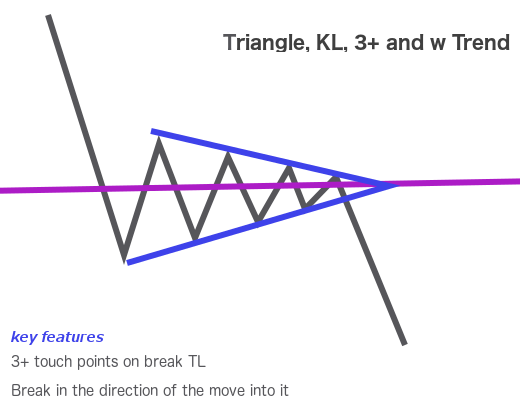

Triangles and Reverse Broken Triangles

30 March 2019Summary

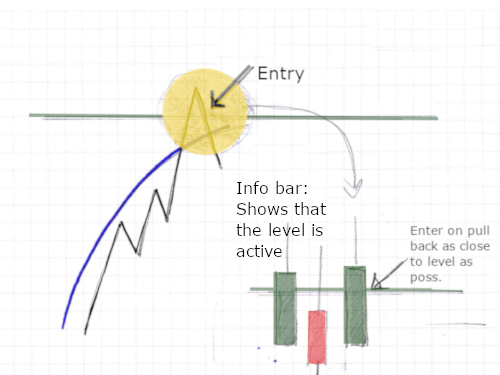

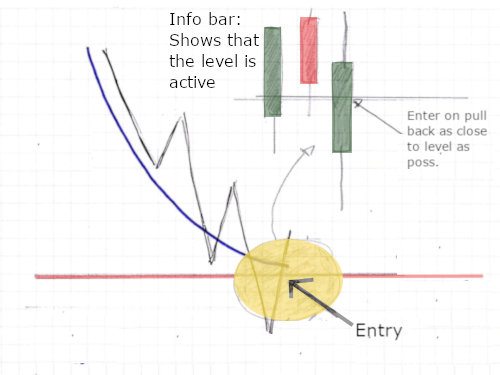

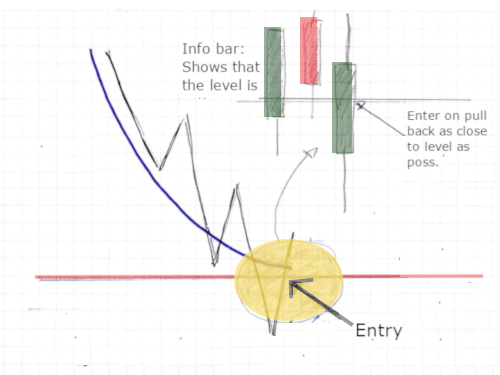

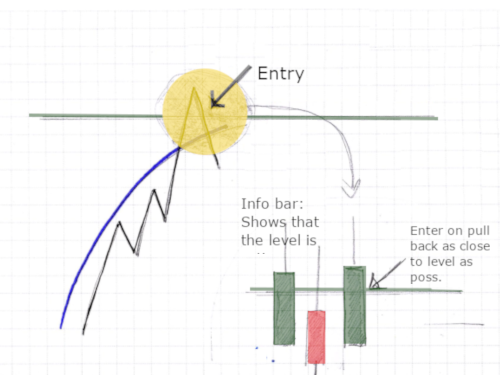

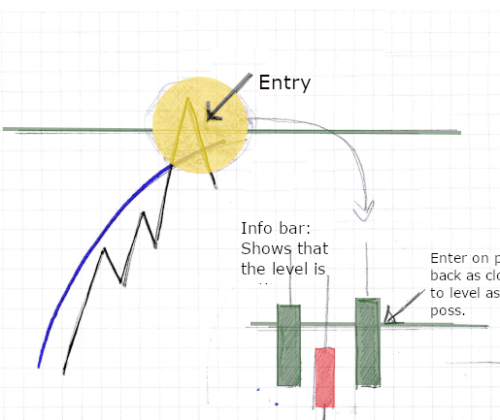

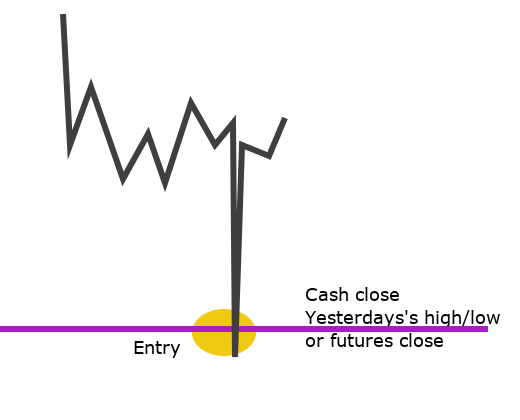

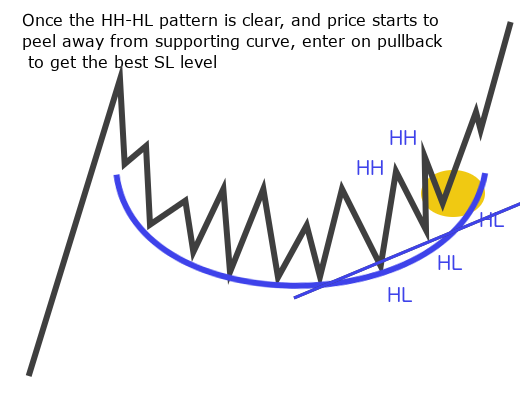

The trade sets up when price hits a KL while outside the Bolli Band on the 3-min chart.

Entry: as close to the level as possible; wait for the sublest sign that the level is active.

Exit: stop loss is 10pts and trade is automatically STE at 1:1.

Take profits: 50% at 2:1 and the rest at 5:1

Results

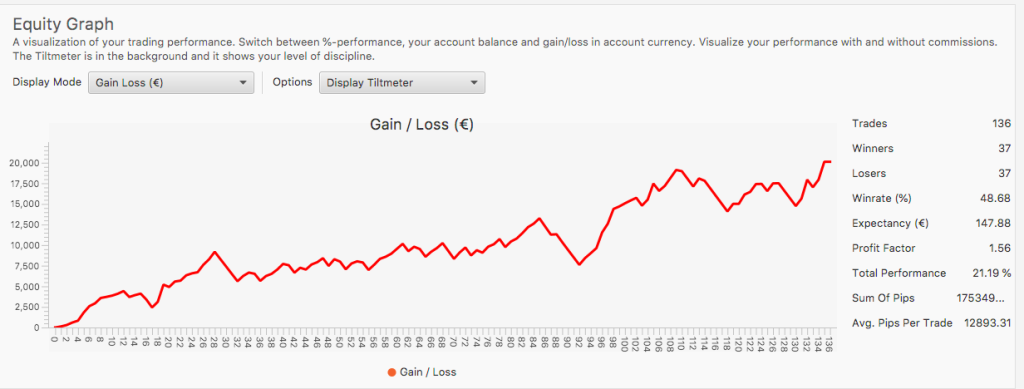

Trading between 9:00 and 11:00 mid-Oct 2018 to end-Feb 2019; the stats during 2018 are likely to be less accurate as I was developing my journaling process over this period.

| Setup | # of Trades | Total PnL EUR (%) R=1% | Average R/winner | Losses # (%) | Reached 1:1 & reversed (BE trade) | Achieved => 2:1 # (%) | Achieved =>5:1 # (%) | Achieved 10:1 +# (%) | Pnl using standard TP strategy | Theoretical PnL vs. Actual PnL |

|---|---|---|---|---|---|---|---|---|---|---|

| 3Min Bolli | 82 | 19,337 / 21.5% (+21.5R) | 1.56 | 37 (45%) | 9 (10.9%) | 36 (43%) | 21 (25%) | 14 (17%) | -37+36+(2.5x21) =51.5 | +30R |

These stats are from Edgewonk. Number of trades is different from the value shown value in the table because Edgewonk counts closed trades, and the figures in the tables represent opened trades.

Why it works

A fast move into the level is necessary for the setup because it implies an order vacuum immediately prior to the level, so the market is moving because it’s looking for orders – not because it’s trending. If this is the case, when it finds the orders, it will at least retrace and maybe make a significant reversal.

Skills and qualities required

- ability to identify levels where there is a high probabilty of a lot of trade activity and waiting orders

- patience to wait for the level

- courage to trade against a fast move and to do it consistently

Filters that make the trade stronger

The trade more likley to work and more likely to run if:

- there is white space to trade into

- there are strong levels and confluence to trade against

Filters that cancel the trade

There is nothing definitive here as my trade plan is to take every setup. However, there are some factors that seem to make is less likley to work (although these ideas are not tested or quantified in any way):

- if the market has just broken a major KL or TL, as trading against the fresh momentum is unlikely to work

- if the level has been hit two or more times in the session (under test)

Open issues

- whether to trade immediately at the level or whether to wait for a reaction

- whether the trade works as a retest i.e. if the level has been broken but then price retests the level while outside the 3Min Bolli

- what is the impact on the success rate of the number of times the level has been hit during the session – are the the second, third and fourth hits less likley to work or does it just depend on the PA

- is it possible to develop a filter for these trades so that I don’t jump in front of a moving train e.g if a daily or cash chart KL or TL has just been broken?

- 17% of these trades get to 10R+ I am not seeing any of this on my account. This is the difference:

My TP strategy = 0.5R + 2.5R = 3R

If I left just 10% of the trade open, with STE or ST to the KL

On 10R trades = 0.5R + 2R + 10R = 12.5R

From my results, 21 trades hit 5R and of those, 14 hit 10R or more. Crazy to leave this money on the table.