know the levels and the overall trend direction

- patience to wait for a compression/vibration entry when the trend is not clear

Filters

PA context that supports the trade

The trade more likely to work and more likely to run if:

- the market is trending, otherwise the trade will be stopped in the range-bound indecision

- the direction of the trend is clear so that the retest represents a ‘sell rallies’ or ‘buy dips’ strategy

PA context or other factors that cancel the trade

If the market has started to range intraday, this trade is unlikely to be successful

- corrective, range-bound PA

- layered levels close to the entry and in the direction of the trend

Open issues

- in EW there must be a distinction between a KL and a TL retest

- how does the extent and shape of the break affect the outcome of the retest – if at all?