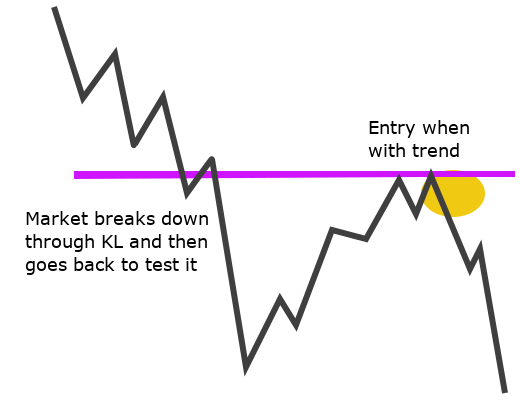

Retest-reversals of a KL or TL

9 March 2019Summary

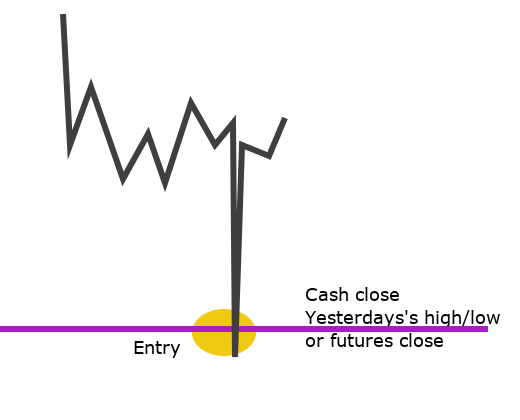

This is a counter-trend trade to position for the reversal of an exhaustion move.

Entry rules: impulsive move down followed by (1) a rejection of lower for a few small candles (2) a LL (3) the 3rd point which is a HL bull pin bar and then entry is on a close of the pin bar candle

Exit: use 10pts and automatic STE at 1:1

Take profits: this trade could run since it is a trend reversal trade so use standard 50% off at 2:1 and rest at 5:1.

Results

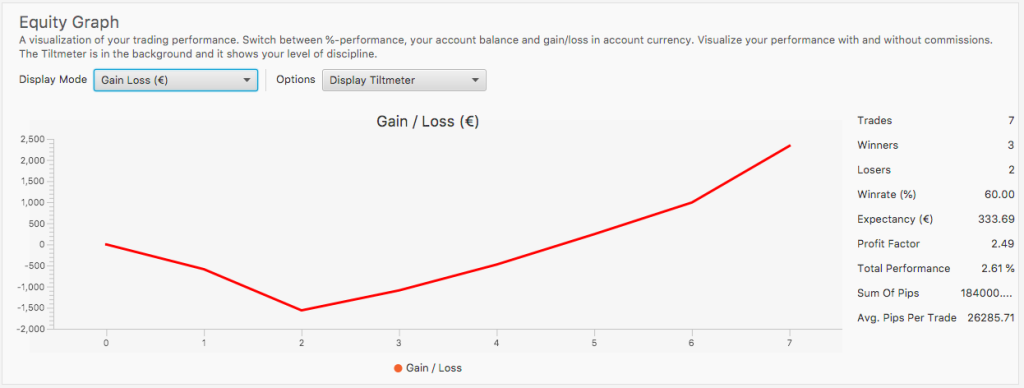

Trading between 9:00 and 11:00 mid-Oct 2018 to end-Feb 2019. There are too few trades for these results to be significant – from March 2019, one of my targets is to trade this setup consistently.

| Setup | # of Trades | Total PnL EUR (%) R=1% | Average R/winner | Losses # (%) | Reached 1:1 & reversed | Achieved => 2:1 # (%) | Achieved =>5:1 # (%) | Achieved 10:1 +# (%) | Pnl using standard TP strategy | Theoretical PnL vs. Actual PnL |

|---|---|---|---|---|---|---|---|---|---|---|

| V-shaped 3-legs Rev | 4 | 2,335 (2.7%) +2.6R | 2.49 | 3 (75%) | 0 (0%) | 2 (50%) | 1 (25%) | 1 (25%) | -3+2+(2.5x1) = 1.5 | -1.1R |

These stats are from Edgewonk. Number of trades is different from the value shown value in the table because Edgewonk counts closed trades, and the figures in the tables represent opened trades.

Why it works

An impulsive move down sees its first rejection but the buyers don’t have enough power to reverse the market so after a few smaller corrective bars, the market breaks down to make a LL. Because there has already been a pause in the PA and the impulse move has been slowed, the buyers here (the ‘initiators’) are taking on a lot of risk by buying a move before it’s reversed, but they are not stepping in front of a steam train and they are able to move the market up. Sellers then come back in for a second time but they are not able to push the market down again, so lower levels are firmly rejected and buyers are willing to get on board at a worse price (an HL vs. the previous Lows) all of which is implied by the pin bar which triggers the entry.

Skills and qualities required

- patience to wait for the formation to complete

- discernement to choose only valid setups

- PA reading skills to see it in real time and set logical TP

- market function understanding to know why it works

Filters

PA context that supports the trade

The trade more likely to work and more likely to run if:

- the ATR has to be high enough to get the necessary R:R

- the trade sets up near or at the lows of the day

- strong, impulsive move down

- an entry candle which is above the 20MA but still close to it

- the 3rd point is higher than the first low (i.e. buyers willing to enter at a higher price shows greater confidence)

PA context or other factors that cancel the trade

- the bounce off the lowest low must be corrective and quite contained otherwise the bulls may have used up too much firepower and it also means that buyers have to relinquish a lot of control to make the third low, which does not suit the trade

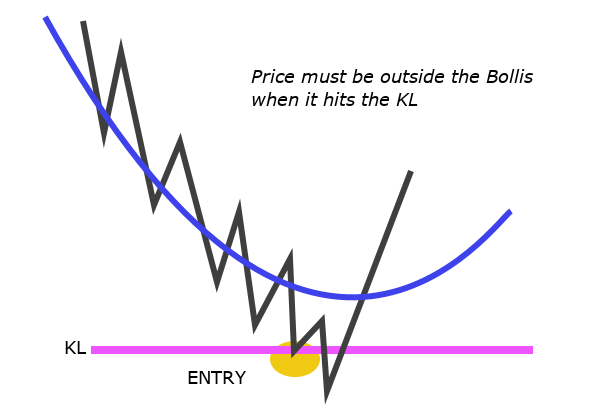

- ranging intraday PA that is stuck inside the 3Min Bolli

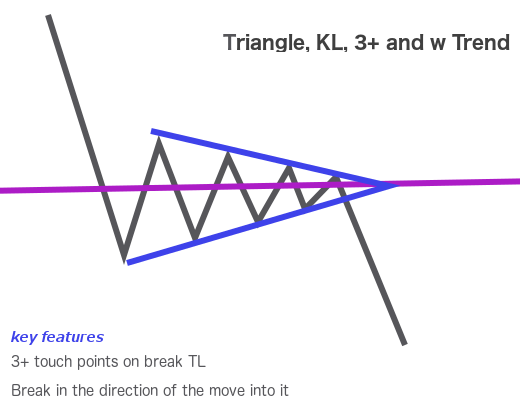

- a non specific level relative to the intraday PA

- low-ATR and low MOM PA context

Open issues

- does this work as a short trade as well? CC says the short version is a 2pt reversal)

- can I trade this with a 10pt SL or should it be adjusted to the PA?

- CC places his stop below the last few lows but not below the lowest low – does this work better?

- how often do these trades run into multiples greater than 5?

- CC TP is the level where the move down started